Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

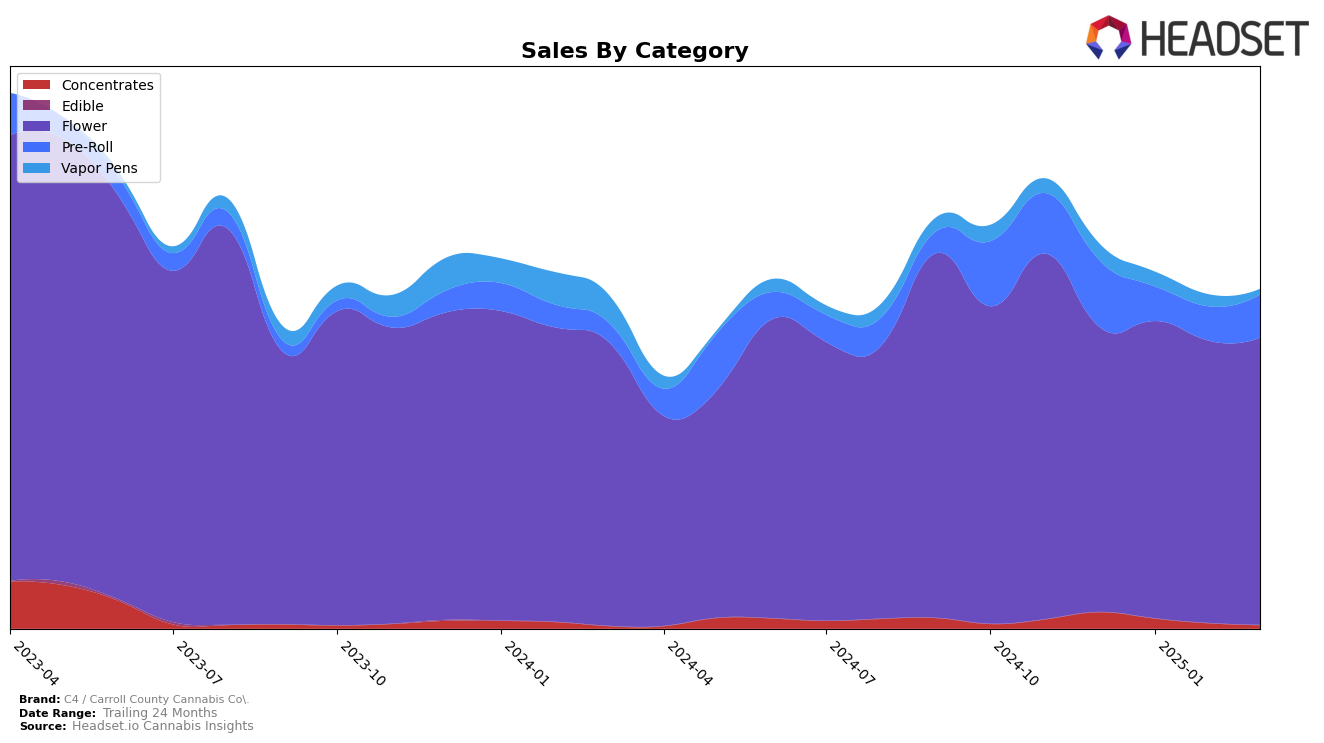

The performance of C4 / Carroll County Cannabis Co. in the Missouri market reveals interesting trends across different product categories. In the Flower category, the brand maintained a strong presence with consistent rankings around the mid-teens, peaking at 16th place from January to February 2025 before slightly dropping to 17th in March. This stability suggests a solid consumer base and consistent demand in the Flower segment. In contrast, the Concentrates category saw the brand drop out of the top 30 after January 2025, indicating a potential challenge in maintaining competitiveness or consumer interest in this segment. This drop-off could signal the need for strategic adjustments or a focus on innovation to regain market share.

The Pre-Roll category presents a more volatile performance for C4 / Carroll County Cannabis Co. in Missouri. Starting at 20th place in December 2024, the brand experienced a sharp decline in rankings to 32nd by March 2025. This downward trend, despite a slight sales uptick in March, highlights potential issues with brand positioning or product differentiation in the Pre-Roll segment. The fluctuations in ranking could be indicative of competitive pressures or shifts in consumer preferences that the brand may need to address. Overall, while C4 / Carroll County Cannabis Co. shows strength in the Flower category, the challenges in Concentrates and Pre-Rolls suggest areas for strategic focus and improvement.

Competitive Landscape

In the competitive landscape of the Missouri flower category, C4 / Carroll County Cannabis Co. has shown resilience amidst fluctuating market dynamics. From December 2024 to March 2025, C4 maintained a relatively stable rank, hovering around the 16th to 18th positions. This steadiness contrasts with the performance of competitors such as Proper Cannabis, which experienced a decline from 14th to 18th place, and Robust, which improved its rank from 22nd to 15th. Notably, Pinchy's demonstrated significant volatility, climbing from 26th to 14th before settling at 16th, indicating a dynamic market presence. Despite these shifts, C4's sales remained relatively consistent, suggesting a loyal customer base. However, the brand may need to strategize to enhance its competitive edge, especially as brands like Robust and Pinchy's show potential for upward momentum.

Notable Products

In March 2025, Bubba Fett (3.5g) maintained its position as the top-performing product for C4 / Carroll County Cannabis Co., showing a significant sales increase to 5211 units. Tropical Chem (3.5g) held steady at the second spot, continuing its strong performance from February. Super Lemon Haze (3.5g) remained in third place, despite a decline in sales from previous months. Bubba Fett (Bulk) improved its ranking to fourth, recovering from a dip in February. Blue Dream (3.5g) re-entered the top five, marking a return to the rankings after being absent in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.