Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

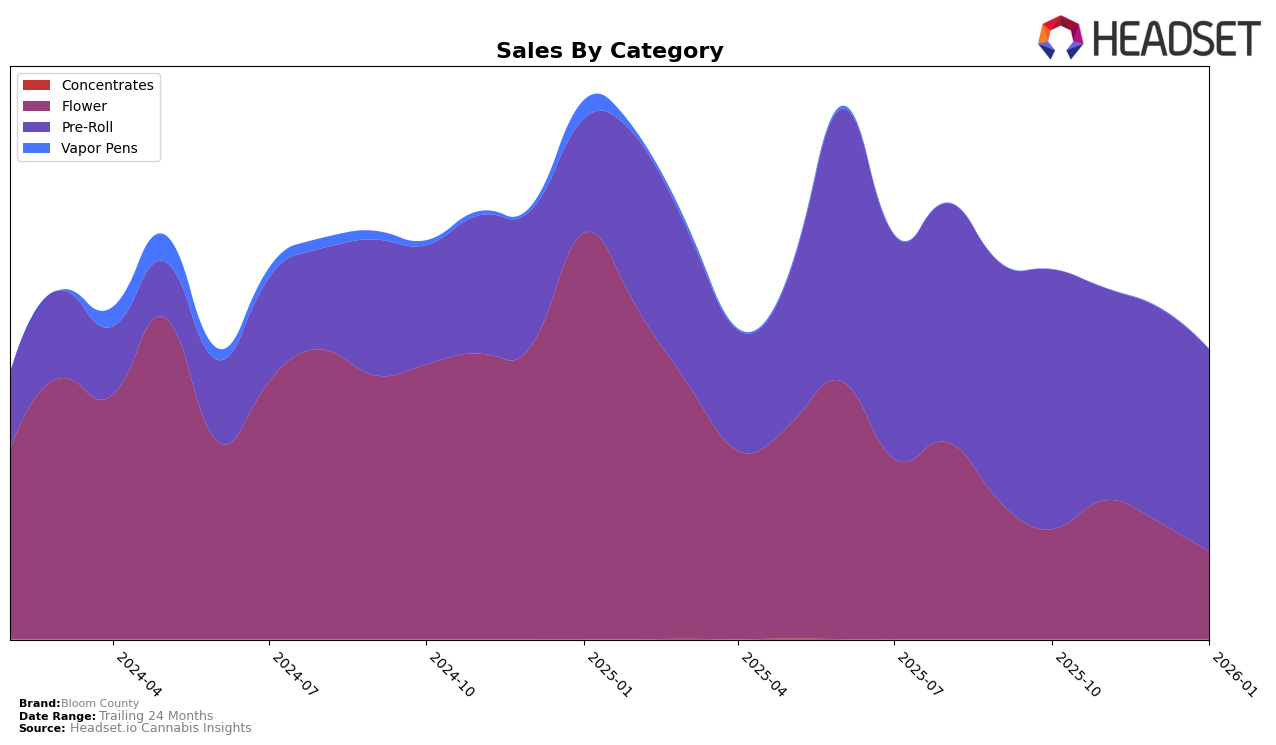

Bloom County's performance in the Colorado market shows a varied trajectory across different product categories. In the Flower category, Bloom County did not make it into the top 30 rankings between October 2025 and January 2026, indicating a challenging competitive landscape. The brand's sales in this category saw fluctuations, with a peak in November 2025, followed by a decline, suggesting potential seasonal influences or market shifts impacting consumer preferences. In contrast, the Pre-Roll category tells a different story, where Bloom County consistently held strong positions, ranking as high as 4th in October and November 2025. This consistency in the Pre-Roll category highlights a robust demand for their products, despite a slight dip in rankings towards January 2026.

The fluctuations in Bloom County's Flower category performance in Colorado could be attributed to various factors including increased competition or shifts in consumer trends. On the other hand, the Pre-Roll category not only maintained a top 10 presence but also demonstrated a solid consumer base, with sales remaining relatively stable despite a slight downward trend in rankings. This indicates that while Bloom County faces challenges in the Flower category, they continue to capitalize on their strengths in Pre-Rolls, possibly due to product differentiation or effective market positioning. The data suggests that Bloom County might benefit from strategic adjustments in their Flower offerings to improve their standing and capitalize on the apparent stability seen in Pre-Rolls.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll category, Bloom County has experienced a notable shift in its market positioning over the past few months. Initially holding a strong 4th place rank in October and November 2025, Bloom County has seen a decline to 6th in December 2025 and further to 7th by January 2026. This downward trend in ranking is accompanied by a decrease in sales, which contrasts with the stable performance of Bonsai Cultivation, consistently holding the 5th position. Meanwhile, TWAX has shown a positive trajectory, climbing from 11th in October to 6th by January, surpassing Bloom County in the process. This shift highlights the competitive pressure Bloom County faces, particularly from brands like TWAX, which have managed to increase their market share. Additionally, Spectra and Pure Blaze Pre-Rolls have maintained relatively stable positions, indicating a competitive but steady market environment. For Bloom County, these insights underscore the need to reassess its strategies to regain its earlier standing and counteract the rising competition.

Notable Products

In January 2026, the top-performing product for Bloom County was the Super Boof Pre-Roll (1g) in the Pre-Roll category, climbing from fifth place in December 2025 to secure the number one spot with sales of 11,425. Chem Gem Pre-Roll (1g) maintained its position at second place, showing consistent performance from the previous month. Super Boof Popcorn (Bulk) emerged in third place, marking its first appearance in the rankings. Modified Grapes Pre-Roll (1g) entered the list at fourth place, while Purple Garlic Pre-Roll (1g) dropped from its previous top position in October 2025 to fifth place. This shift in rankings highlights a dynamic change in consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.