Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

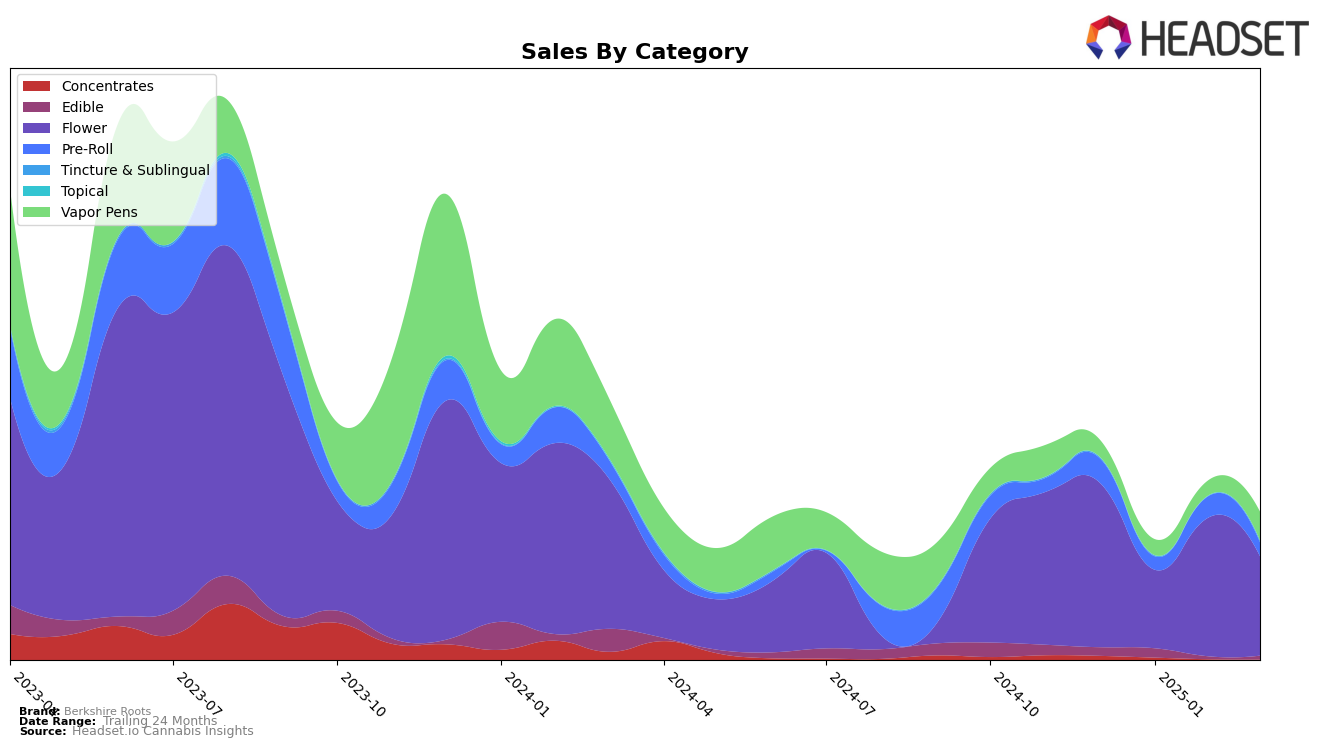

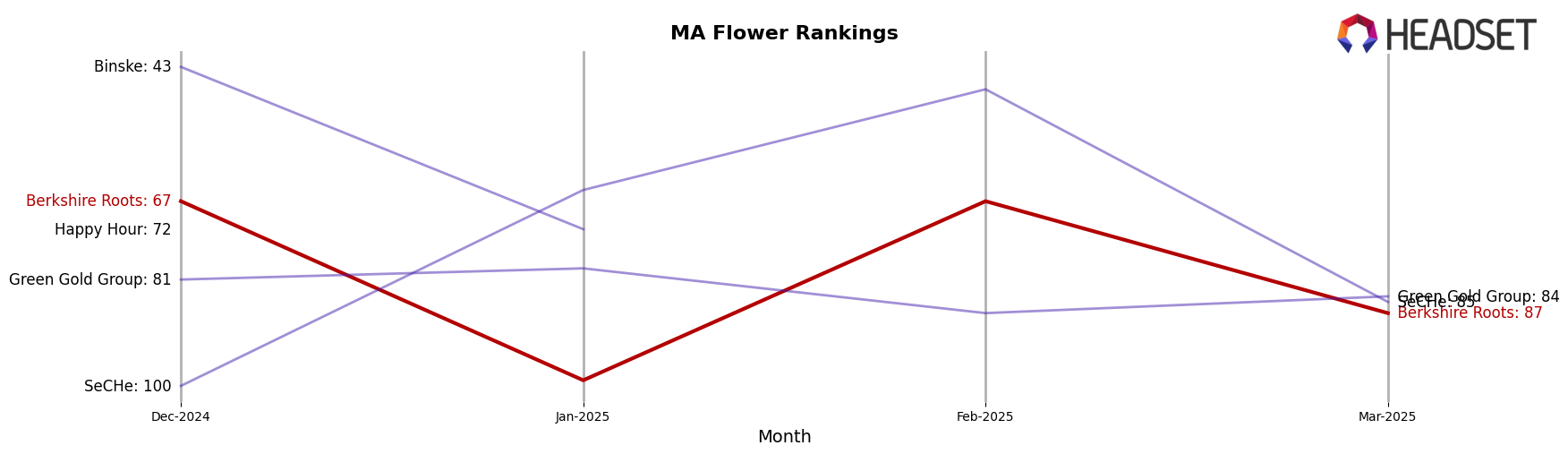

In the state of Massachusetts, Berkshire Roots has shown fluctuating performance in the Flower category over the past few months. Starting at rank 67 in December 2024, the brand experienced a drop to rank 99 in January 2025, but then rebounded to rank 67 in February 2025, only to fall again to rank 87 in March 2025. This volatility in rankings might suggest challenges in maintaining a consistent presence in the top 30 brands, as they were not ranked within this bracket for any of these months. Despite these shifts, the sales figures indicate a notable recovery from January to February, with a significant increase in sales value, although March saw another decline.

Meanwhile, in New York, Berkshire Roots has demonstrated a more positive trend in the Vapor Pens category. The brand improved its ranking from 93 in December 2024 to 75 by March 2025, showing a steady upward movement. This consistent climb in rankings suggests an increasing acceptance and popularity of their vapor pen products in the New York market. Although they did not break into the top 30 during this period, the brand's upward trajectory in rankings and sales, particularly notable in March 2025, indicates potential for future growth and a stronger market position in the coming months.

Competitive Landscape

