Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

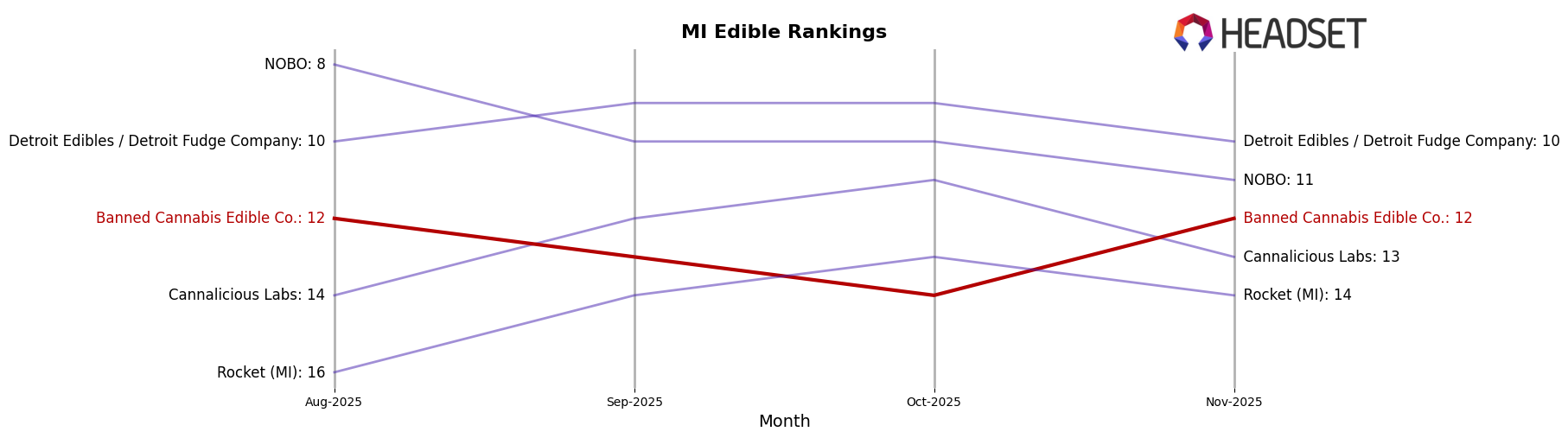

Banned Cannabis Edible Co. has shown a dynamic performance across various states, particularly in the Michigan market. Over the past few months, the brand has maintained a steady presence within the top 15 rankings in the Edible category. In August 2025, the company held the 12th position, and despite a slight dip to 14th place in October, it rebounded to reclaim the 12th spot in November. This fluctuation suggests a resilient market strategy, as they managed to improve their sales from October to November, hinting at effective promotional or product strategies that have resonated well with consumers.

However, it's worth noting that Banned Cannabis Edible Co. did not appear in the top 30 rankings for any other states or categories besides Michigan's Edible category during the same period. This absence could indicate a lack of presence or competitive edge in other regions or categories. While the company has a solid footing in Michigan, expanding its influence beyond this state could be a potential area of growth. The fluctuations in their rankings within Michigan also suggest that while they are competitive, there is room for strengthening their market position further to ensure more consistent upward movement in rankings.

Competitive Landscape

In the competitive landscape of the Michigan Edible market, Banned Cannabis Edible Co. has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. From August to November 2025, Banned Cannabis Edible Co. saw its rank shift from 12th to 13th, then to 14th, before climbing back to 12th. This fluctuation suggests a competitive struggle to maintain a stable position amidst other brands. Notably, Detroit Edibles / Detroit Fudge Company consistently outperformed Banned Cannabis Edible Co., maintaining a rank within the top 10, while NOBO also held a higher rank until November. Meanwhile, Cannalicious Labs and Rocket (MI) trailed closely behind, with Cannalicious Labs occasionally surpassing Banned Cannabis Edible Co. in rank. These insights highlight the competitive pressures Banned Cannabis Edible Co. faces, as it seeks to differentiate itself and capture a larger market share in the Michigan Edible category.

Notable Products

For November 2025, Banned Cannabis Edible Co. saw Berry Melon Nerdless Gummies 4-Pack (200mg) rise to the top position among its product lineup, with notable sales of 9080 units. Grape Cluster Gummies 4-Pack (200mg) followed closely in the second position, improving from a fourth place ranking in October. Cherry Cluster Gummies 4-Pack (200mg) moved down to third place after leading the sales in October. Blueberry Cluster Gummies 4-Pack (200mg), previously ranked second, slipped to fourth place. Blueberry Gummy (200mg) maintained its position at fifth, showing consistency in its performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.