Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

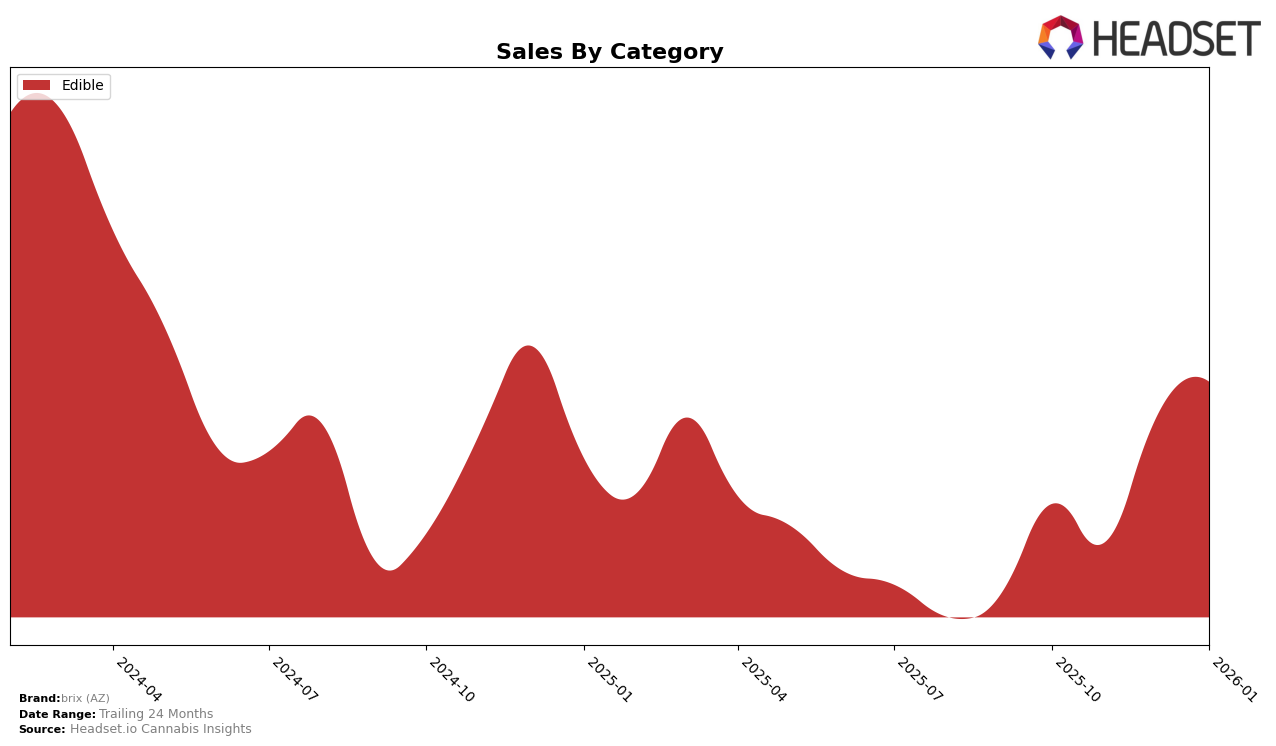

The performance of brix (AZ) in the Arizona market has shown remarkable consistency across the Edible category. Over the months from October 2025 to January 2026, brix (AZ) maintained a steady rank of 7th place, indicating a stable presence in the competitive landscape. This consistent ranking suggests that brix (AZ) has a solid foothold in the Arizona edible market, which is a positive indicator of brand loyalty and consumer preference. Despite fluctuations in monthly sales figures, with a noticeable increase from November to January, the brand's rank did not falter, highlighting its resilience and ability to sustain its market position amidst varying sales volumes.

While brix (AZ) has successfully held its ground in the Arizona edible category, the absence of rankings in other states or categories could be seen as both a challenge and an opportunity. The lack of presence in the top 30 brands in other states or categories might indicate untapped potential for expansion or a need for strategic re-evaluation. This situation presents an intriguing scenario for stakeholders to consider whether focusing efforts on strengthening positions in existing markets or exploring new territories could yield higher returns. As the cannabis industry continues to evolve, keeping an eye on these dynamics will be crucial for understanding brix (AZ)'s future growth trajectory.

Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, brix (AZ) maintained a consistent rank of 7th from October 2025 through January 2026. This stability in ranking suggests a steady performance amidst a dynamic market. Notably, Wana and Smokiez Edibles consistently ranked higher, occupying positions 5th and 6th interchangeably, indicating stronger sales performance. Despite this, brix (AZ) showed a positive sales trend, with a notable increase from December 2025 to January 2026. Meanwhile, Flav and Pure Edibles trailed behind brix (AZ) in both rank and sales, suggesting that brix (AZ) holds a competitive edge over these brands. The data indicates that while brix (AZ) faces stiff competition from leading brands, its consistent rank and upward sales trajectory position it well for potential growth in the Arizona edible market.

Notable Products

In January 2026, the top-performing product for brix (AZ) was the Strawberry Watermelon Gummy (100mg) in the Edible category, maintaining its first-place ranking from previous months with sales reaching 13,954 units. The Blueberry Pomegranate Gummy (100mg) consistently held the second position, although its sales slightly decreased from December 2025. Goldenberry Gummy (100mg) remained in the third spot, showing a steady performance across the months. Blackberry Raspberry Gummy (100mg) and Blackberry Raspberry Big Dose Gummies 2-Pack (1000mg) retained their fourth and fifth positions respectively, indicating stable consumer preference for these products. Notably, the sales figures for these top products have shown a general upward trend from October 2025 to January 2026, suggesting growing popularity and demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.