In the Massachusetts flower category, Berkshire Roots has experienced fluctuating rankings and sales over recent months, indicating a volatile competitive landscape. From December 2024 to March 2025, Berkshire Roots' rank varied significantly, dropping from 67th to 99th in January, then recovering to 67th in February, only to fall again to 87th in March. This inconsistency suggests challenges in maintaining a stable market position. In contrast, SeCHe showed a strong upward trend, improving from 100th in December to 47th in February, before a slight dip to 85th in March, potentially capturing market share from Berkshire Roots. Meanwhile, Binske and Green Gold Group maintained more stable positions, with Binske not ranking in the top 20 after January, and Green Gold Group showing consistent mid-tier rankings. These dynamics highlight the competitive pressure on Berkshire Roots to innovate and stabilize its market presence to avoid losing further ground to rising competitors like SeCHe.

Notable Products

In March 2025, the top-performing product for Berkshire Roots was Orange Chameleon (3.5g) in the Flower category, which ascended from second place in February to secure the top spot with sales of 514 units. The Orange Chemeleon Pre-Roll (1g) maintained a strong position, ranking second, although its sales decreased significantly from the previous months. Basics - Mandarin Cookies (3.5g) in the Flower category slipped to third place, after leading in January. Trop Cherry Pre-Roll (1g) climbed to fourth position from fifth in February, showing a positive trend. Dessert Lime Live Resin Cartridge (0.5g) entered the rankings for the first time in March, securing the fifth position in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.