Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

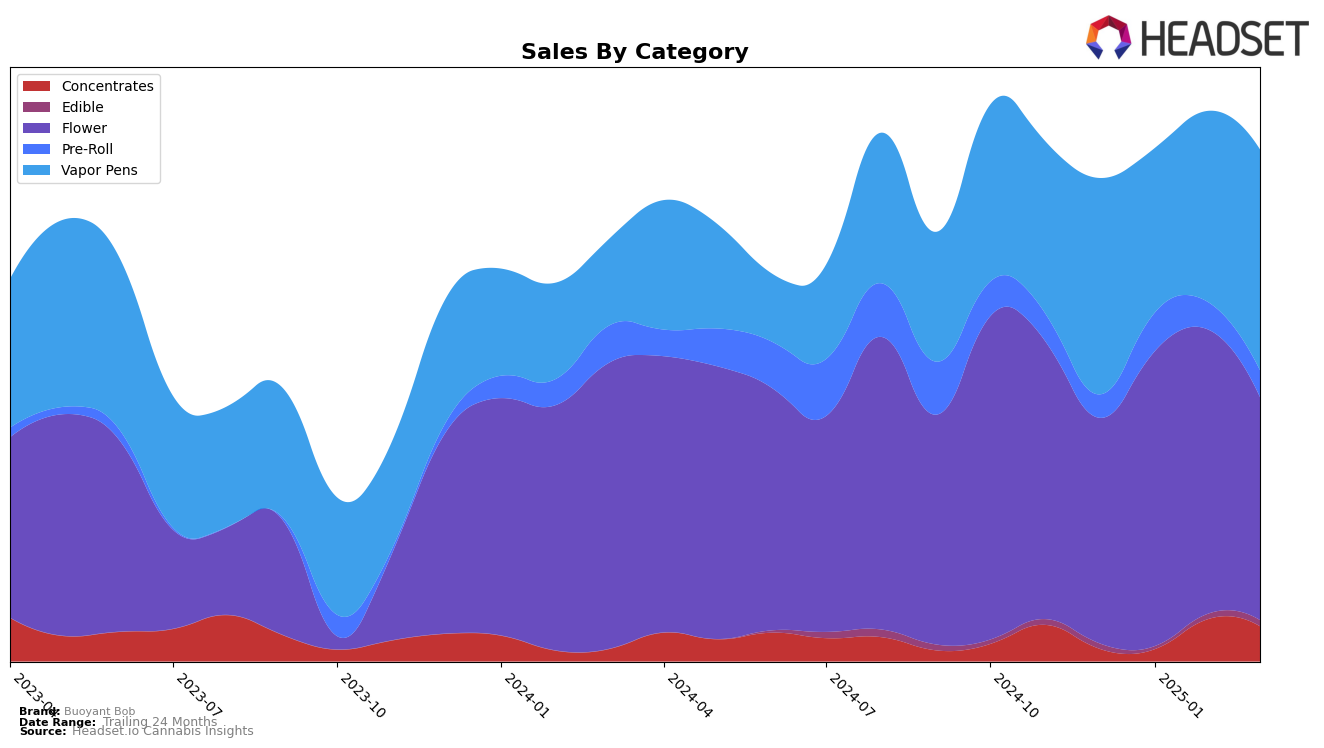

Buoyant Bob has demonstrated varied performance across different categories and states, with notable movements in Missouri. In the Concentrates category, the brand experienced a significant leap, moving from the 29th position in January 2025 to an impressive 11th position by February, although it slightly dipped to 12th in March. This suggests a strong upward trend, indicating growing consumer interest or effective marketing strategies. Meanwhile, in the Flower category, Buoyant Bob maintained a steady presence within the top 15, though it did experience some fluctuations, ending March in the 14th position after peaking at 10th in February. Such resilience in the Flower category suggests a solid foothold in the market, despite the competitive landscape.

In New Jersey, Buoyant Bob's performance paints a different picture. The brand struggled to break into the top 30 in both Flower and Vapor Pens categories consistently. For instance, in the Flower category, Buoyant Bob was ranked 38th in January 2025 but dropped out of the top 30 by March. Similarly, in Vapor Pens, the brand was absent from the rankings in January and March, only appearing in February at the 38th position. This sporadic presence highlights the challenges Buoyant Bob faces in establishing a strong market presence in New Jersey, contrasting with its more stable performance in Missouri. Such insights could be crucial for strategic planning and market penetration efforts in the coming months.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Buoyant Bob has experienced fluctuating rankings over recent months, indicating a dynamic market presence. Starting at rank 15 in December 2024, Buoyant Bob climbed to the 10th position by February 2025, showcasing a notable improvement in market standing. However, by March 2025, the brand dropped to rank 14, suggesting potential challenges in maintaining its upward trajectory. In comparison, Greenlight consistently held a stronger position, ranking between 10th and 13th, while Elevate (Elevate Missouri) showed a similar pattern of fluctuation, ending March at the 12th spot. Meanwhile, Robust and Pinchy's demonstrated upward trends, with Robust moving from 22nd to 15th and Pinchy's from 26th to 16th over the same period. These shifts highlight the competitive pressure Buoyant Bob faces in maintaining its market share, especially as competitors like Robust and Pinchy's gain momentum. This analysis underscores the importance for Buoyant Bob to strategize effectively to capitalize on its peak performance periods and address the factors contributing to its rank volatility.

Notable Products

In March 2025, Buoyant Bob's top-performing product was Wounded Warrior's Breath Pre-Roll (1g), which climbed to the number one spot with sales reaching 7,156 units. Hard Lemonade Distillate Disposable (1g) secured the second position, showing a decline from its top rank in December 2024. Mai Tai Distillate Cartridge (1g) emerged as a new contender, achieving the third rank, while Blue Dream Distillate Cartridge (1g) followed closely in fourth place. Gas Cake (3.5g) completed the top five, maintaining its position from February 2025. These shifts highlight a dynamic change in consumer preferences over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.