Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

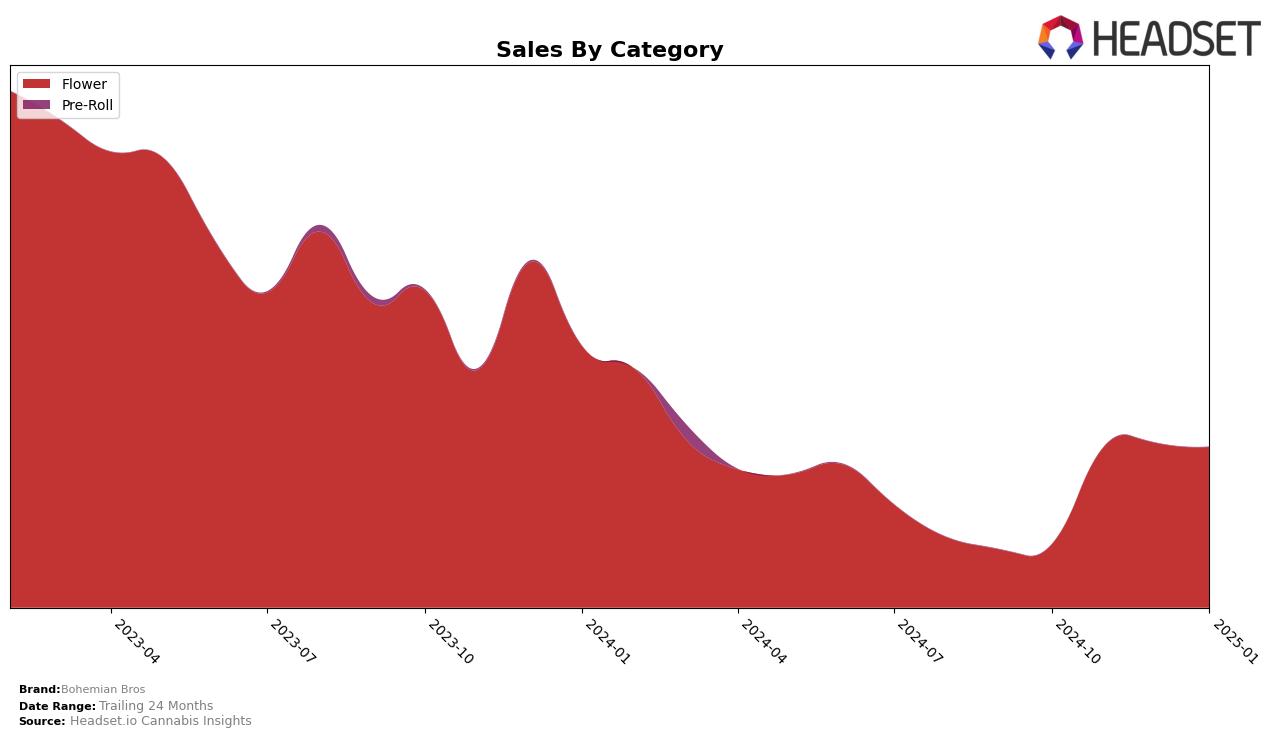

Bohemian Bros has shown a notable improvement in their performance within the Nevada market, particularly in the Flower category. Starting from a ranking of 58 in October 2024, they have climbed to the 27th position by January 2025. This upward trajectory suggests a significant increase in their market presence and consumer preference for their products. The rise in rankings indicates a strategic growth, possibly driven by enhanced product offerings or effective market penetration strategies. However, it is important to note that Bohemian Bros was not in the top 30 brands in Nevada at the beginning of this period, which might have implications for their brand recognition and competitive positioning at that time.

Despite their progress in Nevada, it is crucial to consider that Bohemian Bros did not appear in the top 30 rankings across other states or categories during this period. This absence might highlight challenges in expanding their footprint beyond Nevada or diversifying their product success across different cannabis categories. The sales figures, although not detailed here, reflect a positive trend in Nevada, suggesting that their strategy might be more localized or tailored to this specific market. As they continue to grow, monitoring their ability to replicate this success in other states and categories will be essential for understanding their broader market potential.

Competitive Landscape

In the Nevada flower category, Bohemian Bros has demonstrated a notable upward trajectory in brand ranking from October 2024 to January 2025. Initially ranked at 58th in October, Bohemian Bros climbed to 27th by January, indicating a significant improvement in market positioning. This rise in rank is accompanied by a steady increase in sales, suggesting effective market strategies and growing consumer preference. In contrast, Mojave experienced fluctuating ranks, starting at 35th in October and reaching 26th by January, with sales peaking in January. Meanwhile, TRENDI and Safety Meeting maintained relatively stable ranks, though Khalifa Kush saw a decline from 17th in November to 28th in January, despite a sales peak in November. These dynamics highlight Bohemian Bros' competitive edge and potential for continued growth in the Nevada flower market.

Notable Products

In January 2025, Wedding Pie (3.5g) emerged as the top-performing product for Bohemian Bros, claiming the number one rank with sales of 2646 units. Orange 43 (3.5g) climbed to the second position, showing a significant increase from its fifth rank in the previous two months. Dosi Face Popcorn (3.5g) made a notable entry into the rankings at third place, while Medula (3.5g) experienced a drop from its top position in December to fourth in January. Moon Cat (3.5g) rounded out the top five, maintaining a steady presence despite a slight decline from its third-place finish in December. Overall, the January rankings reflect a dynamic shift in consumer preferences for Bohemian Bros' flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.