Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

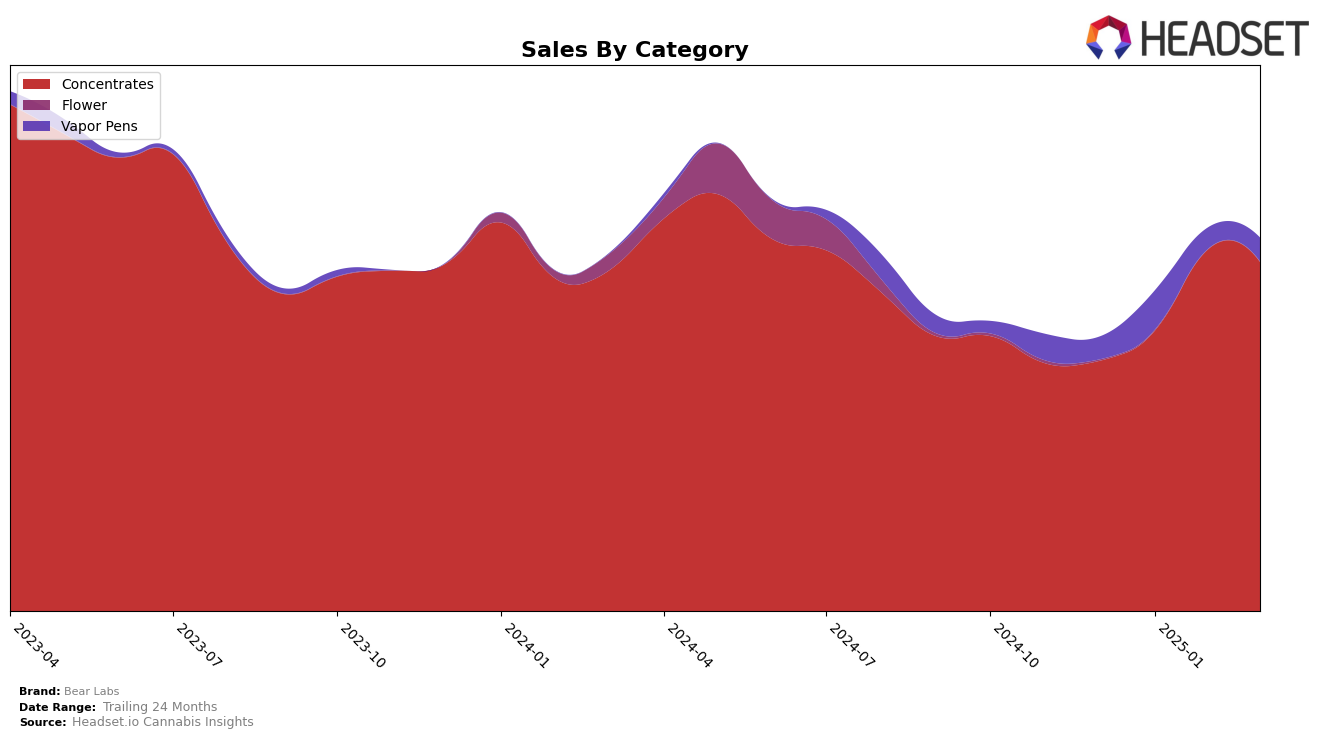

Bear Labs has shown a notable performance in the Concentrates category within California. Over the past few months, the brand has fluctuated in its rankings, starting at 10th place in December 2024 and moving to 11th in January 2025. However, Bear Labs made a strong comeback in February, climbing to 8th place, before slightly dipping to 9th in March. This upward trend in February suggests a significant improvement in their market presence, which is further supported by a substantial increase in sales from January to February, indicating a successful strategy or product launch during that period.

It is worth noting that Bear Labs has consistently remained within the top 30 brands in the Concentrates category in California, which is a positive indicator of their stability and consumer preference in this highly competitive market. The absence of ranking data for any other states or provinces might suggest that Bear Labs is either focusing its efforts primarily in California or has yet to break into the top 30 in other regions. This could be seen as a potential area for growth and expansion if they are looking to diversify their market reach and increase their brand recognition beyond their current stronghold.

Competitive Landscape

In the competitive landscape of the California concentrates market, Bear Labs has demonstrated a notable upward trajectory in its rankings from December 2024 to March 2025. Initially ranked 10th in December, Bear Labs climbed to 8th place by February, before settling at 9th in March. This upward movement is indicative of a strong performance, particularly when compared to brands like ABX / AbsoluteXtracts, which experienced a slight decline from 9th to 11th place over the same period. Meanwhile, Himalaya and West Coast Cure maintained higher ranks, though Himalaya's sales showed a downward trend, potentially opening opportunities for Bear Labs to further close the gap. Bear Labs' sales growth, particularly the significant jump in February, underscores its competitive edge and potential for continued advancement in the market.

Notable Products

In March 2025, Garlic Juice Live Rosin (1g) emerged as the top-performing product for Bear Labs, leading the sales with 821 units sold. Following closely was GMO Cookies Live Rosin (1g) in second place, and Banana Bomb Live Rosin (1g) secured the third position. Honey Bananas Live Rosin (1g) ranked fourth, while Bud Booster THCa (1g) dropped to fifth place after previously holding the top rank in January 2025. Notably, Garlic Juice Live Rosin (1g) saw a significant rise to the top rank, indicating strong consumer preference this month. The shift in rankings highlights a dynamic market where consumer tastes are continuously evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.