Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

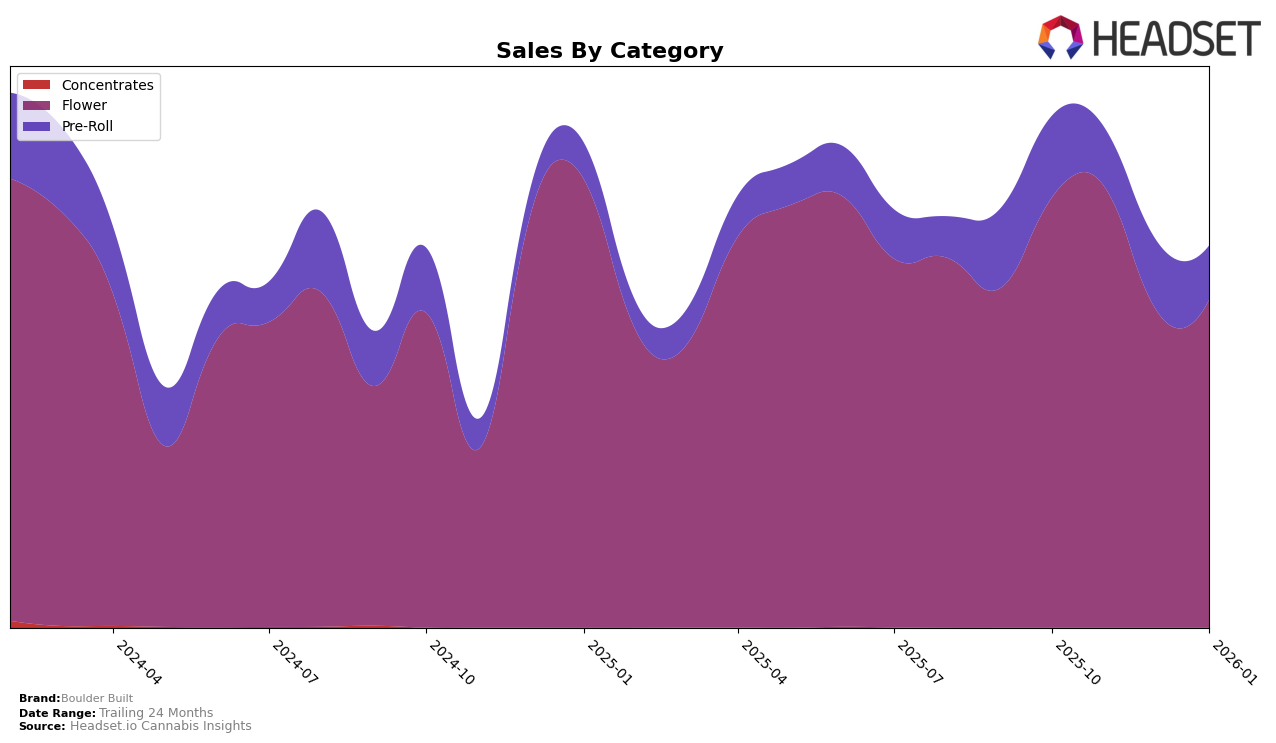

Boulder Built has shown a dynamic performance in the Colorado market, particularly in the Flower category. Over the span from October 2025 to January 2026, their ranking fluctuated, initially moving up from 15th to 14th, then experiencing a drop to 27th in December, before recovering to 21st in January. This volatility suggests a competitive market landscape, but Boulder Built's ability to rebound indicates resilience. Sales figures reflect this trend, with a notable dip in December, followed by a modest recovery in January. Such movements highlight the challenges and opportunities within the Flower category for Boulder Built.

In contrast, Boulder Built's presence in the Pre-Roll category in Colorado has been more stable, though less prominent. The brand consistently hovered around the lower end of the rankings, not breaking into the top 30, with positions at 33rd, 35th, 33rd, and 34th from October 2025 to January 2026. This consistency, albeit at a lower rank, could indicate a steady, if limited, market presence. The sales trajectory, with fluctuations but no significant upward movement, suggests that while Boulder Built maintains a foothold in this category, there may be untapped potential or challenges that need addressing to improve their standing.

