Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

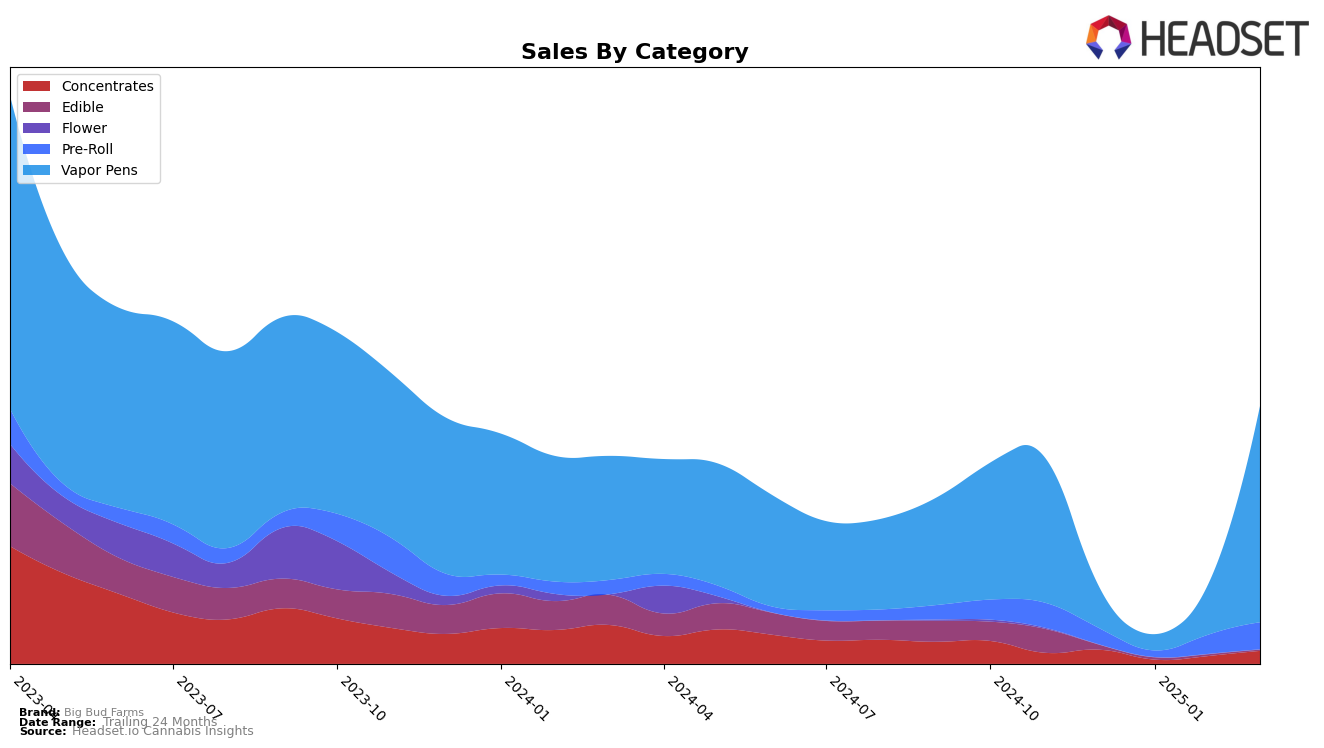

Big Bud Farms has shown varied performance across different categories in Arizona. In the Concentrates category, their rank fluctuated from 36th in December 2024 to 35th in March 2025, indicating a slight improvement despite dropping out of the top 30 in January. This suggests a potential recovery or strategic adjustments that might have been implemented in the latter months. Notably, their performance in the Pre-Roll category improved significantly from 52nd in December to 42nd by March, demonstrating a consistent upward trend that could signify growing consumer preference or effective marketing strategies in this segment.

In the Vapor Pens category, Big Bud Farms experienced a dramatic rise, jumping from 47th place in December 2024 to an impressive 20th place by March 2025. This substantial improvement could be attributed to increased brand visibility or product innovation that resonated well with consumers. Interestingly, their absence from the top 30 in January did not hinder their overall progress, hinting at a possible strategic pivot or successful promotional campaigns that boosted their rankings in the following months. Such trends highlight the brand's potential to capitalize on specific market dynamics in Arizona.

