Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

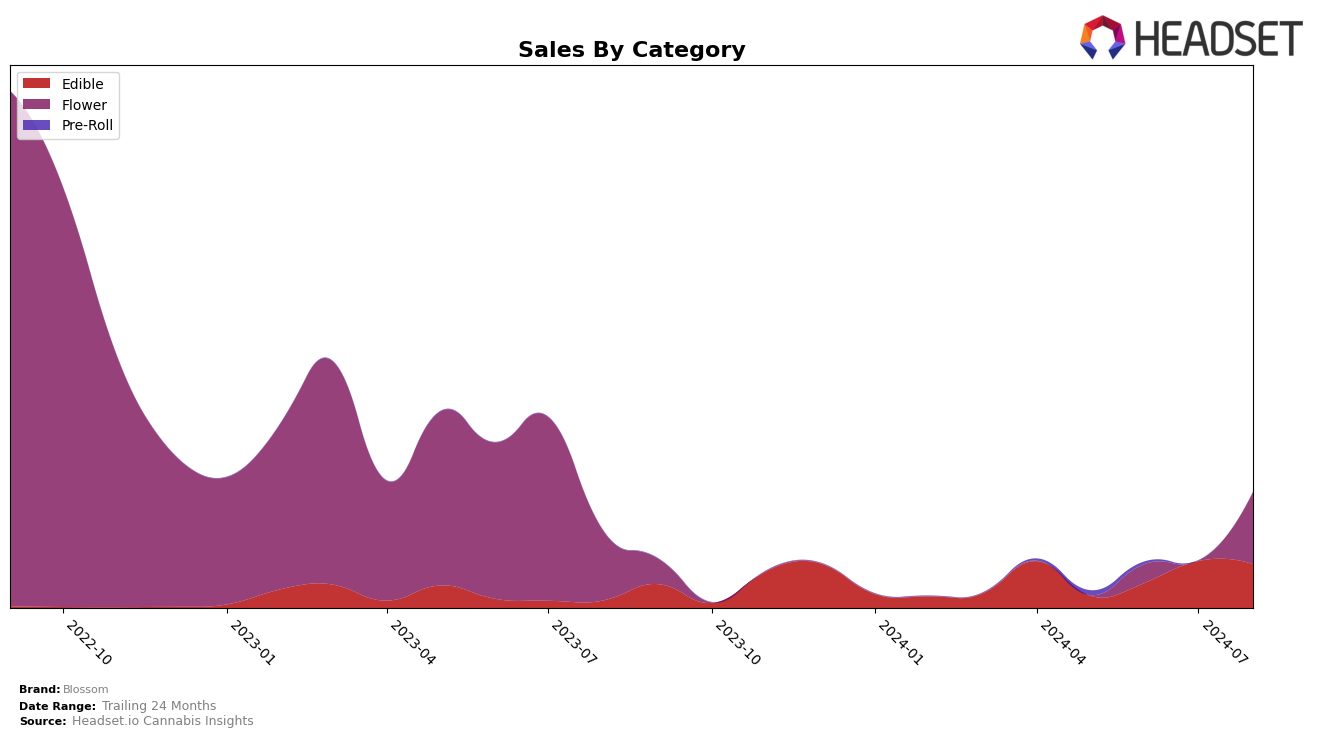

Blossom has shown varied performance across different states and product categories in recent months. In Colorado, the brand did not make it into the top 30 rankings for the Flower category from May through August 2024. This indicates a potential struggle in maintaining a competitive edge in this particular market segment within the state. On the other hand, the situation in Oregon paints a more optimistic picture. Here, Blossom's Edible products climbed from being outside the top 30 in May to securing the 28th position in both July and August 2024. This steady presence in the top 30 suggests a growing acceptance and preference for Blossom's Edibles among consumers in Oregon.

Analyzing the sales trends, Blossom's performance in Oregon's Edible category shows a significant upward trajectory, with sales jumping from $10,277 in June to $19,261 in July 2024. This growth is noteworthy and indicates that the brand is gaining traction in the market. Conversely, the absence of Blossom in the top 30 Flower brands in Colorado could be seen as a red flag, suggesting that the brand might need to revisit its strategy in this category or focus on other product lines. The contrasting performance in these two states highlights the importance of regional strategies and adaptability in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Blossom has shown a notable re-entry into the top 20 brands in August 2024, securing the 74th rank. This resurgence is significant, especially when compared to competitors like Summit, which experienced fluctuations but remained within the top 100, ranking 83rd in August after peaking at 64th in June. Another competitor, Green Treets, also saw a positive trend, improving from 92nd in May to 72nd in August. Meanwhile, Meraki Gardens reappeared in the rankings at 87th in August after being absent in June and July, indicating a volatile performance. Bud Fox Supply Co showed a consistent upward trend, climbing to 71st in August. Blossom's return to the rankings suggests a potential recovery or strategic shift that could be capitalizing on market dynamics, positioning it favorably against these competitors.

Notable Products

In August 2024, Hype Train (Bulk) in the Flower category ranked first with notable sales of 967 units. Strawberry Gummy (100mg) from the Edible category maintained its second-place position with 822 units sold. Limeade Gummy (100mg), also an Edible, dropped to third place from its previous second-place ranking in July, selling 810 units. Tart Cherry Gummy (100mg) experienced a decline, moving from first place in July to fourth place in August with 772 units sold. Mango Gummy (100mg) held steady in fifth place, showing a consistent performance with 760 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.