Competitive Landscape

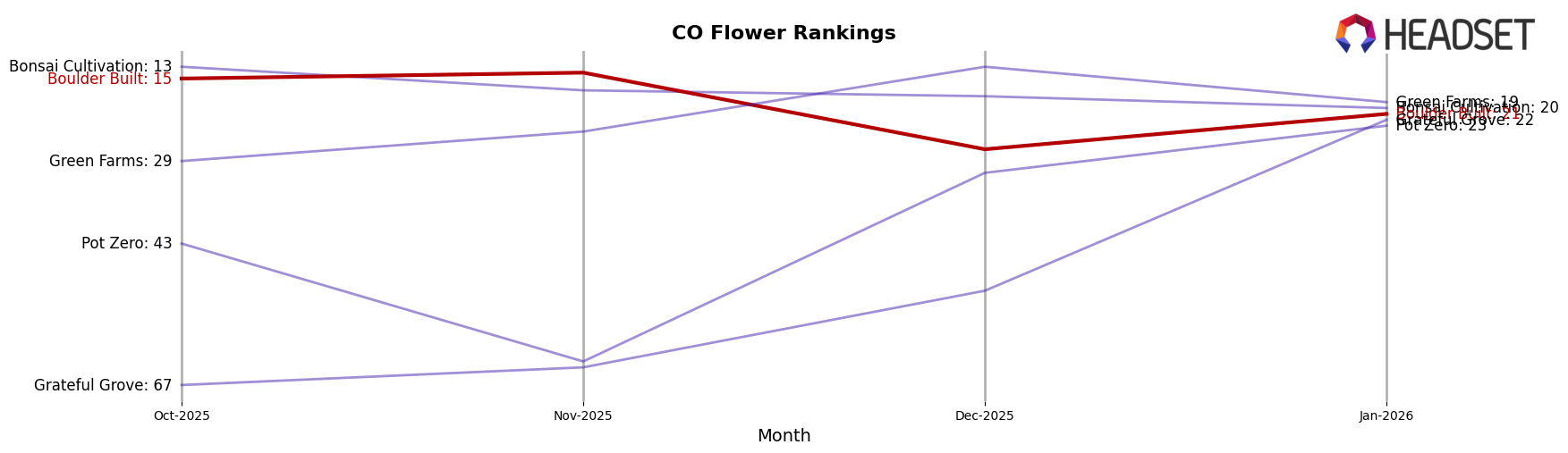

In the competitive landscape of the Colorado flower category, Boulder Built has experienced notable fluctuations in its rankings and sales, reflecting dynamic market conditions. Over the past few months, Boulder Built's rank shifted from 15th in October 2025 to 21st by January 2026, indicating a slight decline in its competitive positioning. Meanwhile, Bonsai Cultivation also saw a drop from 13th to 20th, suggesting a broader trend affecting established brands. Conversely, Pot Zero demonstrated a remarkable climb from 63rd to 23rd, showcasing a significant upward momentum that could pose a competitive threat. Similarly, Green Farms improved its rank from 29th to 19th, further intensifying the competition. Interestingly, Grateful Grove achieved a dramatic rise from 67th to 22nd, highlighting an aggressive market entry. These shifts underscore the importance for Boulder Built to adapt its strategies to maintain and enhance its market share amidst evolving consumer preferences and competitive pressures.

Notable Products

In January 2026, Boulder Built's top-performing product was Karen Bulk in the Flower category, securing the first rank with sales reaching 4947 units. Frosted Cherry Cookies Bulk, also in the Flower category, followed closely in second place. Pink Animal Mints Bulk rose to third place from its previous fourth position in December 2025, showing a significant increase in sales. Golden Goat Pre-Roll 1g, which was third in December, dropped to fourth place in January. GMO Crasher Bulk debuted in the rankings at fifth place, indicating strong sales performance for new entries in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.