Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

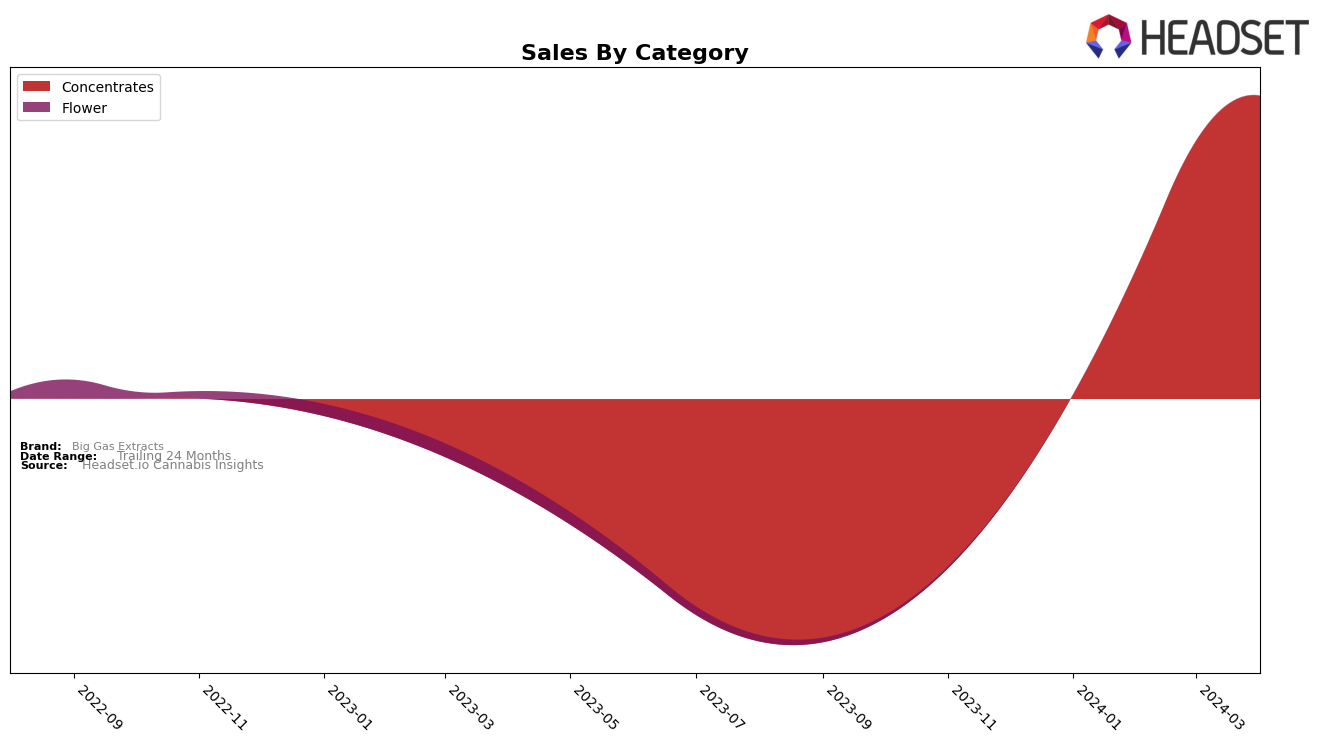

In the competitive cannabis market of Michigan, Big Gas Extracts has shown a noteworthy performance in the concentrates category, demonstrating a significant upward trend in its rankings over the first four months of 2024. Starting the year outside of the top 30 brands in Michigan for the concentrates category, Big Gas Extracts made a remarkable entry at rank 62 in February, before climbing to rank 37 in March, and further advancing to rank 30 by April. This progression not only highlights the brand's growing popularity and consumer acceptance in Michigan but also showcases its potential to capture a larger market share within the concentrates segment. The sales figures support this upward trajectory, with a notable increase from $78,135 in February to $180,295 in April, indicating a strong and growing consumer demand for Big Gas Extracts' offerings in this category.

While the data provides a clear indication of Big Gas Extracts' improving position in the Michigan concentrates market, it's important to note the absence of the brand from the top 30 in January 2024. This could be seen as a slow start to the year or simply a lack of visibility in the data due to the brand not breaking into the top rankings until February. However, the subsequent months' performance strongly suggests that Big Gas Extracts has effectively overcome any early-year hurdles, rapidly gaining momentum and market recognition. The significant sales increase from February to April further underscores the brand's successful strategies in expanding its footprint and enhancing its appeal among Michigan's cannabis consumers. This growth trajectory, marked by substantial ranking improvements and sales increases, positions Big Gas Extracts as a brand to watch in the evolving Michigan cannabis market.

Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Big Gas Extracts has shown a notable improvement in its market positioning over the recent months. Initially not ranking in the top 20 in January 2024, it surged to the 62nd position in February, climbed to 37th in March, and further ascended to 30th by April, showcasing a significant upward trajectory in both rank and sales. This performance is particularly impressive when compared to competitors such as Rise (MI), which also saw improvement but started from a lower base and ended at 34th in April, and Cannashine, which experienced a more volatile rank change but remained ahead in April at 31st position. Notably, Dabs & Doses and Feefers were consistently ahead of Big Gas Extracts, with Dabs & Doses ending April at 29th and Feefers at 28th, indicating a highly competitive environment. Despite the fierce competition, Big Gas Extracts' remarkable rise in the ranks and sales underscores its growing prominence and potential threat to its competitors in the Michigan concentrates market.

Notable Products

In April 2024, Big Gas Extracts saw "Banana Acai Mintz Live Resin Badder (1g)" as its top-performing product with sales reaching 1664 units, marking a consistent rise from its previous rankings of 5th in February to 2nd in March, and finally leading the chart in April. A newcomer, "Papaya Bomb Live Resin Badder (1g)", made a significant entry, tying for the top spot in sales but officially ranked as the second-best seller due to internal metrics. Following closely, "Blue Moon Pie Live Resin Badder (1g)" and "Gush Mintz Live Resin Badder (1g)" were ranked third and fourth, respectively, indicating a diverse interest among consumers in the concentrates category. "Grease Monkey Live Resin Badder (1g)" which was the leader in March, slipped to the fourth position in April, showcasing the dynamic nature of consumer preferences. These shifts highlight the competitive landscape within Big Gas Extracts' product lineup and the fluctuating consumer demand across different concentrate products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.