Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

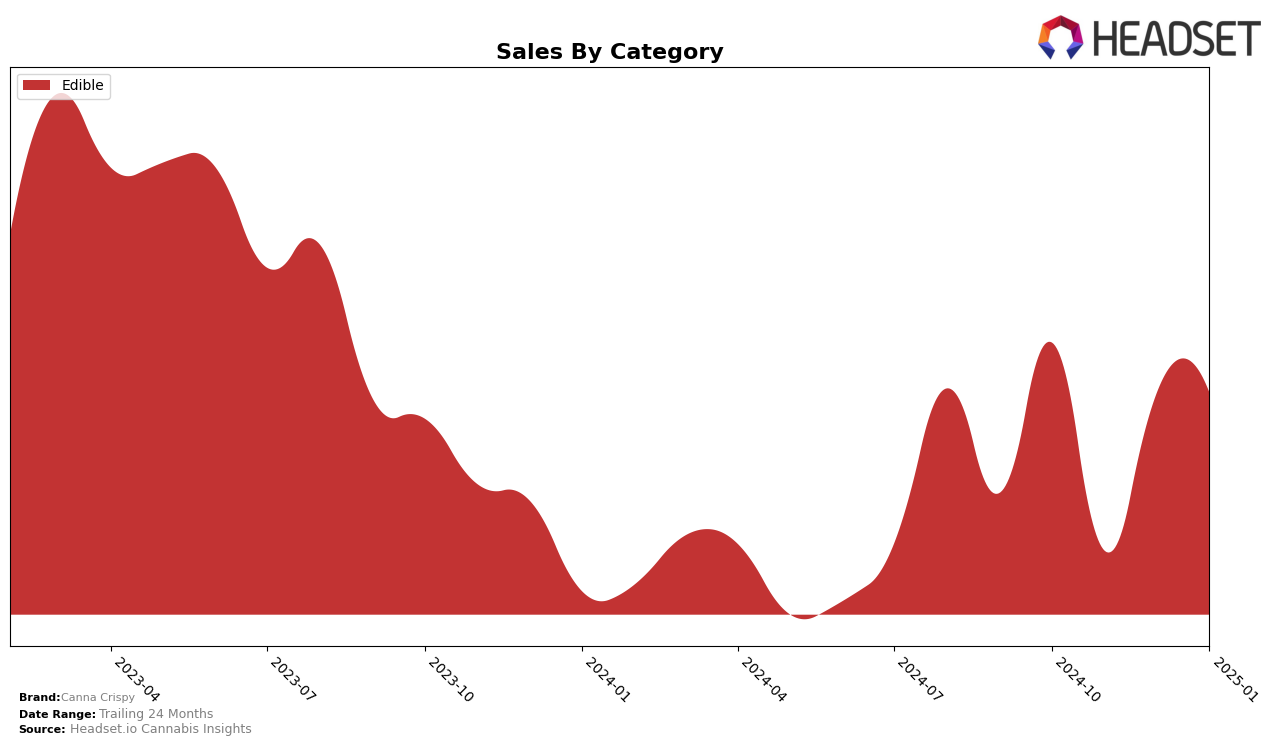

The performance of Canna Crispy in the Edible category in Oregon has shown a notable trend over the past few months. Starting from October 2024, Canna Crispy held the 25th position, briefly dropping to 28th in November, before climbing back to 25th in December and improving further to 24th in January 2025. This upward trajectory, despite a dip in November, suggests a growing consumer preference or effective marketing strategies that have helped the brand regain and slightly improve its standing in the state. The sales figures reflect this trend, with a significant dip in November but a recovery and stabilization in the subsequent months.

Interestingly, Canna Crispy's presence in the top 30 rankings in other states or provinces is not mentioned, indicating that the brand may not have a strong foothold or a significant market share outside of Oregon. This could be seen as a potential area for growth or a challenge that the brand needs to address if it aims to expand its influence beyond its current market. The focus on Oregon, with consistent ranking improvements, highlights the importance of maintaining and building upon the brand's existing strengths while exploring opportunities for broader market penetration.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Oregon, Canna Crispy has shown a dynamic performance from October 2024 to January 2025. During this period, Canna Crispy's rank fluctuated, starting at 25th in October, dropping to 28th in November, and then recovering to 24th by January. This indicates a resilient market presence despite the competitive pressures. Notably, Dr. Feel Good consistently outperformed Canna Crispy, maintaining a higher rank and demonstrating stronger sales momentum, particularly in October and December. Meanwhile, Tasty's (OR) and Mellow Vibes (formerly Head Trip) also presented formidable competition, with Tasty's maintaining a more stable rank and sales trajectory. Canna Crispy's ability to regain its rank in January suggests potential strategic adjustments or market responses that could be further explored to sustain and enhance its competitive edge in the Oregon edible market.

Notable Products

In January 2025, the top-performing product for Canna Crispy was the Sativa Fruity Crispy Treat (100mg), which climbed to the number one rank with notable sales of 1118 units. Following closely, the Indica Peanut Butter Chocolate Crispy Treats (100mg) maintained its strong performance, holding the second position consistently from December 2024 with sales reaching 1073 units. The Indica Fruity Crispy Treat (100mg) improved its ranking to third place, showing a positive trend from fifth in December 2024. The Hybrid Chocolate Crispy Treat (100mg) experienced a slight decline, dropping to fourth position after leading in November 2024. Lastly, the Sativa Strawberry Crispy Treats (100mg) re-entered the top five, marking a significant improvement from its absence in December 2024 rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.