Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

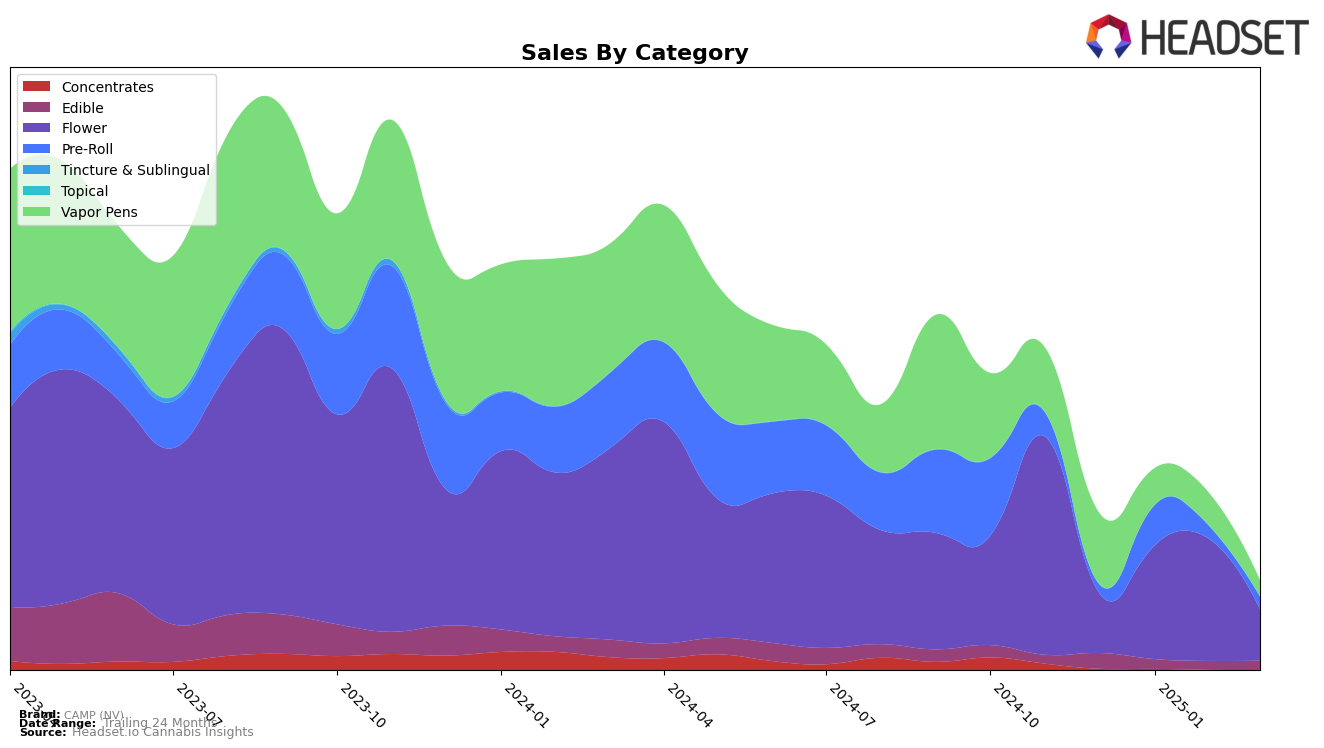

In the state of Nevada, CAMP (NV) has shown varied performance across different cannabis categories. In the Flower category, the brand experienced a significant upward trend from December 2024 to February 2025, climbing from the 21st position to an impressive 7th place, before dropping back to 22nd in March 2025. This fluctuation suggests a dynamic market presence, with potential opportunities for regaining higher ranks. Meanwhile, in the Edible category, the brand maintained a relatively stable position, hovering around the 16th to 18th ranks, indicating consistent consumer demand despite a gradual decline in sales figures over the months.

The Pre-Roll category witnessed a dramatic shift for CAMP (NV), where the brand jumped from 37th place in December 2024 to 7th in January 2025, only to fall to 27th by March 2025. This volatility could reflect either a response to competitive pressures or changes in consumer preferences. In contrast, the Vapor Pens category showed a downward trajectory, with the brand dropping out of the top 30 by March 2025. This decline might highlight challenges in maintaining market share, possibly due to increased competition or shifts in consumer buying patterns. These movements across categories present a mixed bag of successes and challenges for CAMP (NV) in Nevada.

Competitive Landscape

In the competitive landscape of the Nevada flower category, CAMP (NV) has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting at rank 21 in December, CAMP (NV) made a significant leap to rank 11 in January and further climbed to rank 7 in February, showcasing a strong upward trajectory. However, by March, it slipped back to rank 22, indicating potential volatility or increased competition. This fluctuation is particularly significant when compared to competitors like Khalifa Kush, which maintained a relatively stable ranking between 17 and 23, and Polaris MMJ, which improved its position from 30 to 20 over the same period. Meanwhile, Vegas Valley Growers showed a dramatic rise from rank 64 in February to 21 in March, potentially contributing to the competitive pressure faced by CAMP (NV). Despite these challenges, CAMP (NV) demonstrated impressive sales growth in January and February, which could be leveraged to regain its competitive edge in the upcoming months.

Notable Products

In March 2025, the top-performing product for CAMP (NV) was the First Class Funk Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with a notable sales figure of 4262 units. The 007 UP Pre-Roll (1g), also in the Pre-Roll category, followed closely at the second position. Peach Rosin Gummies 10-Pack (100mg) in the Edible category ranked third, maintaining a strong position from a previous second place in December 2024. Wedding Crashers Pre-Roll (1g) and Jack Herer Pre-Roll (1g) occupied the fourth and fifth ranks, respectively, both experiencing a drop from their previous top two placements in January 2025. Overall, the Pre-Roll category dominated the top ranks, indicating a strong consumer preference in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.