Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

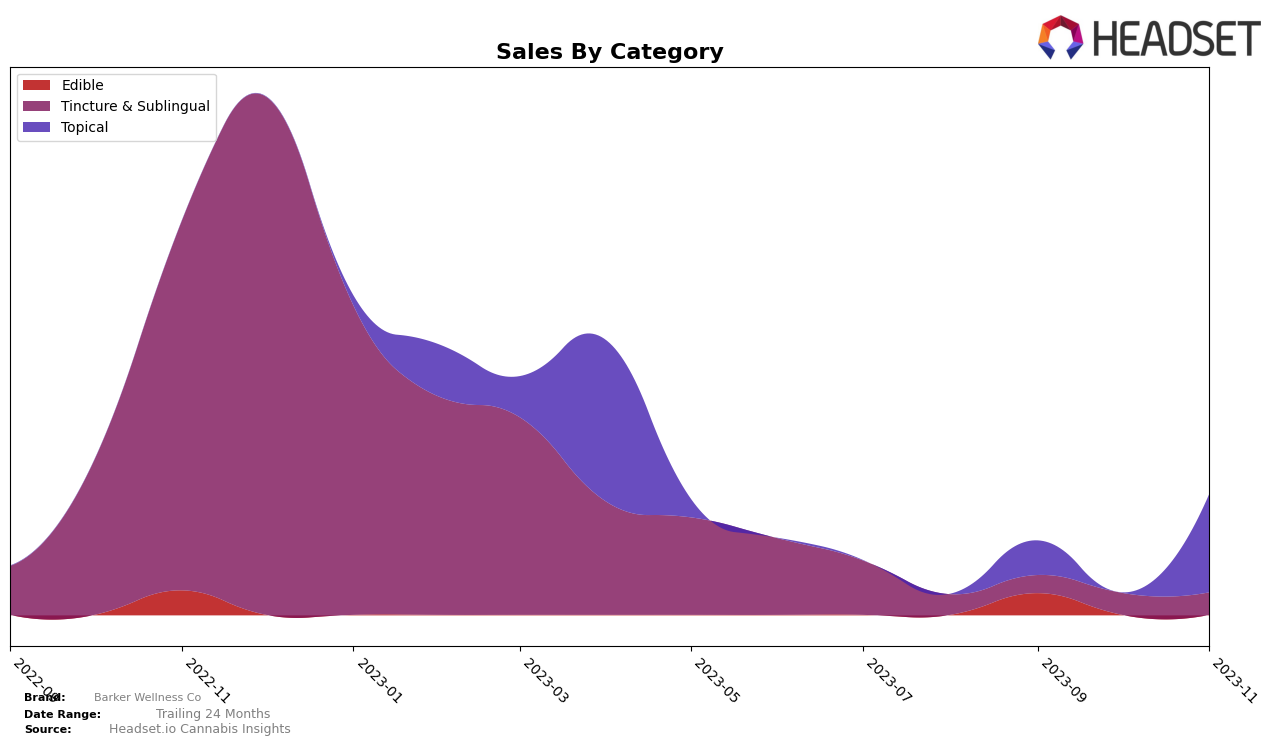

Looking at the performance of Barker Wellness Co in the Nevada market, there are some interesting trends to note. In the Edible category, the brand was not in the top 20 in August, but managed to break into the ranking at 61st place in September. However, there is no ranking data for October and November, indicating that the brand was not in the top 20 in these months. This could be seen as a potential area for improvement. On the other hand, in the Tincture & Sublingual category, Barker Wellness Co has consistently maintained its position in the top 25, showing a steady performance.

Furthermore, Barker Wellness Co's performance in the Topical category in Nevada has shown a significant improvement. Although the brand was not ranked in the top 20 in August and October, it jumped to 21st place in September and made a remarkable leap to 16th place in November. This suggests a strong upward trend in this category. However, it's worth noting that the brand's sales in the Tincture & Sublingual category have remained relatively stable, with a slight increase from 260 units in August to 284 units in November. This could be indicative of a solid customer base in this category.

Competitive Landscape

In the Topical category for Nevada, Barker Wellness Co. has shown a significant upward trend, moving from not being in the top 20 in August 2023, to ranking 21st in September, and then jumping to 16th in November. This indicates a positive trajectory for the brand, especially when compared to competitors such as Mary Jane's Medicinals which only entered the top 20 in October and November, maintaining a steady rank of 19th. Foria, on the other hand, has shown a slight improvement in rank from 22nd to 17th, but has failed to surpass Barker Wellness Co. in November. Canna Hemp and Remedy have maintained a consistent presence in the top 20, but their ranks have fluctuated slightly over the months. This data suggests that Barker Wellness Co. is a strong contender in the market, with potential for further growth.

Notable Products

In November 2023, Barker Wellness Co's top-performing product was the 'CBC:CBG :CBD 3:1:1 Pain Relief Balm', maintaining its position from the previous month. The 'CBD/CBC 1:1 Bath Soak' moved up two spots to become the second best-selling product. The 'CBD/CBN Sleep Tincture' and 'CBD/CBC Recovery Tincture' both dropped two spots to tie for third place. The 'CBD/CBG 1:1 Maintenance Tincture' fell from first place in August to not being in the top four in November. Notably, the 'CBC:CBG :CBD 3:1:1 Pain Relief Balm' had a raw sales figure of 9.0, illustrating its popularity among customers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.