Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

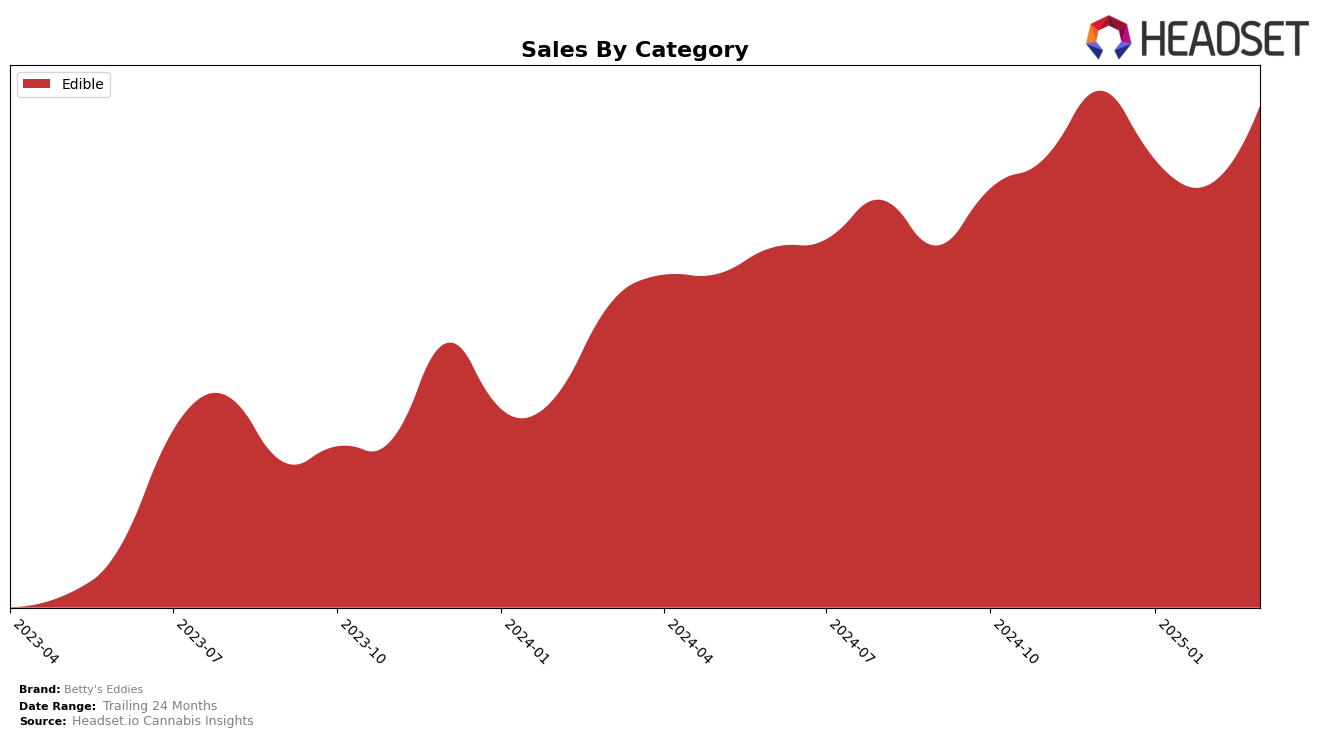

Betty's Eddies has shown a consistent performance in the Edible category across several states, with notable differences in ranking and sales trends. In Maryland, the brand has maintained a stronghold on the top position from December 2024 through March 2025, indicating a robust market presence and consumer preference. Conversely, in Illinois, Betty's Eddies experienced some fluctuations, peaking at rank 8 in February 2025, before returning to rank 11 in March. This suggests a competitive environment in Illinois, with potential challenges in maintaining higher rankings despite a rebound in sales from January to March.

In Massachusetts, Betty's Eddies has consistently held the fourth position, demonstrating steady performance in a likely competitive market. The brand's ability to maintain this rank throughout the observed months suggests a stable consumer base. However, the absence of Betty's Eddies in the top 30 in other states might indicate limited geographical reach or a focus on specific markets. This strategic positioning could be beneficial if it aligns with consumer demand and market dynamics in these key states, but it also highlights areas for potential expansion or increased marketing efforts.

Competitive Landscape

In the Maryland edibles market, Betty's Eddies has consistently maintained its top position from December 2024 through March 2025, showcasing its strong brand presence and customer loyalty. Despite a slight decrease in sales from December to February, Betty's Eddies experienced a rebound in March, solidifying its leadership. Competing brands like Incredibles and Wyld have remained stable in their rankings, with Incredibles holding the second position consistently and Wyld fluctuating slightly between third and fourth place. This stability among competitors highlights a competitive but steady market environment, where Betty's Eddies' ability to maintain its rank suggests effective brand strategies and product appeal. As the market evolves, monitoring these trends can provide valuable insights for stakeholders looking to capitalize on emerging opportunities in the Maryland edibles sector.

Notable Products

In March 2025, the top-performing product from Betty's Eddies was Bedtime Betty's Lemon Agave Fruit Chews 10-Pack (50mg), maintaining its position at rank 1 for four consecutive months, with sales reaching 14,451 units. The Bedtime Betty's Lemon Agave Melatonin Fruit Chews 10-Pack (100mg THC, 20mg Melatonin) held steady at rank 2 since January 2025, showing a notable increase in sales from the previous month. Bedtime Betty's CBD/THC/CBN 2:1:1 Raspberry Creme Fruit Chews 10-Pack remained consistently at rank 3, demonstrating stable performance over the months. Ache Away CBD/THC/CBC 4:1:1 Cherry Fruit Chews 10-Pack maintained its position at rank 4, with sales figures reflecting a slight improvement from February. Achy Eddies CBD/D9THC/CBC 40:10:5 Cherry Fruit Chews 10-Pack re-entered the rankings at position 5, marking a return to notable sales performance in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.