Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

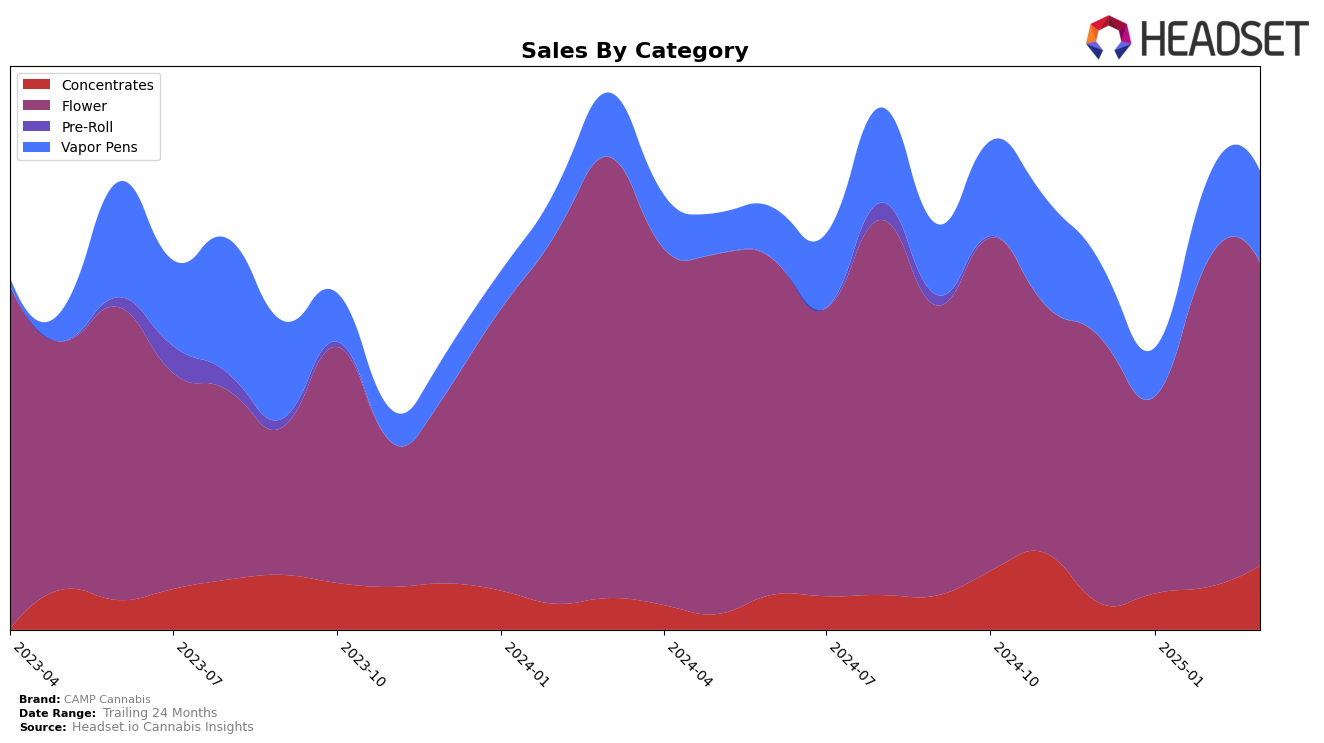

In the state of Missouri, CAMP Cannabis has shown notable progress in the Concentrates category, climbing from 28th place in December 2024 to 15th place by March 2025. This upward trajectory is indicative of a strong performance, with sales increasing significantly from $56,192 to $135,116 over the same period. This growth suggests that CAMP Cannabis is effectively capturing market share in this segment. However, in the Vapor Pens category, the brand has not managed to break into the top 30 rankings, maintaining a steady position around the 40s. This could imply either a saturated market or a need for strategic adjustments to enhance their presence in this category.

Meanwhile, in the Flower category, CAMP Cannabis has experienced fluctuating rankings, starting at 29th in December 2024, dipping to 30th in January 2025, before rising to 21st in February and slightly declining to 22nd in March. Despite these shifts, the brand's sales figures have remained robust, with a noticeable peak in February 2025. This suggests that while their position in the rankings has been variable, consumer demand for their Flower products remains strong. The absence from the top 30 in the Vapor Pens category highlights an area where potential growth could be targeted, possibly through product innovation or marketing efforts to increase visibility and competitiveness in this sector.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, CAMP Cannabis has shown a notable upward trajectory in its rankings over the first quarter of 2025. Starting from a rank of 29 in December 2024, CAMP Cannabis improved to rank 21 by February 2025, before slightly dropping to rank 22 in March 2025. This positive shift in rank indicates a strengthening market presence, potentially driven by a significant increase in sales from January to February 2025. However, despite this progress, CAMP Cannabis still trails behind competitors like Nuthera Labs, which consistently maintained a higher rank, peaking at 16 in December 2024 and closing at 20 in March 2025. Meanwhile, TwentyTwenty (IL) and Sundro Cannabis also represent significant competition, with both brands showing resilience in maintaining or improving their positions. The data suggests that while CAMP Cannabis is making strides, there is still a competitive gap to close to reach the top tier of the Missouri Flower market.

Notable Products

In March 2025, the top-performing product from CAMP Cannabis was Papayaz Ice Cream Cake (3.5g) in the Flower category, which climbed to the number one spot with sales of 2433 units. Melted Strawberries (3.5g) followed as the second-best seller, showing strong market presence. Trilla (3.5g) secured the third position, while Stardawg Hashplant (3.5g) and Sugar High (Bulk) rounded out the top five. Notably, Papayaz Ice Cream Cake (3.5g) improved significantly from its fifth position in February 2025 to lead the rankings in March. This upward movement indicates a growing consumer preference for Papayaz Ice Cream Cake (3.5g) over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.