Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

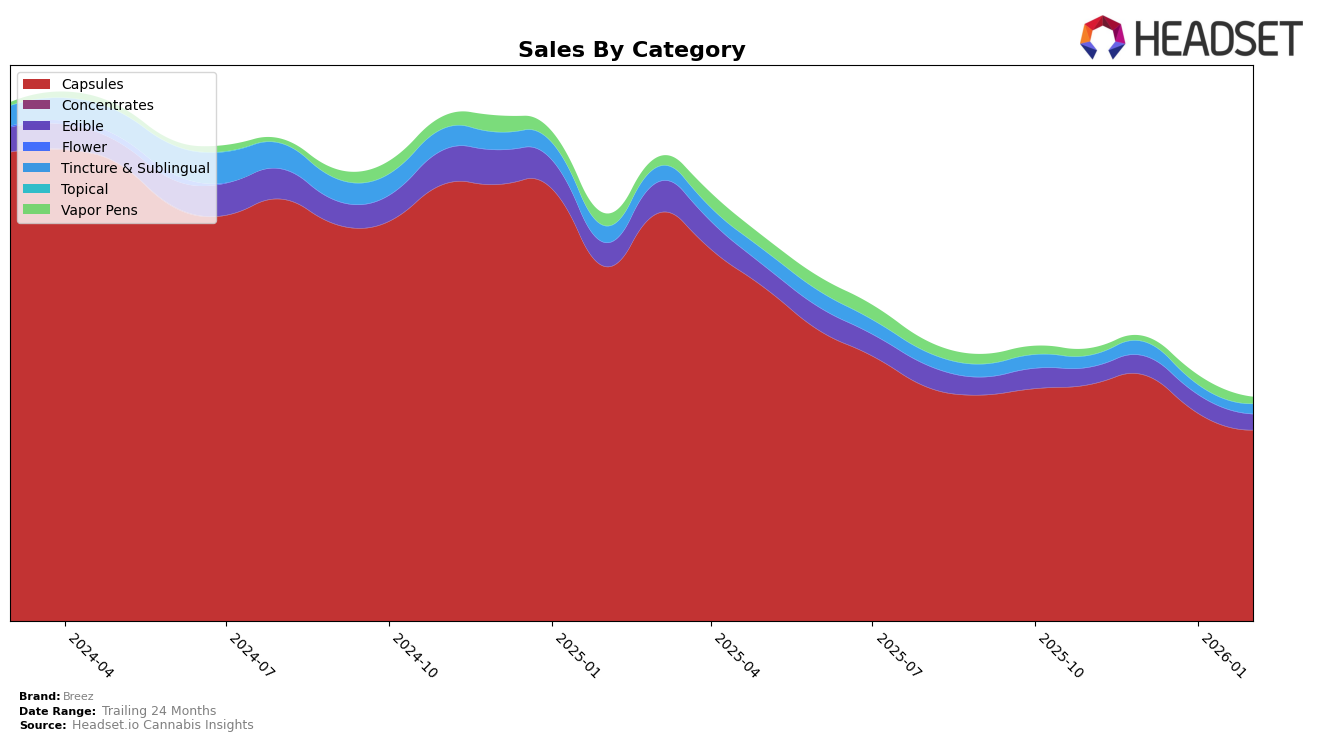

Breez has demonstrated notable performance in the California market, especially in the Capsules category. The brand secured the top position in December 2025 and February 2026, showcasing strong consumer preference despite a slight dip to the second position in January 2026. However, in the Edible category within California, Breez has been struggling to break into the top 40, with rankings hovering around the mid-40s over the observed months. This indicates a potential area for improvement or strategic focus. Meanwhile, their presence in the Tincture & Sublingual category has been inconsistent, with a notable absence from the top 30 in January 2026, which could suggest fluctuating demand or competitive pressure.

In Illinois, Breez's performance in the Capsules category has been stable, maintaining a consistent fourth position in both November and December 2025. However, their absence from the rankings in early 2026 might indicate a decline in market presence or a shift in consumer preferences. The Tincture & Sublingual category saw Breez making an appearance only in December 2025, suggesting limited market penetration or inconsistent sales. Interestingly, in the Vapor Pens category, Breez re-entered the rankings in January 2026, albeit at a lower position, which could imply a renewed effort to capture market share. This varied performance across categories and months highlights the dynamic nature of Breez's market strategy and the challenges they face in maintaining a consistent presence.

Competitive Landscape

In the competitive landscape of the California cannabis capsules market, Breez has demonstrated notable fluctuations in its ranking over the months from November 2025 to February 2026. Breez consistently alternated between the 1st and 2nd positions, indicating a strong presence and competitive edge. In November 2025, Breez was ranked 2nd, but it climbed to the top spot in December 2025, showcasing its ability to capture market share effectively. However, in January 2026, Breez slipped back to 2nd place, only to regain the 1st position in February 2026. This oscillation in rank highlights the intense competition with brands like Level, which mirrored Breez's rank changes, and ABX / AbsoluteXtracts, which maintained a steady 3rd position throughout the period. Despite these rank changes, Breez's sales figures indicate a downward trend from December 2025 to February 2026, suggesting potential challenges in sustaining its market leadership amidst fierce competition.

Notable Products

In February 2026, Breez's Indica Extra Strength Tablet 50-Pack (1000mg) maintained its position as the top-selling product, despite a decrease in sales to 3947 units. The Hybrid Extra-Strength Tablet 50-Pack (1000mg) and Sativa Extra Strength Tablet 50-Pack (1000mg) consistently held their ranks at second and third, respectively, showing stable performance across the months. The Original Mint Tin 20-Pack (100mg) remained in fourth place, although its sales figures saw a decline compared to January 2026. Sativa Royal Mint 20-Pack (100mg) continued to rank fifth, showing consistency since its re-entry in January. Overall, the rankings for February did not change from previous months, indicating a steady preference for Breez's top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.