Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

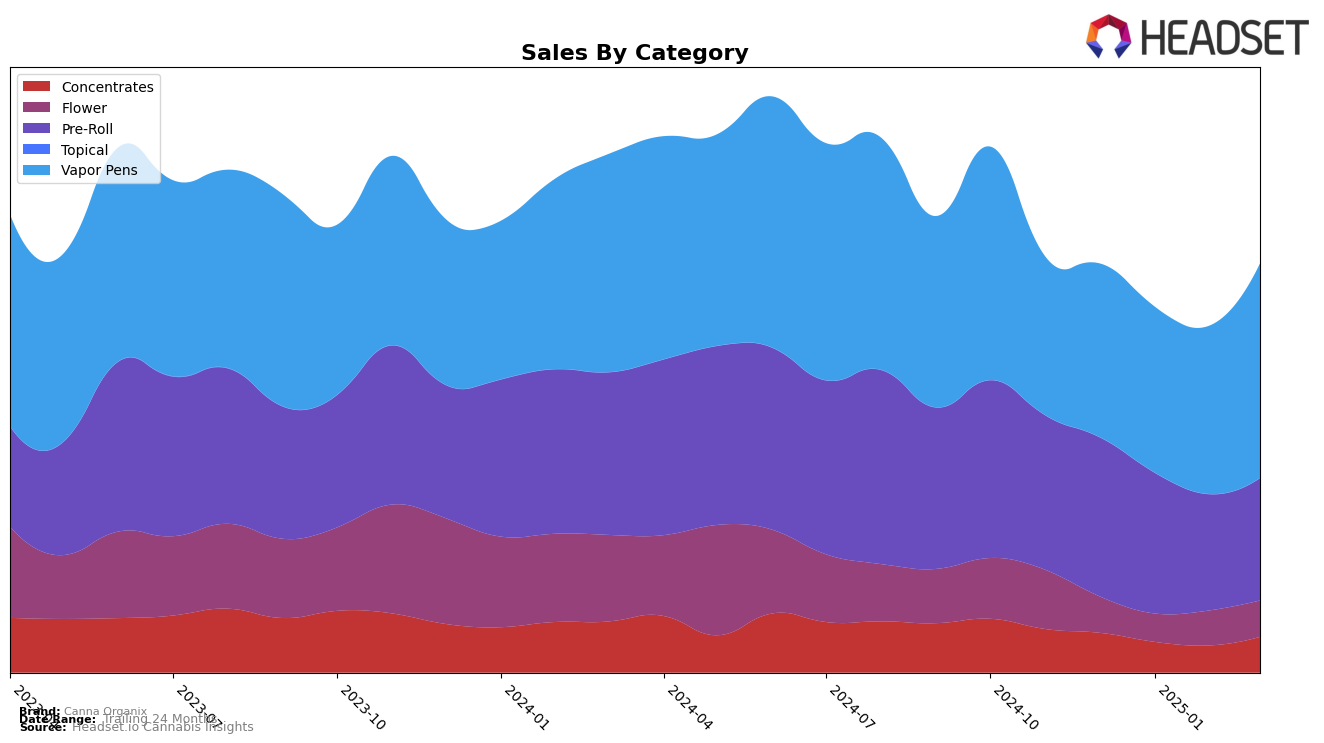

Canna Organix has shown varying performance across different product categories in Washington. In the Concentrates category, Canna Organix has not made it into the top 30 brands over the past few months, with rankings hovering in the mid-50s and 60s. Despite this, there was a notable increase in sales from February to March 2025, suggesting a potential upward trend that could position them for future growth. The Pre-Roll category tells a different story, with Canna Organix consistently ranking in the low 30s, though experiencing a slight decline from December 2024 to March 2025. This suggests a need for strategic adjustments to regain momentum in this category.

Meanwhile, the Vapor Pens category has been a bright spot for Canna Organix in Washington. The brand has shown impressive improvement, climbing from a 39th place ranking in December 2024 to reaching 28th place by March 2025. This upward trajectory is accompanied by a significant increase in sales, indicating strong consumer demand and effective market strategies in this segment. The brand's ability to break into the top 30 in this category highlights a successful approach that could be leveraged to improve performance in other categories. Overall, Canna Organix's performance across these categories in Washington reflects a mix of challenges and opportunities that could shape their strategic decisions moving forward.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Canna Organix has shown a notable upward trend in its rankings, moving from 39th in December 2024 to 28th by March 2025. This improvement is significant, especially when compared to competitors like SKÖRD, which experienced fluctuations, peaking at 23rd in February 2025 before dropping to 30th in March. Meanwhile, 5Th House Farms maintained a relatively stable position, hovering around the 27th to 29th range, and Treehaus Cannabis showed a similar upward trajectory, ending March at 27th. Thrills, despite starting strong at 20th, saw a decline to 26th by March. These movements suggest that Canna Organix is gaining traction in the market, potentially due to strategic marketing or product improvements, and is closing the gap with higher-ranked competitors, indicating a promising direction for future sales growth.

Notable Products

In March 2025, the top-performing product for Canna Organix was the Spritzer Sauced & Tossed Infused Pre-Roll 2-Pack (1g), which climbed to the number one rank with sales of 861 units. This product showed a significant improvement from its previous third-place ranking in January 2025. The Canna Whupass - Peach Ringz Distillate Cartridge (1g) also performed well, reaching the second position, up from fourth in February 2025. The Gelato #41 Sauced & Tossed Infused Pre-Roll 2-Pack (1g) secured the third spot, marking its entry into the top ranks. On the other hand, the Sauced & Tossed - Blue Lobster Infused Pre-Roll 2-Pack (1g) saw a decline, moving from first in December 2024 to fourth in March 2025.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.