Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

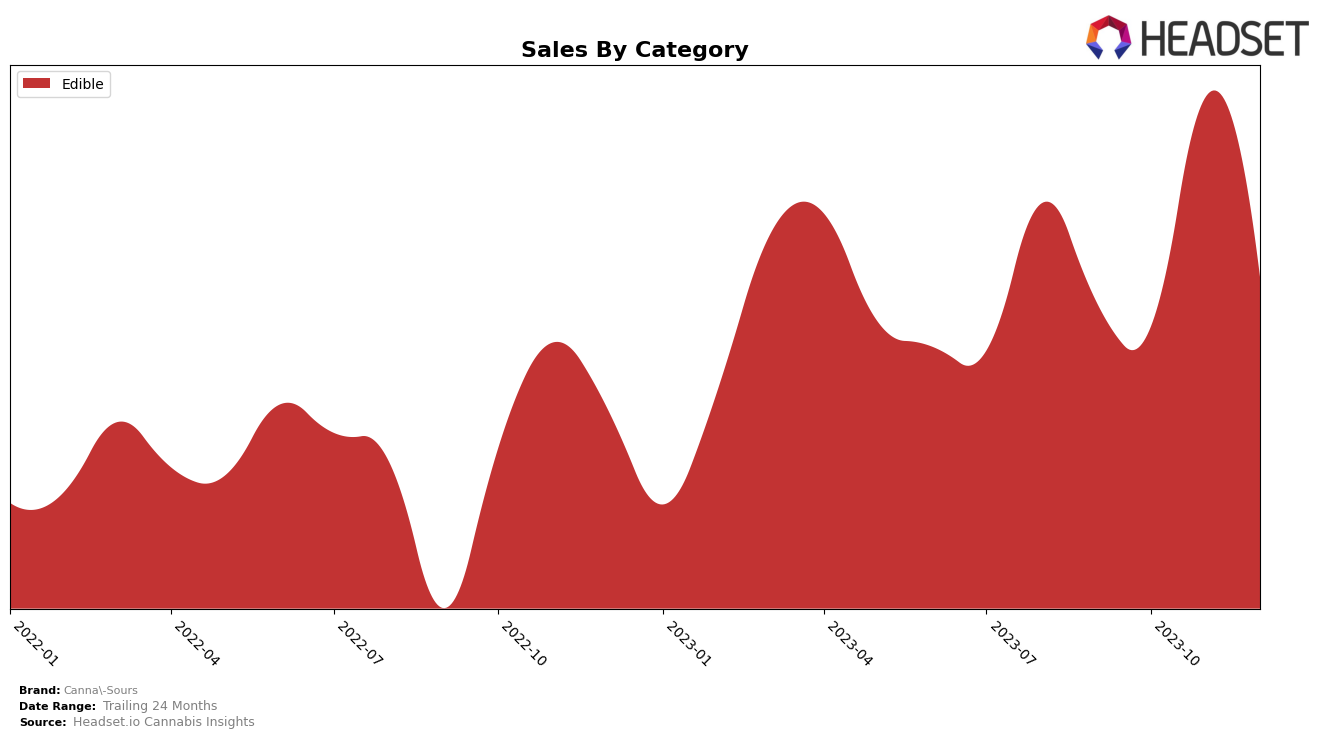

In the edible category, Canna-Sours has shown a promising performance in Illinois. The brand has consistently ranked within the top 20 brands for the last four months of 2023, despite a slight fluctuation in its position. The brand started at the 19th position in September and managed to climb up to the 16th position by November, showing a positive upward movement. However, it's worth noting that the brand slipped back to the 18th position in December, indicating a need for strategies to maintain its upward trajectory.

From a sales perspective, Canna-Sours experienced a significant surge in November 2023, with sales peaking at approximately 304,414. Despite a drop in December, the brand's sales remained higher than its September and October figures, suggesting a generally positive trend. However, the absence of Canna-Sours from the top 20 in other states and categories might indicate areas for potential growth and expansion. The brand's performance in Illinois, particularly in the edible category, demonstrates its potential to perform well in similar markets.

Competitive Landscape

In the edible category within the Illinois market, Canna-Sours has been experiencing a competitive landscape. In the last quarter of 2023, Canna-Sours has seen a fluctuation in its ranking, starting from the 19th position in September, improving to 16th in November, and then falling back to 18th in December. This indicates a volatile market position. Its closest competitors, The Botanist and DIBZ, have maintained a slightly higher rank throughout the same period. However, Sweet Life by Hannah, which was not in the top 20 in September, has seen a significant rise, ending the year at 19th rank. Enliven Edibles has also maintained a consistent position in the top 20. In terms of sales, Canna-Sours had a peak in November but ended the year with lower sales, indicating a need for strategic changes to maintain its market position.

Notable Products

In December 2023, the top-performing product from Canna-Sours was the Sour Pink Lemonade Gummies 5-Pack (25mg), maintaining its number one rank from previous months with an impressive sales figure of 25,864 units. The Sour Peach Gummies 5-Pack (25mg) held the second position, consistent with its rank in prior months. Notably, the Tropical Sour Gummies 5-Pack (25mg) secured the third spot, showing a stable performance throughout the period. A new entrant to the top ranks was the Sour Peach Gummies 5-Pack (50mg), which climbed to the fourth position. The Hybrid Sour Tropical Gummies 5-Pack (50mg) dropped from fourth in November to fifth in December, indicating a slight decline in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.