Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

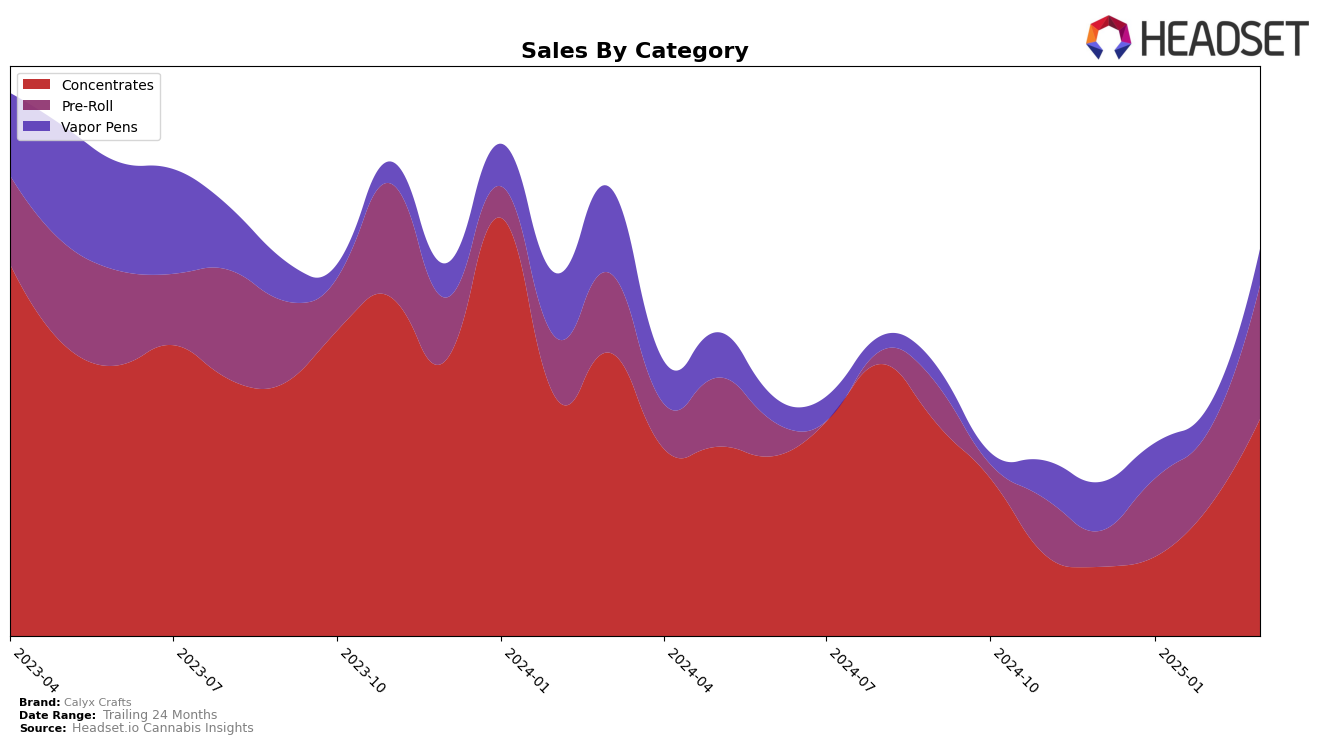

In the state of Oregon, Calyx Crafts has shown a notable upward trajectory in the Concentrates category. Starting from a rank of 55 in December 2024, the brand has climbed to 30 by March 2025, indicating a significant improvement in market presence and consumer preference. This positive trend is supported by a marked increase in sales, which more than doubled over the span of four months. However, in the Vapor Pens category, Calyx Crafts did not make it into the top 30 in February 2025, suggesting a potential area for growth or increased competition within that segment.

The performance of Calyx Crafts in the Pre-Roll category also reflects a steady climb, moving from a rank of 95 in December 2024 to 62 in March 2025. This progress suggests a growing acceptance and popularity of their products among consumers in Oregon. Despite these gains, the brand did not secure a top 30 position in the Vapor Pens category in February 2025, which may indicate challenges in maintaining consistent performance across all product lines. This fluctuation in rankings across categories highlights areas where Calyx Crafts could potentially focus their efforts to achieve a more balanced market presence.

Competitive Landscape

In the Oregon concentrates market, Calyx Crafts has shown a notable upward trajectory in rank over the first quarter of 2025, climbing from 55th in December 2024 to 30th by March 2025. This improvement in rank is accompanied by a significant increase in sales, particularly between February and March, where sales nearly doubled. This positive trend positions Calyx Crafts favorably against competitors such as Afterglow, which, despite a similar sales boost in March, only moved from 38th to 29th. Meanwhile, Happy Cabbage Farms experienced a decline in rank, dropping from 27th to 37th, indicating potential challenges in maintaining their market position. Sessions Supply Co. (CA) and Sand Castle Hash Co. also faced fluctuations in rank, with Sessions Supply Co. dropping from 19th to 32nd, while Sand Castle Hash Co. improved slightly from 33rd to 28th. These dynamics suggest that Calyx Crafts is effectively capitalizing on market opportunities and gaining ground against its competitors in Oregon's concentrates category.

Notable Products

In March 2025, Tokyo Space Fuel Shatter (1g) from Calyx Crafts maintained its position as the top-performing product in the Concentrates category, with sales reaching 2465 units. This product has consistently held the number one spot since December 2024. Among Pre-Rolls, Closet Monster Infused Pre-Roll (1g) emerged as the second-best seller, followed by Pink Elephant Diamond Infused Pre-Roll (1g) and Bollywood Infused Pre-Roll (1g) in third and fourth places, respectively. Notably, Grande Bazooka Infused Pre-Roll (1g) climbed back to fifth place in March after a brief absence from the rankings in January. This indicates a strong performance in the Pre-Roll category for March, with several new entries making a significant impact.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.