Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

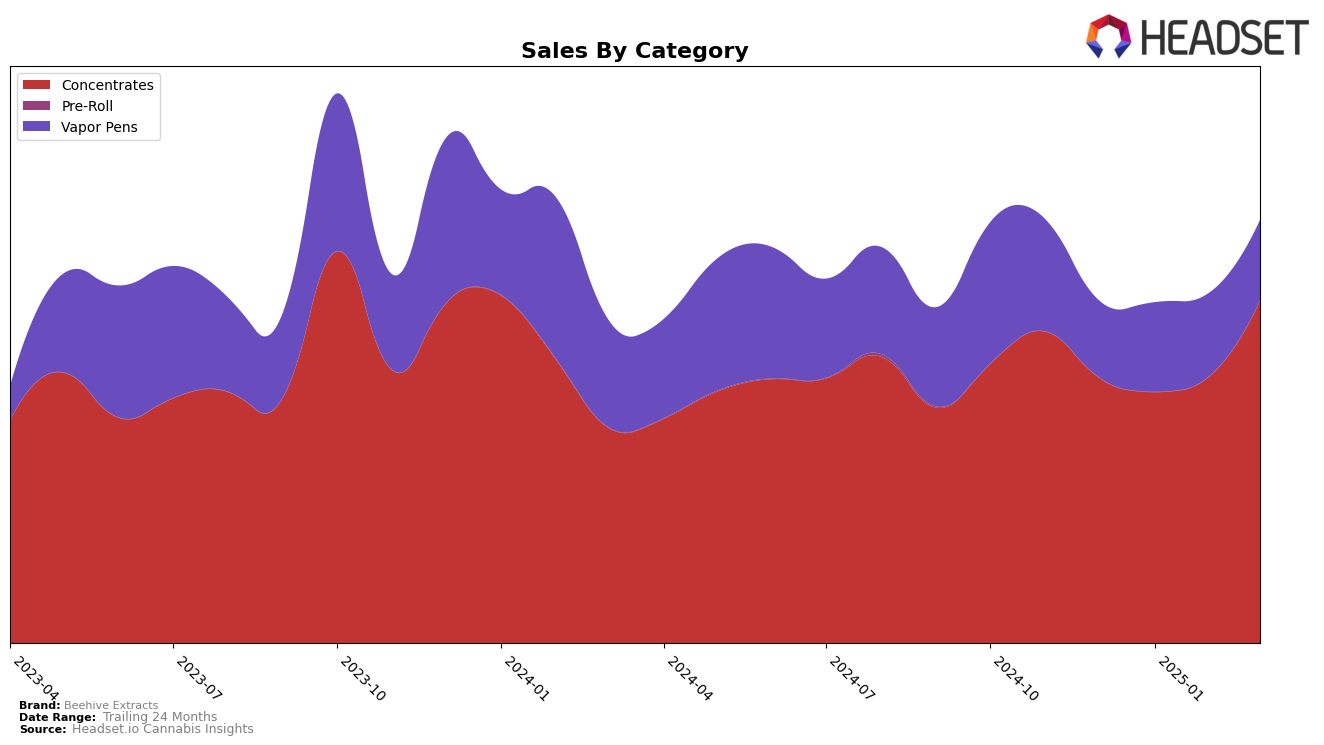

Beehive Extracts has shown a notable trajectory in the Oregon market, particularly within the Concentrates category. From December 2024 to March 2025, the brand improved its ranking from 16th to 11th, indicating a positive reception and growing market presence. This upward movement is complemented by a significant increase in sales, with March 2025 figures substantially higher than those in December 2024. Such a trend suggests effective strategies in product development or marketing that have resonated well with consumers in Oregon. However, in the Vapor Pens category, Beehive Extracts did not manage to break into the top 30, reflecting either a more competitive landscape or a need for strategic adjustments in this segment.

In the Vapor Pens category, Beehive Extracts hovered around the mid-50s ranking, with minor fluctuations between December 2024 and March 2025. Despite a slight sales increase from December to January, the brand was unable to maintain a consistent upward trajectory, which might indicate challenges in scaling or differentiating its products in a crowded market. The lack of a top 30 presence in this category suggests potential areas for improvement or a reassessment of market strategies to enhance their competitive edge. Overall, while Beehive Extracts is making headway in Concentrates, there is room for growth and optimization in the Vapor Pens market in Oregon.

Competitive Landscape

In the competitive landscape of Oregon's concentrates market, Beehive Extracts has shown a promising upward trajectory in recent months. Starting from a rank of 16th in December 2024, Beehive Extracts has climbed to 11th by March 2025. This improvement in rank is indicative of a positive trend in sales, which have increased significantly from December 2024 to March 2025. In contrast, NW Kind, which started at 6th place, has seen a gradual decline, slipping to 9th place by March 2025. Meanwhile, Dirty Arm Farm has made remarkable progress, moving from outside the top 20 in December to 10th place by March. Focus North experienced a dip in February but regained its standing to rank 13th in March. Notably, Higher Cultures made a significant leap from 23rd in January to 12th in March, showcasing a strong recovery. These shifts highlight the dynamic nature of the market and underscore the importance of strategic positioning for Beehive Extracts to continue its upward momentum.

Notable Products

In March 2025, Scorpion Tears Badder (1g) led the sales for Beehive Extracts, securing the top position with 997 units sold, marking a significant achievement. Following closely, Peanut Butter Jealousy Badder (1g) and Lemon Cherry Gelato Badder (1g) ranked second and third, respectively, showcasing strong performance within the Concentrates category. Amherst Sour Diesel Badder (1g) achieved the fourth position, while Peanut Butter Jealousy Badder (2g) rounded out the top five. Compared to previous months, Scorpion Tears Badder (1g) climbed to the leading position, indicating a rise in popularity. Overall, these products have consistently dominated the rankings, reflecting their strong market presence for Beehive Extracts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.