Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

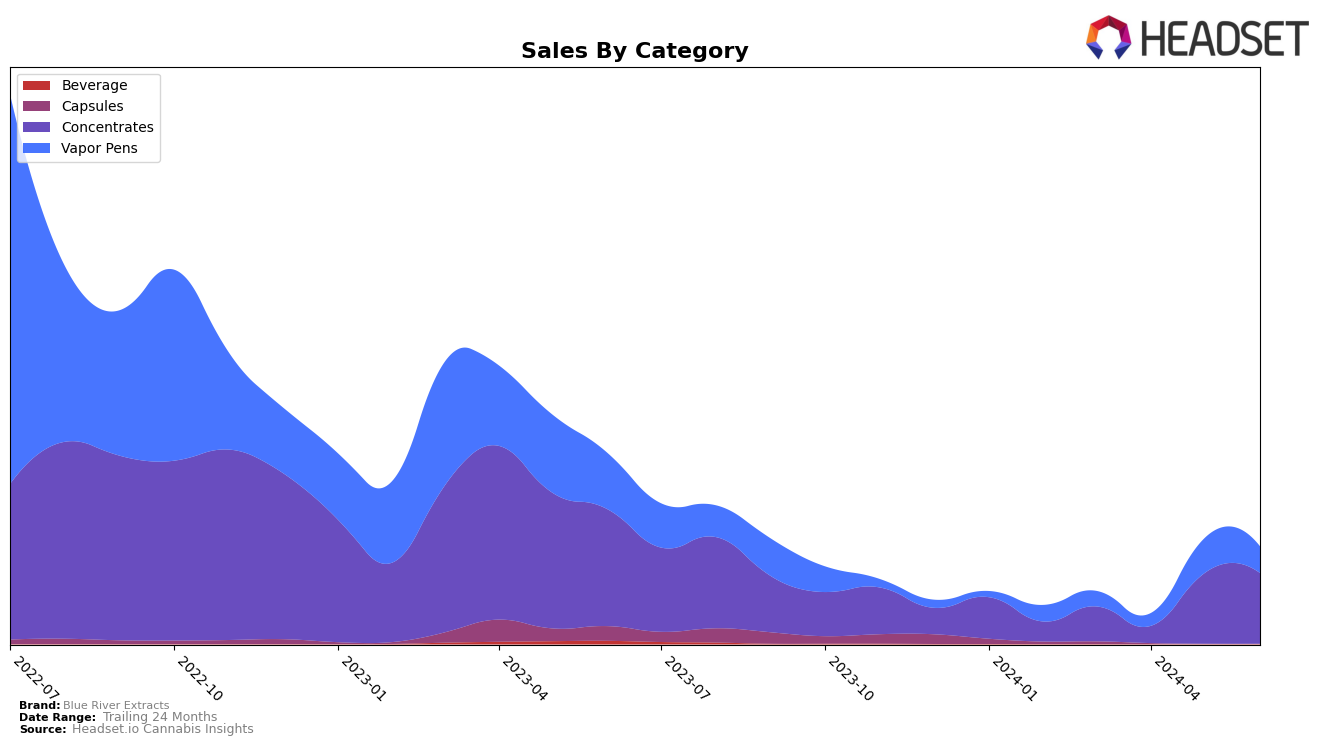

Blue River Extracts has demonstrated a notable performance in the Massachusetts cannabis market, particularly within the Concentrates category. In March 2024, the brand was ranked 52nd, but by May and June 2024, it had ascended to the 30th position. This rise into the top 30 indicates a strong upward trend, highlighting the brand's growing popularity and acceptance among consumers. The sales figures for May and June 2024 reflect this positive trajectory, with both months seeing sales just over $30,000. However, the absence of an April ranking suggests that the brand did not make it into the top 30 during that month, which could be seen as a momentary setback before their subsequent recovery.

In the Vapor Pens category, Blue River Extracts' presence in Massachusetts has been less prominent. The brand did not appear in the top 30 rankings for March and April 2024, indicating a weaker performance in this segment. By May and June 2024, Blue River Extracts managed to secure the 95th and 94th spots, respectively. While these rankings are relatively low, the slight improvement from May to June suggests a gradual increase in market penetration. Despite the lower rankings, the brand's consistent sales figures in this category underline a steady consumer base that could potentially grow with strategic marketing and product development.

Competitive Landscape

In the Massachusetts concentrates category, Blue River Extracts has shown a notable improvement in rank over the past few months. After not being in the top 20 in March 2024, they surged to rank 30 in both May and June 2024. This upward trend is significant when compared to competitors such as DRiP, which fluctuated between ranks 26 and 34 during the same period, and Mile 62, which also showed improvement but remained slightly ahead at rank 29 in June 2024. Another key competitor, Treeworks, experienced a decline, dropping to rank 32 in June 2024. Meanwhile, Root & Bloom saw a significant drop from rank 14 in May to rank 33 in June 2024. This competitive landscape indicates that Blue River Extracts is gaining traction and improving its market position, which could positively impact its sales trajectory in the coming months.

Notable Products

In June 2024, the top-performing product from Blue River Extracts was K Dynamite Live Rosin (1g) in the Concentrates category, maintaining its first-place ranking with notable sales of 397 units. Dog 2.0 Live Rosin Disposable (0.5g) in the Vapor Pens category moved up to second place from its fifth position in May. Bananaconda Live Rosin Disposable (0.5g), also in Vapor Pens, held steady in third place, showing a slight decline in sales figures. Dog 2.0 Live Rosin (1g), another Concentrates product, dropped one spot to fourth place. Bananaconda Live Rosin (1g) fell from second place in May to fifth in June, indicating a significant decrease in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.