Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

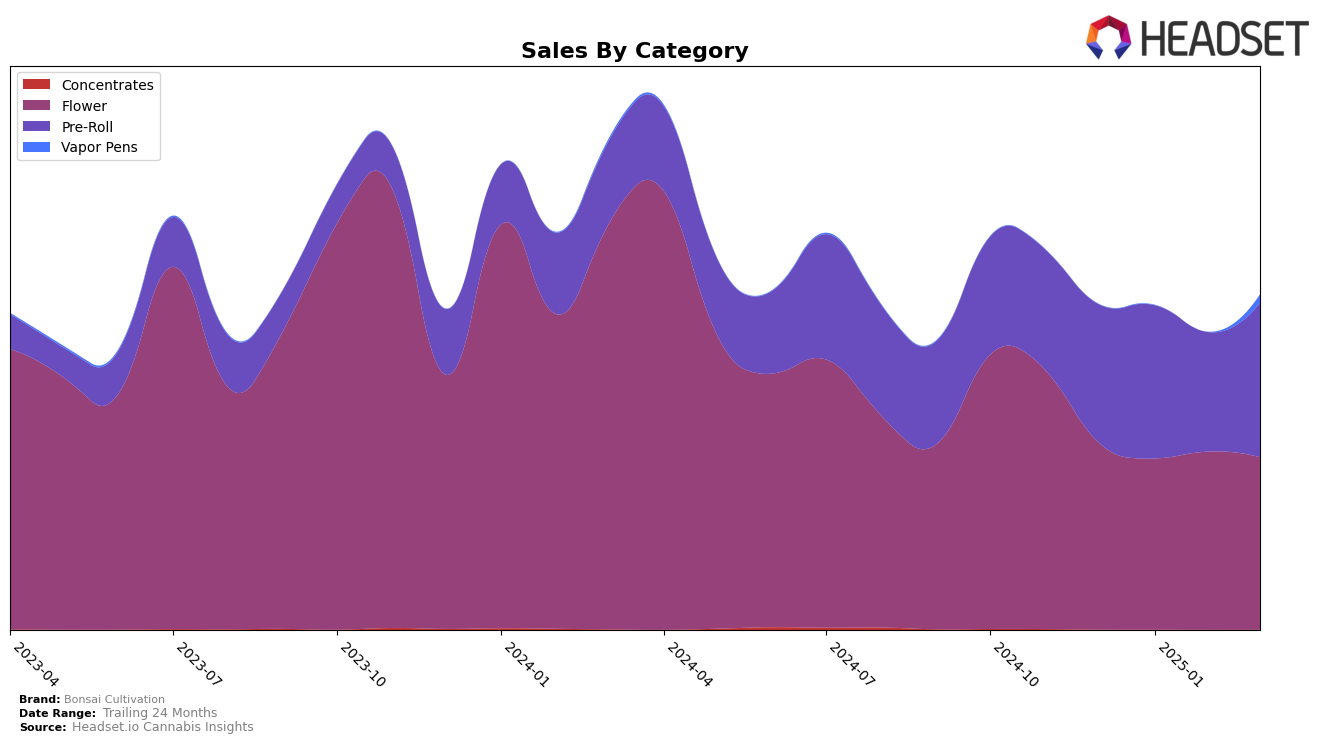

Bonsai Cultivation has shown varied performance across different product categories in Colorado. In the Flower category, the brand maintained a steady presence, starting at rank 22 in December 2024, moving slightly up to 20 in February 2025, but then dropping back to 24 by March 2025. This fluctuation indicates a competitive market dynamic where Bonsai Cultivation is holding its ground but facing challenges in climbing higher. The Pre-Roll category, however, tells a more promising story. Starting from a respectable rank of 8 in December 2024, Bonsai Cultivation climbed to 7 by January 2025, briefly dipped to 9 in February, and then recovered back to 7 in March. This suggests a strong consumer preference and consistent demand for their pre-rolls.

On the other hand, the Vapor Pens category presents a different scenario for Bonsai Cultivation in Colorado. The brand did not make it into the top 30 rankings from December 2024 through March 2025, signaling a potential area for growth or reevaluation. Despite this, the sales figures in March 2025 were recorded at 14,459, indicating some level of market activity, albeit not enough to break into the higher rankings. This absence from the top tier could be seen as a challenge or an opportunity for Bonsai Cultivation to innovate or adjust their strategies in the Vapor Pens category to enhance their market presence.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Bonsai Cultivation has experienced fluctuations in its market position, with a notable improvement to 20th rank in February 2025, before slipping to 24th in March. This period saw Equinox Gardens initially maintaining a stronger position, ranking as high as 13th in January, but then dropping significantly to 26th by March, which could indicate a potential opportunity for Bonsai Cultivation to capture market share from a weakening competitor. Meanwhile, Natty Rems also showed volatility, ranking 16th in January but falling to 25th by March, suggesting a similar trend of instability. Conversely, Host and Kind Love have shown upward momentum, with Kind Love climbing from 45th in December to 23rd in March, potentially posing a competitive threat if this trend continues. These dynamics highlight the importance for Bonsai Cultivation to strategize effectively to maintain and improve its market position amidst shifting competitor performances.

Notable Products

In March 2025, Energy Pre-Roll (1g) maintained its top position as the leading product for Bonsai Cultivation, with a notable sales figure of 19,210 units. Creativity Pre-Roll (1g) held steady in second place, showing an increase in sales compared to the previous month. Energy Pre-Roll 2-Pack (1g) climbed to third place, marking its first appearance in the top three this year. Creativity Pre-Roll 2-Pack (1g) consistently remained in fourth place, while Relaxation Pre-Roll (1g) experienced a drop to fifth place from its previous third position in February. This month witnessed a reshuffling in the rankings, particularly with Energy Pre-Roll 2-Pack (1g) gaining traction in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.