Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

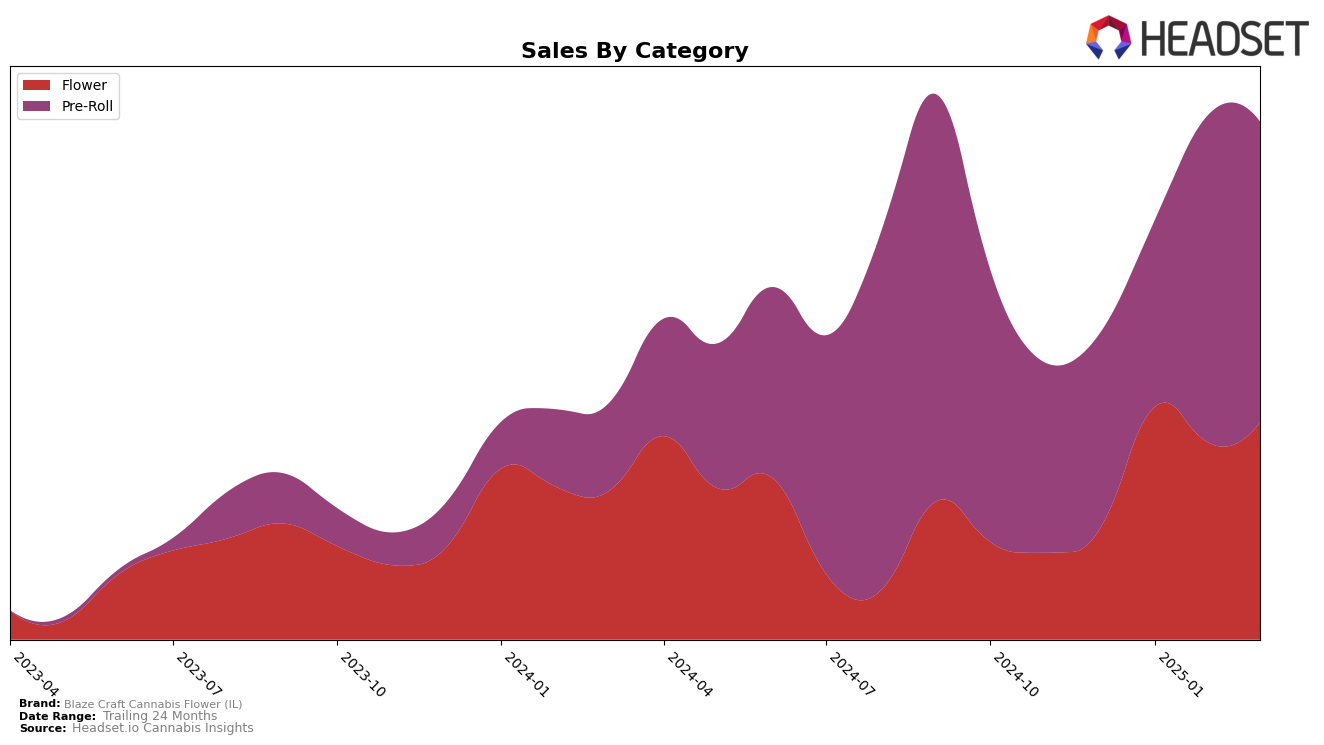

Blaze Craft Cannabis Flower (IL) has shown varied performance across different categories in the state of Illinois. In the Flower category, the brand did not make it to the top 30 in December 2024, ranking 44th, but improved its position to 34th in January 2025. However, it slipped slightly to 38th in both February and March 2025, indicating a need for strategic adjustments to regain momentum. This fluctuation in rankings suggests that while there is potential for growth, consistent performance remains a challenge in this category for Blaze Craft Cannabis Flower (IL).

In contrast, the brand's performance in the Pre-Roll category in Illinois has been more stable and promising. Blaze Craft Cannabis Flower (IL) maintained a strong presence, consistently ranking within the top 20. The brand held the 16th position in both December 2024 and January 2025, and even climbed to 9th place in February 2025 before settling at 12th in March 2025. This upward trajectory in the Pre-Roll category highlights a positive trend and suggests that Blaze Craft Cannabis Flower (IL) is successfully capturing consumer interest and market share in this segment.

Competitive Landscape

In the competitive landscape of the Illinois Pre-Roll category, Blaze Craft Cannabis Flower (IL) has demonstrated a notable upward trajectory in rank and sales, particularly from January to February 2025, where it climbed from 16th to 9th place. This surge is indicative of a significant increase in consumer preference, as evidenced by its sales jump from January's lower figures to a peak in February. In contrast, competitors like Simply Herb and Grassroots have shown fluctuating ranks, with Simply Herb dropping from 8th to 11th and Grassroots maintaining a more stable position around the 10th spot. Meanwhile, Nature's Grace and Wellness and Revolution Cannabis have consistently ranked lower, with Nature's Grace and Wellness holding steady at 11th and 13th, and Revolution Cannabis at 12th and 14th. This competitive analysis highlights Blaze Craft Cannabis Flower's strategic positioning and potential for continued growth in the Illinois market.

Notable Products

In March 2025, Blaze Craft Cannabis Flower (IL) saw Soap Pre-Roll (1g) rise to the top position in the Pre-Roll category, achieving the number one rank with notable sales of 7,381 units. Cobra Kai Pre-Roll (1g) followed closely, securing the second position, while Chemdawg x Super Skunk Pre-Roll (1g) took the third spot. Pink Cookies Pre-Roll (1g) and Moon Blend Pre-Roll (1g) completed the top five, ranking fourth and fifth respectively. Notably, Soap Pre-Roll (1g) improved from second place in February 2025 to first place in March 2025, indicating a positive trend in its popularity. Other products like Cobra Kai Pre-Roll (1g) made a significant debut in the rankings this month.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.