Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

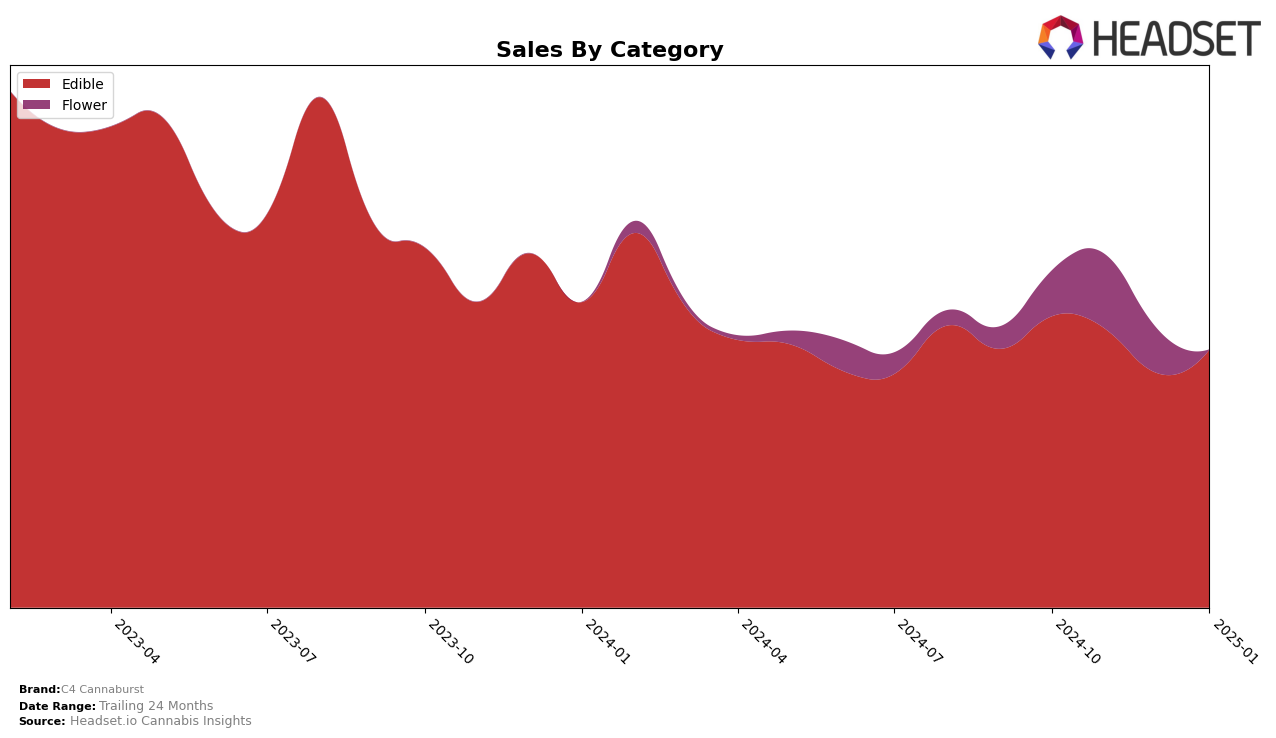

C4 Cannaburst has demonstrated a fluctuating performance in the Washington market, particularly within the Edible category. In October 2024, the brand managed to secure the 29th position, indicating a presence in the competitive landscape. However, the subsequent months of November and December saw a dip, with C4 Cannaburst falling out of the top 30, only to regain the 30th spot by January 2025. This movement suggests a volatile market presence, which may be attributed to seasonal demand shifts or competitive pressures within the Edible category. The brand's ability to re-enter the top 30 by January could be indicative of strategic adjustments or marketing efforts that resonated with consumers during that period.

When examining sales trends, C4 Cannaburst experienced a noticeable decline from October to December 2024, with a slight recovery in January 2025. This pattern highlights potential challenges the brand faced during the holiday season, a critical period for many edible products. Despite the sales drop, the brand's January rebound suggests resilience and the potential for growth if the right strategies are implemented. The brand's fluctuating rank and sales figures underscore the dynamic nature of the cannabis market in Washington, where consumer preferences and competitive dynamics can significantly impact brand performance.

Competitive Landscape

In the competitive landscape of the Edible category in Washington, C4 Cannaburst has shown a steady presence but faces notable competition from brands like Hi-Burst and Chewee's. Over the months from October 2024 to January 2025, C4 Cannaburst maintained a rank around 29 to 31, indicating a consistent but challenging position in the market. In contrast, Hi-Burst consistently ranked higher, maintaining positions between 24 and 27, suggesting stronger market traction. Similarly, Chewee's hovered around ranks 28 to 30, slightly outperforming C4 Cannaburst. This competitive pressure is reflected in the sales trends, where C4 Cannaburst's sales figures show a downward trend from October to December 2024, before a slight recovery in January 2025. These insights highlight the need for strategic marketing efforts by C4 Cannaburst to enhance its market position and compete more effectively with these established brands.

Notable Products

For January 2025, the top-performing product from C4 Cannaburst was the Sativa Sour Atomic Apple Fruit Chews 10-Pack, which reclaimed its number one rank with sales reaching 353 units. This product showed resilience by returning to the top spot after dropping to second place in December 2024. The Indica Pineapple Orange Guava Fruit Chews 10-Pack followed closely in second place, experiencing a notable drop in sales from December's peak. The Indica Berry Bomb Fruit Chews 10-Pack maintained its position at third, consistent with its December ranking. The Watermelon Whizbang Fruit Chews 10-Pack, both regular and Indica versions, remained stable in their rankings, indicating steady but unremarkable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.