Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

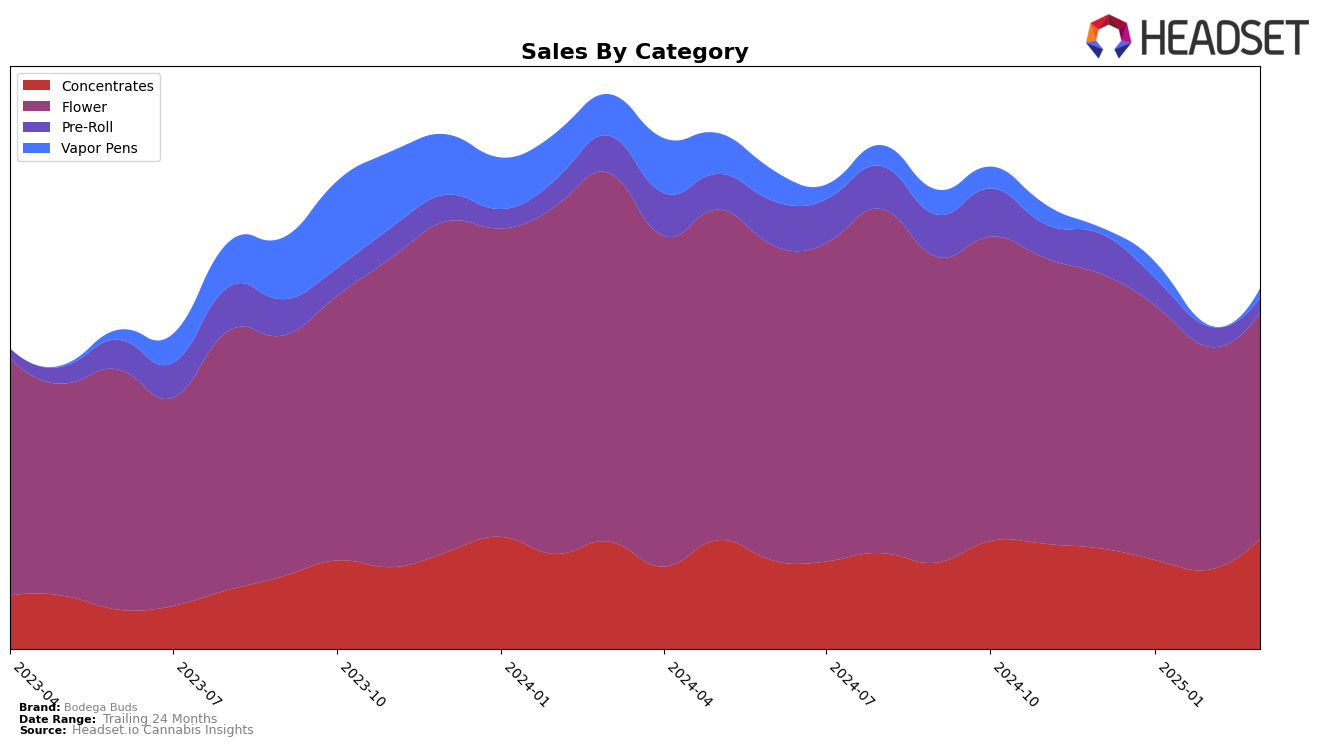

Bodega Buds has exhibited an interesting trajectory in the Washington market across different product categories. In the Concentrates category, the brand saw a notable improvement, climbing from 17th position in December 2024 to 13th by March 2025. This upward movement suggests a strengthening market presence, possibly driven by a strategic focus on this category. Conversely, in the Flower category, Bodega Buds experienced a decline in rankings, slipping from 24th in December 2024 to 28th by March 2025, indicating potential challenges in maintaining competitiveness or shifts in consumer preferences.

The Pre-Roll category paints a more challenging picture for Bodega Buds in Washington. The brand did not make it into the top 30 rankings at any point from December 2024 to March 2025, with ranks in the 70s and 80s, eventually reaching 98th place by March. This suggests significant room for improvement or perhaps a need for strategic realignment in this segment. While the sales figures for Pre-Rolls have shown a downward trend, the Concentrates category has seen a sales increase, highlighting contrasting dynamics within the brand's portfolio. This mixed performance across categories underscores the importance of targeted strategies to capitalize on growth opportunities while addressing challenges.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Bodega Buds has experienced a slight decline in its rank from December 2024 to March 2025, moving from 24th to 28th position. This shift is notable as competitors such as Sweetwater Farms and Withit Weed have maintained or improved their standings, with Sweetwater Farms moving from 21st to 26th and Withit Weed climbing from 33rd to 27th. Despite this, Bodega Buds' sales have remained relatively stable, indicating a loyal customer base, though the brand faces pressure from competitors like Mt Baker Homegrown, which has shown a significant upward trend, improving its rank from 48th to 29th. This competitive environment suggests that while Bodega Buds maintains a strong presence, it may need to innovate or adjust strategies to regain its previous rank and counteract the upward momentum of its competitors.

Notable Products

In March 2025, Bodega Buds' top-performing product was Animal Face Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank from February 2025 with sales of 1625 units. Granddaddy Purple Sugar Wax (1g) in the Concentrates category held steady at the second position, showing an increase in sales from February. White Widow Wax (1g) improved its ranking from fifth in February to third in March, indicating a rise in popularity. Slurricane Sugar Wax (1g) re-entered the rankings in March at fourth place, while Sour Banana Haze Wax (1g) debuted in the rankings at fifth place. These shifts suggest a growing consumer interest in Bodega Buds' Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.