Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

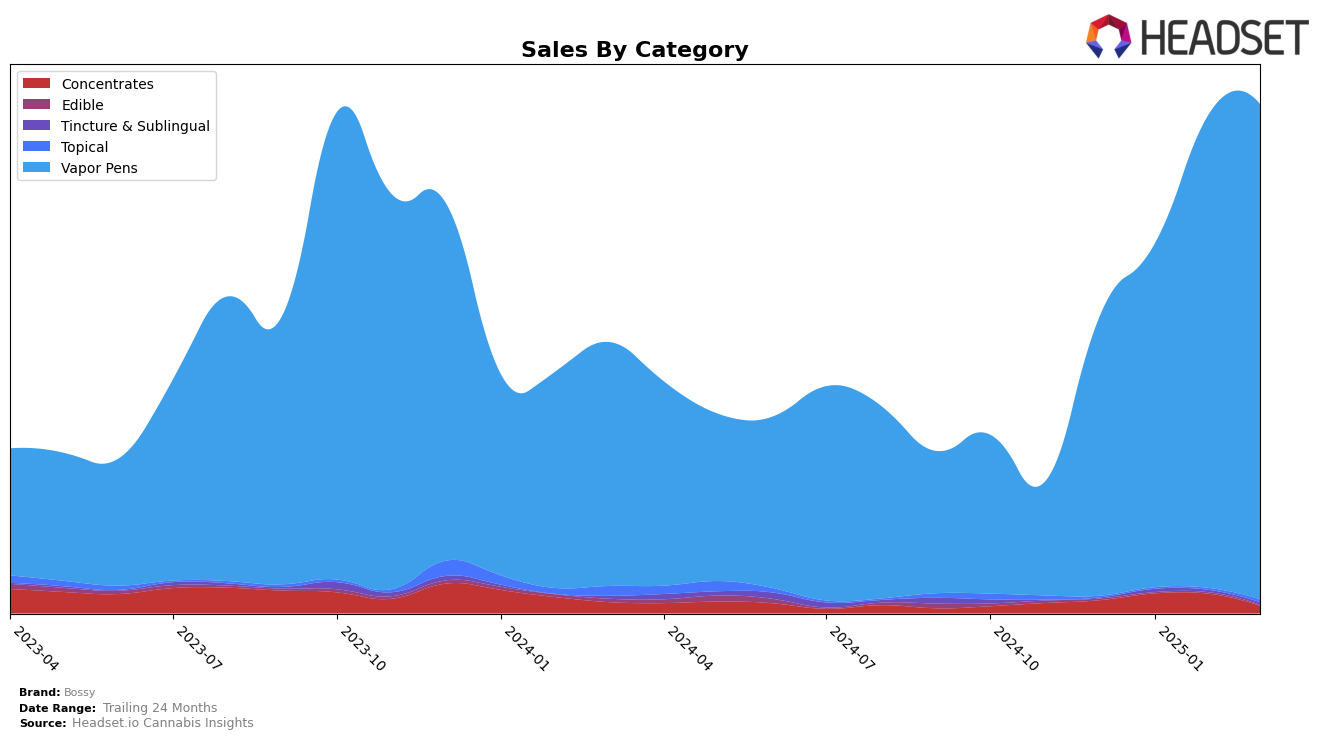

Bossy has shown a notable performance trend in the Michigan market, particularly within the Vapor Pens category. The brand improved its ranking from 25th place in December 2024 to a commendable 16th position by February 2025, before slightly dropping to 17th in March 2025. This upward movement in rankings is mirrored by a significant increase in sales, with the brand achieving over $700,000 in March 2025. However, in the Concentrates category, Bossy did not make it into the top 30 brands in any of the months from December 2024 to March 2025, indicating potential challenges or a lack of focus in this category.

While the Vapor Pens category reflects a strong growth trajectory for Bossy in Michigan, the absence of a ranking in the Concentrates category could suggest either a strategic decision to prioritize other categories or a need for improved market penetration strategies. The consistent presence in the top 30 for Vapor Pens, coupled with the fluctuating but generally positive sales figures, highlights Bossy's potential to capitalize on consumer preferences in this segment. This performance might prompt further analysis of market trends and consumer behavior to understand the dynamics at play in Michigan's cannabis market.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Bossy has shown a notable upward trajectory in its rankings over the past few months, moving from 25th place in December 2024 to 17th by March 2025. This improvement is indicative of a significant increase in sales, which have nearly doubled from December to March. In contrast, Traphouse Cannabis Co. experienced a decline in rank, dropping from 12th to 16th, with a corresponding decrease in sales. Meanwhile, Sauce Essentials maintained a relatively stable position, though it did see a slight dip in March. Pro Gro showed a gradual improvement, climbing from 20th to 18th, while High Minded struggled to maintain a top 20 position, dropping out of the rankings in January and February before re-entering in March. Bossy's ascent in the rankings highlights its growing presence and competitiveness in the Michigan vapor pen market, suggesting a positive trend in consumer preference and brand strength.

Notable Products

In March 2025, the Peaches & Cream Distillate Cartridge (1g) from Bossy reclaimed its top position in the Vapor Pens category, achieving a notable sales figure of 26,099. The Orange Pineapple Smoothie Distillate Cartridge (1g) debuted strongly, securing the second rank. The Premium Granddaddy Purple Distillate Cartridge (1g) maintained consistent performance, holding the third position, reflecting steady growth from previous months. Meanwhile, Premium Candyland Distillate Cartridge (1g) rose to fourth place, demonstrating an upward trend in sales. The Premium Strawberry Kush Distillate Cartridge (1g), which led in February, fell to fifth, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.