Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

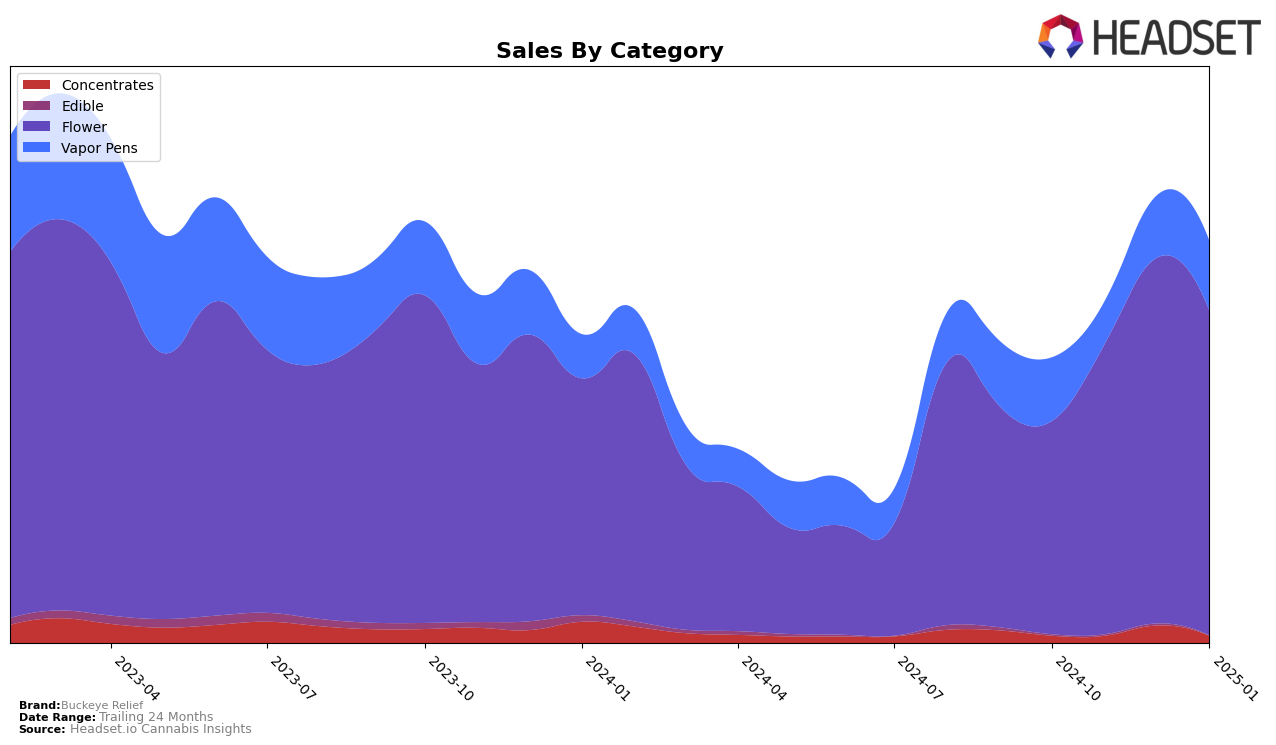

In the state of Ohio, Buckeye Relief has shown varied performance across different product categories. In the Concentrates category, the brand experienced a notable improvement in rankings, moving from 15th in October 2024 to 8th in December 2024, before slightly dropping to 11th in January 2025. This fluctuation suggests a competitive market environment where Buckeye Relief managed to capture significant market interest before facing some challenges. The Flower category tells a slightly different story, with Buckeye Relief reaching as high as 4th place in December 2024, a significant climb from its 11th place in October. This upward trend is indicative of strong consumer demand and effective market strategies in this category.

Conversely, Buckeye Relief's performance in the Vapor Pens category has been less dynamic. The brand's ranking fluctuated slightly, with a consistent presence within the top 20, peaking at 14th place in both December 2024 and January 2025. This steadiness might suggest a loyal customer base, though it also indicates a need for strategic initiatives to break into higher ranks. It's worth noting that while Buckeye Relief is a significant player in Ohio, the absence of rankings in other states or provinces implies limited market penetration outside of Ohio. This could be seen as both a challenge and an opportunity for the brand to expand its footprint and leverage its strong performance in Ohio to enter new markets.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Buckeye Relief has shown a dynamic shift in its market position over recent months. Starting from an 11th rank in October 2024, Buckeye Relief climbed to 7th in November and further improved to 4th in December, before settling at 8th in January 2025. This upward trajectory, particularly the peak in December, indicates a strong competitive performance, likely driven by strategic marketing or product innovations. In contrast, Seed & Strain Cannabis Co. experienced fluctuations, dropping from 6th in October to 12th in November, but rebounding to 6th by January, suggesting potential volatility in their sales strategy or market reception. Meanwhile, Certified (Certified Cultivators) maintained a relatively stable presence, consistently ranking between 4th and 7th, which may indicate a solid customer base and steady sales. Grassroots and Eden's Trees also showed varied performances, with Grassroots maintaining a mid-tier position and Eden's Trees experiencing a notable drop from 5th in October to 12th in December. These shifts highlight the competitive nature of the Ohio flower market and underscore the importance of strategic positioning for Buckeye Relief to maintain and enhance its market share.

Notable Products

In January 2025, Lemon Dosidos (2.83g) emerged as the top-performing product for Buckeye Relief, climbing to the number one rank with notable sales of 4982 units. Rainbow Runtz (2.83g) saw a significant rise, moving up to the second position from its previous fourth place in November 2024, with sales reaching 3911 units. Garlic Breath 2.0 (2.83g) maintained a strong presence, ranking third, slightly dropping from its second position in December 2024, with sales of 3233 units. 92 Cookies (2.83g), previously holding the top spot in December 2024, fell to fourth place with sales decreasing to 2908 units. Blueberry Funk (2.83g) rounded out the top five, experiencing a slight drop in rank compared to October 2024, with sales of 2637 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.