Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

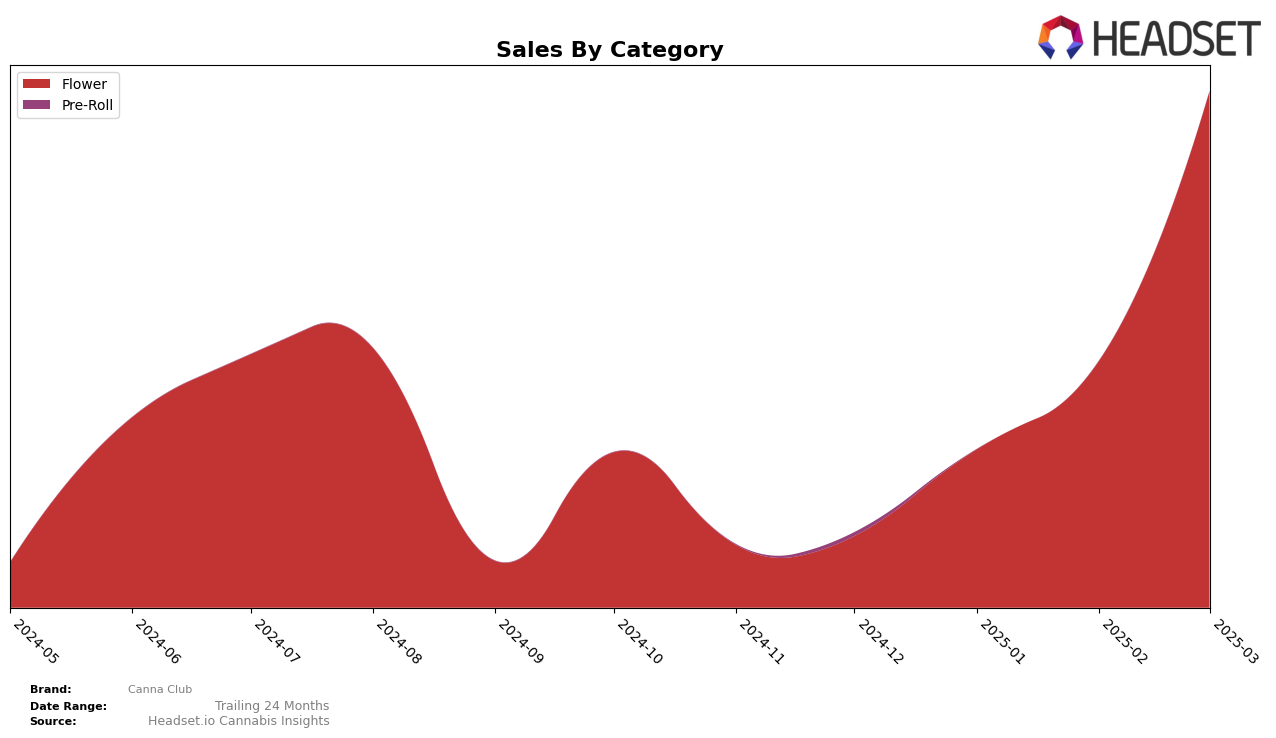

Canna Club has shown a remarkable upward trajectory in the Colorado market, particularly in the Flower category. Starting from a rank of 82 in December 2024, the brand has climbed to an impressive 27 by March 2025. This significant rise suggests a growing consumer preference and increasing market penetration for Canna Club's products in the state. The brand's sales figures have also followed a positive trend, with a noticeable jump from December to March. This upward movement indicates that Canna Club is successfully capturing market share and possibly outpacing competitors in the region.

While Canna Club's performance in Colorado is noteworthy, its absence from the top 30 rankings in other states and categories highlights areas with potential for growth. The brand's focus on the Flower category in Colorado seems to be paying off, but its lack of presence in other states or categories might suggest either a strategic focus or an opportunity for expansion. As the brand continues to gain traction in Colorado, it will be interesting to see if they leverage this momentum to explore new markets or diversify their product offerings.

```Competitive Landscape

In the highly competitive Colorado flower market, Canna Club has demonstrated a remarkable upward trajectory in its rankings over the past few months, moving from a rank of 82 in December 2024 to 27 by March 2025. This significant climb suggests a strong increase in market presence and consumer preference. In contrast, Equinox Gardens, despite starting at a higher rank of 15 in December, has seen a decline, dropping out of the top 20 by March. Similarly, Natty Rems and Nuhi have experienced fluctuations, with both brands also falling out of the top 20 by March. Meanwhile, The Original Jack Herer has shown a notable improvement, moving from a consistent rank of 46 to 28 by March, closely trailing Canna Club. These shifts indicate a dynamic market where Canna Club's strategic efforts are paying off, positioning it as a rising contender among established competitors.

Notable Products

In March 2025, Canna Club's top-performing product was Lemon Wafers Bulk, which climbed to the number one spot from a previous rank of five in February, with sales reaching 7,524 units. Mimosa Bulk followed closely as the second-highest performer, making a strong debut in the rankings. Sunset Sherbet 1g secured the third position, showcasing consistent demand. Warritos 1g and Tribe Walker Bulk rounded out the top five, both maintaining steady placements in the fourth and fifth positions, respectively. Notably, all top five products were in the Flower category, indicating a strong consumer preference for this type.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.