Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

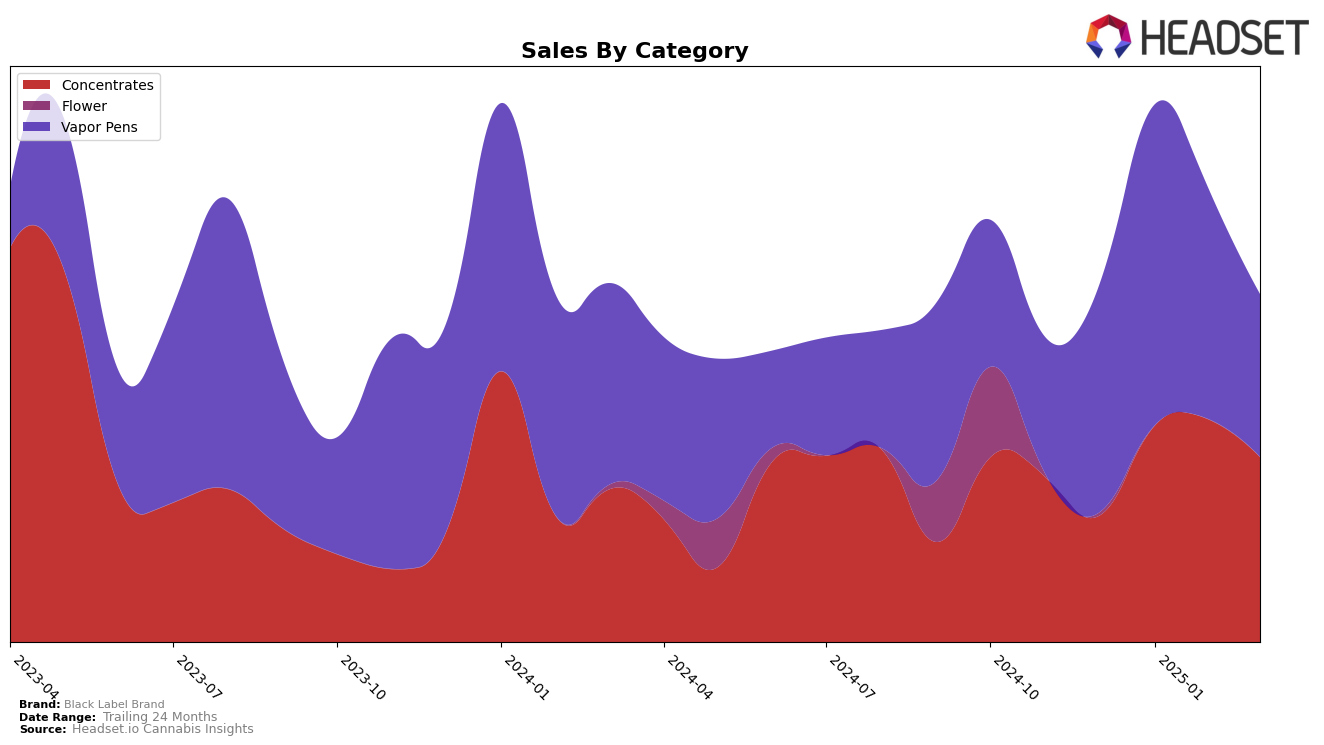

In the Massachusetts market, Black Label Brand has shown some promising movement in the Vapor Pens category. Although they were not ranked in the top 30 over the past few months, March 2025 saw a positive shift as they climbed to the 87th position, improving from their previous ranks in December 2024 and early 2025. This upward trend is notable given the competitive landscape and suggests a potential for further growth. Their sales in March 2025 also saw a significant increase compared to previous months, indicating a strengthening presence in the state.

Meanwhile, in Maryland, Black Label Brand's performance in Vapor Pens has been more volatile. They started strong in December 2024, ranked 29th, and improved to 23rd in January 2025. However, by March 2025, they had dropped to 33rd, falling out of the top 30. This decline in rank, coupled with a decrease in sales from February to March, could be a cause for concern. In contrast, their performance in the New Jersey Concentrates category has been more stable, maintaining a top 10 position throughout early 2025, though with a slight dip from 6th to 8th in March. This consistency in New Jersey highlights their strong foothold in the Concentrates market, contrasting with the fluctuations seen in Maryland.

Competitive Landscape

In the competitive landscape of the New Jersey concentrates market, Black Label Brand has shown a dynamic shift in rankings over the past few months, reflecting its evolving market presence. Starting from a rank of 12 in December 2024, Black Label Brand made a significant leap to rank 7 in January 2025, indicating a strong upward momentum. However, by March 2025, it slightly declined to rank 8, suggesting a need for strategic adjustments to maintain its competitive edge. Notably, MPX - Melting Point Extracts consistently held a stable position at rank 7, except for a brief rise to rank 5 in January 2025, showcasing its solid market presence. Meanwhile, Pyramid Pens fluctuated around the 5th and 6th positions, indicating a competitive pressure point for Black Label Brand. Additionally, ONYX (NJ) and KLIK Canna (MO) maintained lower ranks, with ONYX (NJ) consistently around the 8th and 9th positions, and KLIK Canna (MO) hovering around the 10th and 11th spots. These insights suggest that while Black Label Brand has demonstrated potential for growth, it must navigate a competitive field with brands like Pyramid Pens and MPX - Melting Point Extracts to solidify its market position.

Notable Products

In March 2025, the top-performing product from Black Label Brand was the Hybrid RSO Syringe (1g) in the Concentrates category, maintaining its top rank from February with sales of 1303 units. The Royal Blackberry Distillate Cartridge (1g) in the Vapor Pens category emerged as the second top product, a new entry in the rankings. Baja Blasted BDT Distillate Cartridge (0.5g) followed closely in third place, also a new entry for March. Rainbow Belts 3.0 Sugar (1g) in the Concentrates category ranked fourth, slightly declining from its second-place position in December 2024. Cantaloupe Sherbert Distillate Cartridge (0.5g) completed the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.