Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

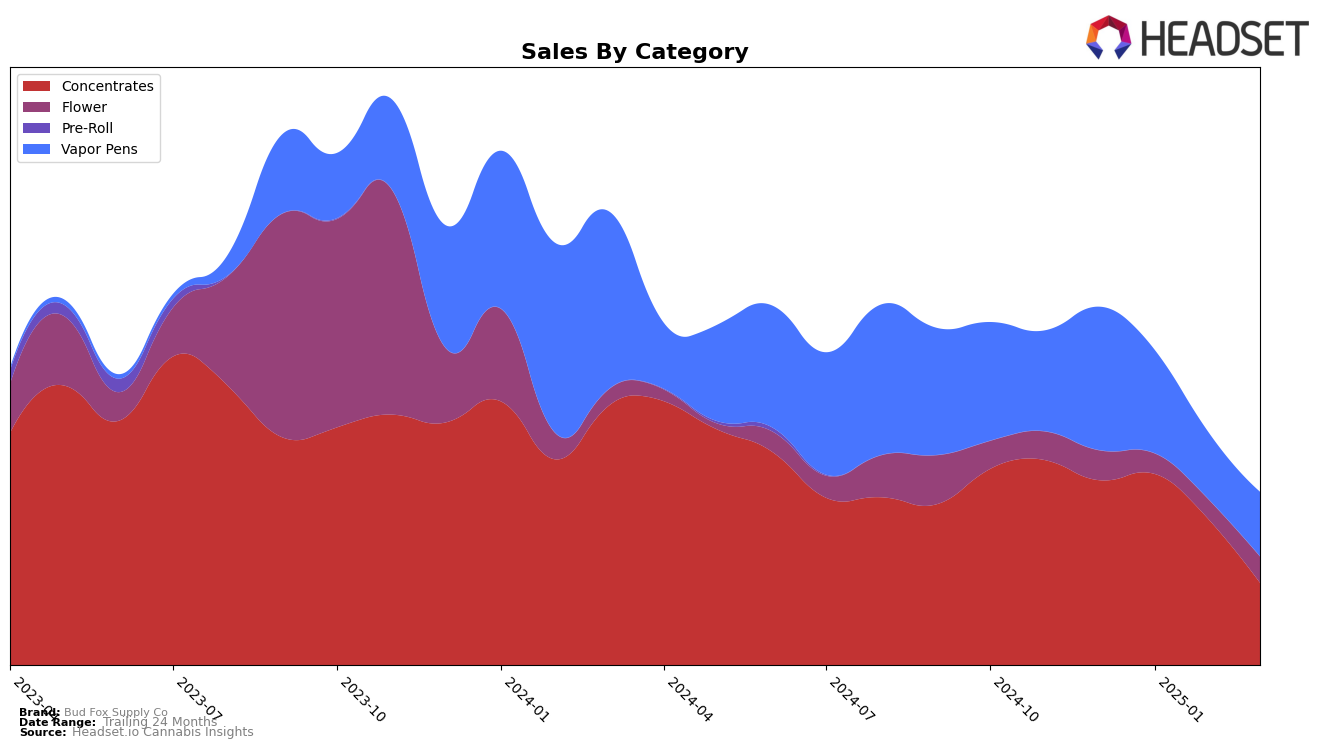

Bud Fox Supply Co's performance in the Colorado concentrates category has shown a notable decline over the first quarter of 2025. Starting the year strong with a consistent rank of 10 in December and January, the brand slipped to rank 13 in February and further down to rank 22 by March. This movement suggests a significant challenge in maintaining its competitive edge in the concentrates market, with sales dropping from over $245,000 in January to just above $105,000 in March. In contrast, their flower category rankings, although not in the top 30, have shown slight improvement, moving from a rank of 93 in January to 84 in March, indicating a potential area of opportunity for growth.

In the vapor pens category, Bud Fox Supply Co has faced a downward trend in rankings, starting at 41 in December and falling to 55 by March. This indicates a competitive struggle within this category in Colorado, where they have not managed to capture a top 30 spot, highlighting a potential area for strategic review. Despite these challenges, the brand's ability to maintain a presence in multiple categories suggests resilience and a foothold in the market that could be leveraged for future growth. Monitoring these trends closely could provide insights into consumer preferences and competitive dynamics in the region.

Competitive Landscape

In the competitive landscape of concentrates in Colorado, Bud Fox Supply Co has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially holding a strong 10th rank in December and January, Bud Fox Supply Co saw a decline to 13th in February and further dropped to 22nd by March. This downward trend in ranking coincides with a significant decrease in sales, contrasting with competitors like Seed and Smith (LBW Consulting), which maintained a consistent 21st rank throughout the same period, indicating stable sales performance. Meanwhile, Mile High Dabs improved its position from 29th in December to 20th by March, suggesting a positive sales trajectory. The volatility in Bud Fox Supply Co's rank and sales highlights the competitive pressures within the Colorado concentrates market, emphasizing the need for strategic adjustments to regain market share.

Notable Products

In March 2025, Gelatti Mints Bulk emerged as the top-performing product for Bud Fox Supply Co, climbing from the 3rd position in January to the 1st position with notable sales of 1,311 units. Aloha Limone Bulk made a significant debut, securing the 2nd rank with a strong entry in the rankings. Farm Truck 3.5g also entered the rankings, capturing the 3rd position, indicating a growing interest in this product. Aloha Limone Sugar Wax 4g maintained its 4th position from February to March, showing consistent demand in the concentrates category. Lastly, Rainbow Bait Live Resin Cartridge 1g rounded out the top five, marking its first appearance in the rankings, which suggests an increasing preference for vapor pens among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.