Competitive Landscape

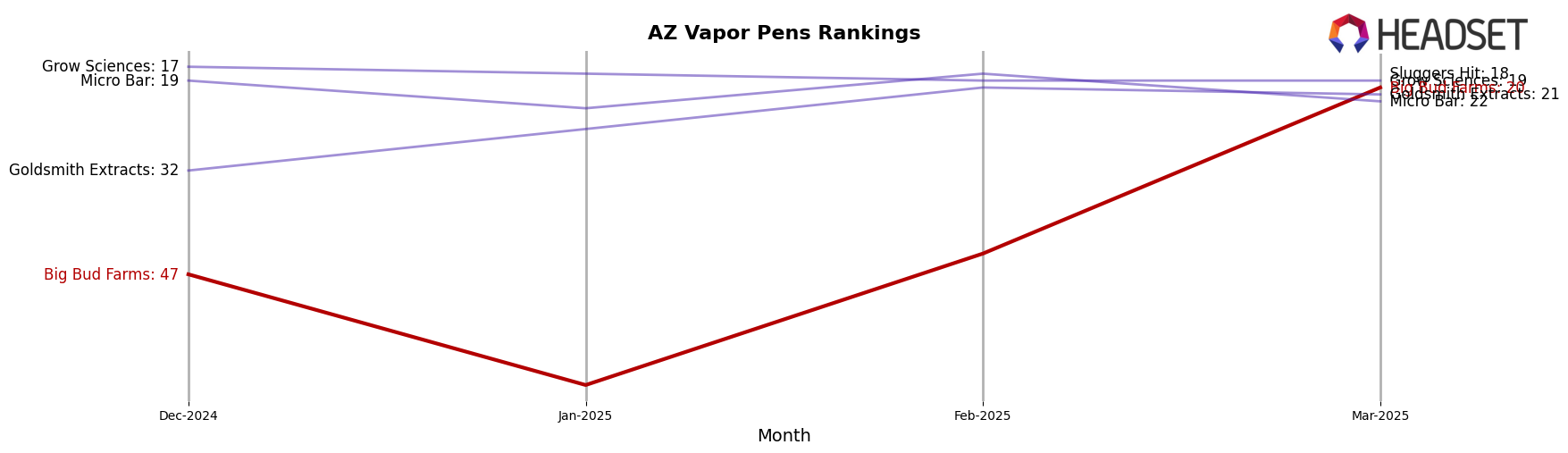

In the competitive landscape of vapor pens in Arizona, Big Bud Farms has shown a remarkable upward trajectory, particularly from February to March 2025. Initially ranked 47th in December 2024, Big Bud Farms climbed to 20th by March 2025, indicating a significant improvement in market presence and consumer preference. This ascent is noteworthy when compared to competitors like Grow Sciences, which maintained a steady but lower rank in the top 20, and Goldsmith Extracts, which hovered around the 20th position. Meanwhile, Micro Bar experienced a slight decline, moving from 19th to 22nd. The re-entry of Sluggers Hit into the rankings at 18th in March also highlights the competitive dynamics in the market. Big Bud Farms' impressive leap in rank suggests a successful strategy in capturing market share, likely driven by product innovation or effective marketing campaigns, positioning them as a formidable player in the Arizona vapor pen category.

Notable Products

In March 2025, Purple Afghan Live Resin Cartridge (1g) from Big Bud Farms maintained its position as the top-performing product in the Vapor Pens category, with sales reaching 2,120 units. Wedding Cake Distillate Cartridge (1g) also held steady in second place, closely following the leader. Summer Sunrise Distillate Cartridge (1g) improved its rank from fourth in February to third in March, demonstrating a notable increase in popularity. Acapulco Gold Distillate Cartridge (1g) debuted in the rankings at fourth place, while Dirty Mai Tai Live Resin Pods (1g) entered the list at fifth. These shifts highlight a dynamic market where new entries and improvements in rank indicate changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.