Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

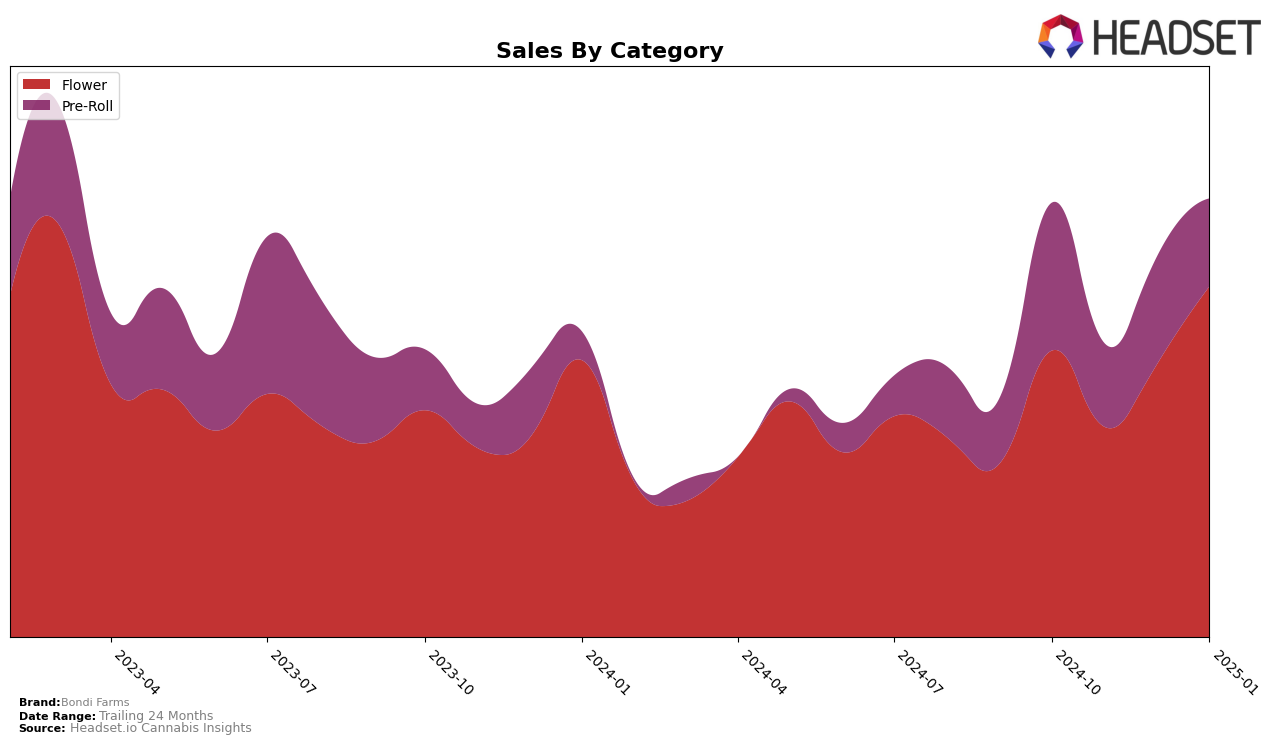

Bondi Farms has exhibited a noteworthy performance in the Washington market, particularly in the Flower category. Despite not being in the top 30 brands in October and November 2024, Bondi Farms climbed to the 31st position in December and made a significant leap to 19th position by January 2025. This upward trajectory indicates a growing consumer preference and suggests effective market strategies or product improvements. Notably, Bondi Farms achieved a sales increase from $236,326 in December to $275,162 in January, underscoring their growing influence in the Flower category.

In the Pre-Roll category, Bondi Farms has maintained a more stable presence within the top 30 rankings in Washington. Starting at the 26th position in October 2024, the brand experienced a slight drop to 27th in November but regained its footing by December, maintaining the 26th position, and improving to 25th in January 2025. This consistency highlights a steady demand for their pre-roll products despite a slight dip in sales from $155,677 in December to $146,010 in January. The brand's ability to stay within the top rankings suggests a loyal customer base and potential for further growth.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Bondi Farms has shown a notable upward trajectory in rankings from October 2024 to January 2025. Starting at rank 33 in October, Bondi Farms improved to rank 19 by January 2025, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Hemp Kings, which started at rank 35 and only reached rank 21 by January, and Mini Budz, which moved from rank 42 to 20. Notably, Good Earth Cannabis also showed a strong performance, ending at rank 18, just ahead of Bondi Farms. Meanwhile, EZ Puff maintained a strong position, consistently ranking higher than Bondi Farms throughout the period. Despite these competitive pressures, Bondi Farms' sales figures reflect a robust growth, especially in January 2025, where they outperformed Hemp Kings and Mini Budz, suggesting a strengthening market position and potential for continued ascent in the rankings.

Notable Products

In January 2025, Bondi Farms' top-performing product was Obama Kush Pre-Roll 2-Pack (1g), maintaining its number one rank from October and November 2024, despite a slight dip in sales to 2566 units. Super Lemon Haze Preroll 2-Pack (1g) climbed to second place after a dip to fifth in December 2024, showing resilience with improved sales figures. Candyland Pre-Roll 2-Pack (1g) slipped to third place from its top position in December, indicating a competitive market for the top spots. Cherry Dosidos Pre-Roll 2-Pack (1g) retained its fourth place consistently from October through January, demonstrating stable demand. The new entrant, Vortex Pre-Roll (1g), debuted at the fifth position, highlighting a potential growth area within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.