Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

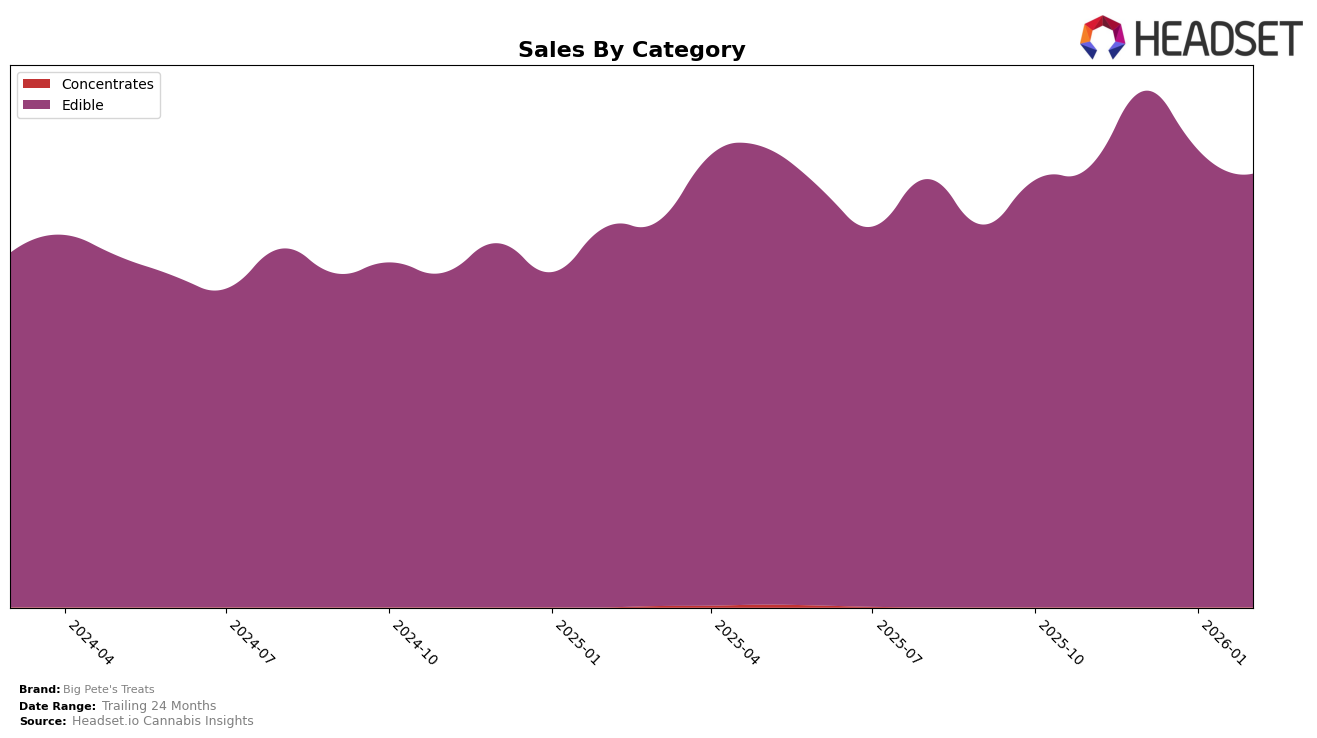

Big Pete's Treats has shown varied performance across different states and provinces, with notable trends in certain regions. In California, the brand has maintained a consistent ranking of 15th in the Edible category from December 2025 to February 2026, highlighting a stable presence in a competitive market. This consistency is paired with fluctuating sales, peaking in December 2025. Meanwhile, in Michigan, the brand has experienced a more dynamic trajectory, climbing from 90th place in December 2025 to 64th in February 2026. This upward movement suggests a growing acceptance and popularity of Big Pete's Treats in Michigan, despite the brand not breaking into the top 30 rankings yet.

In Missouri, Big Pete's Treats has shown a steady improvement, maintaining its position at 44th place in January and February 2026, after a slight rise from 48th in November 2025. This stability indicates a solidifying market presence. On the other hand, in Ontario, the brand made an appearance in December 2025, securing the 33rd spot, but hasn't been able to maintain or improve this ranking in subsequent months. The absence of rankings in Ontario for other months could be seen as a challenge for Big Pete's Treats to establish a stronger foothold in the Canadian market. Overall, while the brand shows promise in certain regions, there is room for growth and increased market penetration in others.

Competitive Landscape

In the competitive California edible market, Big Pete's Treats has shown resilience and moderate growth in rankings from November 2025 to February 2026. Starting at the 18th position in November, Big Pete's Treats improved to 15th by December and maintained this rank through February 2026. This upward movement suggests a positive reception among consumers, although it still trails behind competitors like Smokiez Edibles, which consistently held a higher rank, fluctuating between 11th and 12th place. Meanwhile, ABX / AbsoluteXtracts also maintained a slightly better position, ranking 13th in January and February. Despite Big Pete's Treats' improved ranking, its sales figures indicate a need for strategic initiatives to close the gap with these competitors, especially as Dr. Norm's and Zen Cannabis hover closely in the rankings, posing potential threats to its market share.

Notable Products

In February 2026, the top-performing product for Big Pete's Treats was the Sleepy Time - THC/CBN 2:1 Indica Cherries and Berries Variety Gummies 10-Pack (100mg THC, 50mg CBN), maintaining its first-place rank with sales of 1997 units. The Pineapple & Guava Live Rosin Gummies 10-Pack (100mg) held steady at the second position compared to the previous month. The Strawberry & Watermelon Live Rosin Gummies 10-Pack (100mg) climbed to third place from fourth in January. The Indica Fruity Blast Crispy Marshmallow Treat (100mg) remained in the fourth position, showing consistency across months. Notably, the Original Crispy Marshmallow Treat (200mg) made its debut in the rankings at fifth place, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.