Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

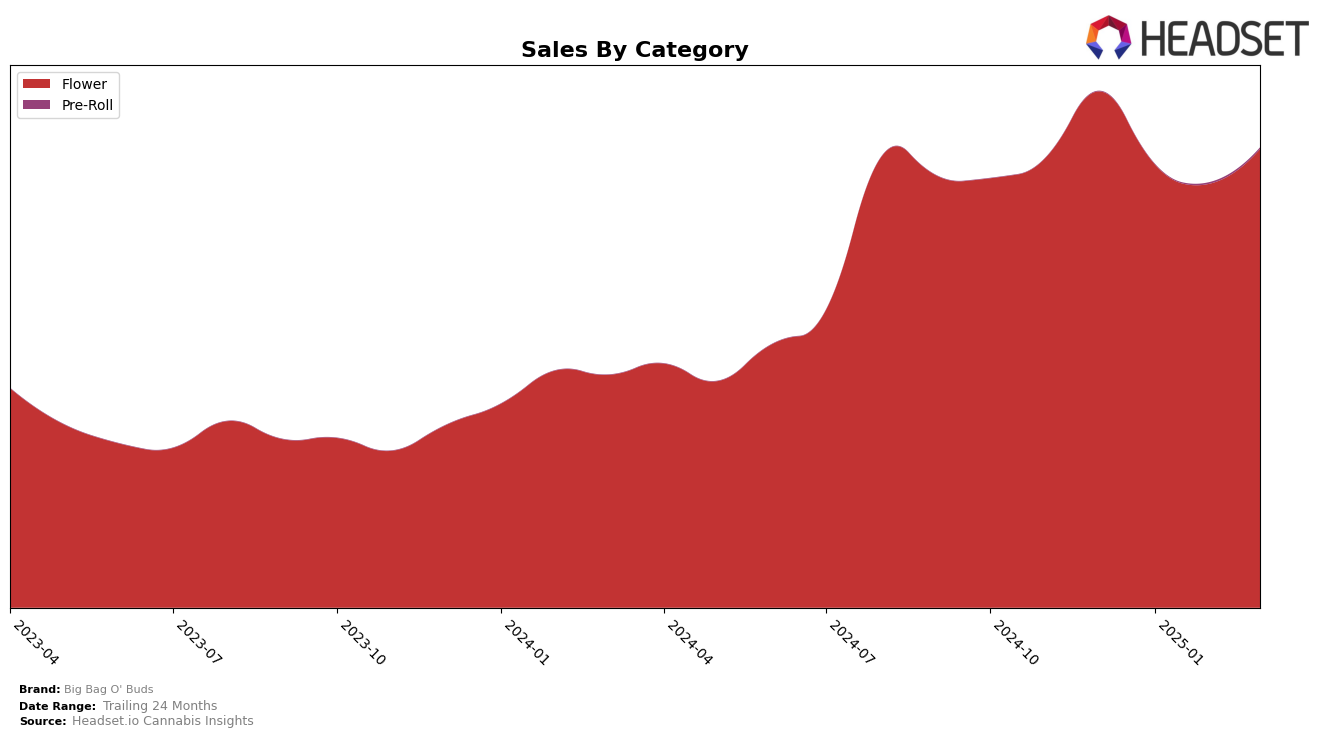

Big Bag O' Buds has demonstrated varied performance across different Canadian provinces, particularly in the Flower category. In British Columbia, the brand has shown a remarkable upward trajectory, clinching the top spot in February and March 2025, up from third place in December 2024. This consistent improvement underscores a strong consumer base and effective market strategies in the province. Conversely, in Alberta, the brand experienced a decline from fourth to seventh place between December 2024 and February 2025, before slightly recovering to sixth place in March. This fluctuation suggests potential challenges in maintaining market share amidst competitive pressures.

The performance in Ontario and Saskatchewan offers a mixed picture. In Ontario, Big Bag O' Buds saw a drop from eighth to twelfth place from December 2024 to January 2025, although it managed to climb back to tenth by March. This recovery could indicate effective adjustments to their market approach. Meanwhile, in Saskatchewan, the brand's ranking fluctuated, reaching as high as sixth place in February 2025, only to settle back to tenth in March. The absence of a top 10 ranking in some months emphasizes the competitive landscape in these regions and the need for strategic positioning to maintain visibility and consumer interest.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Big Bag O' Buds experienced a fluctuating rank from December 2024 to March 2025, starting at 8th place and ending at 10th. Despite this, it maintained a competitive edge against brands like The Loud Plug, which saw a more significant drop from 7th to 12th place over the same period. Meanwhile, Redecan consistently outperformed Big Bag O' Buds, maintaining a higher rank, though it experienced a slight decline from 6th to 8th place. Pepe showed a stable performance, ending the period at 9th place, just ahead of Big Bag O' Buds. The brand Versus improved its position from 14th to 11th, indicating a positive trend. These dynamics suggest that while Big Bag O' Buds is holding its ground, it faces strong competition and must strategize to climb higher in the rankings and boost sales.

Notable Products

In March 2025, Ultra Sour (28g) maintained its position as the top-performing product for Big Bag O' Buds, despite a decrease in sales to 8,217 units. Ultra Sour + Tropical Cookies (28g) consistently held the second position, showing a notable increase in sales from previous months. Jet Fuel Pie (28g) secured the third spot, maintaining the rank it achieved in February 2025. Purple Cherry Punch (28g) remained steady at fourth place, continuing its performance from February. Pink Kush Mints (28g) returned to the rankings in fifth place, after being unranked in February 2025, indicating a rebound in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.