Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

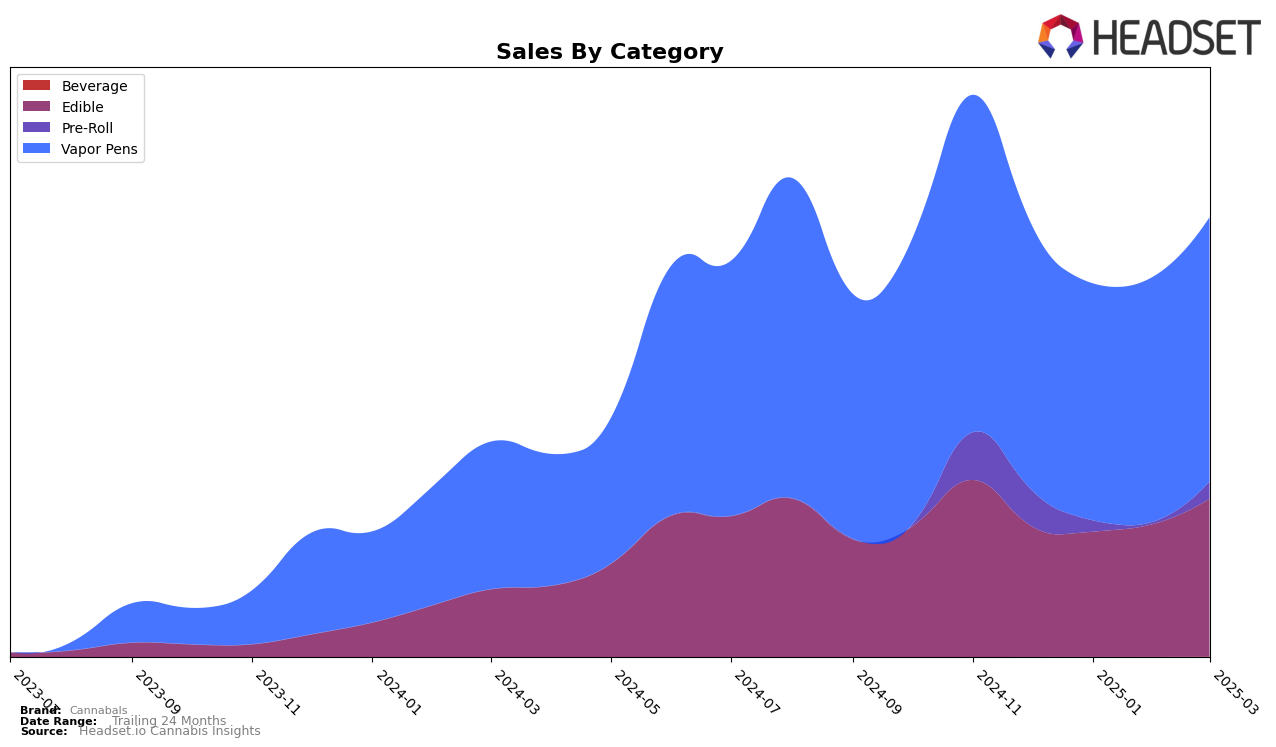

The performance of Cannabals in the New York market has shown some interesting trends across different product categories. In the Edible category, Cannabals maintained a steady presence, consistently holding the 11th position from December 2024 through February 2025, before moving up to the 10th position in March 2025. This upward movement in March is a positive indicator of growth in consumer preference. In contrast, the Vapor Pens category saw some fluctuations, with Cannabals starting at 11th place in December, dropping slightly to 12th in January, then climbing to 10th in February, before falling back to 13th in March. Despite these changes, the sales figures for Vapor Pens remained relatively stable, indicating a loyal customer base.

The Pre-Roll category, however, presents a mixed picture for Cannabals in New York. The brand was ranked 41st in December 2024, but experienced a significant drop to 77th in January 2025. Notably, Cannabals did not make it into the top 30 in February, highlighting a challenging period for this product line. By March, the brand had improved its position slightly to 70th. This volatility in rankings suggests that Cannabals may need to reassess its strategy in the Pre-Roll category to regain a stronger foothold in the market. The absence from the top 30 in February is particularly concerning, as it indicates a potential loss of market share to competitors during that month.

Competitive Landscape

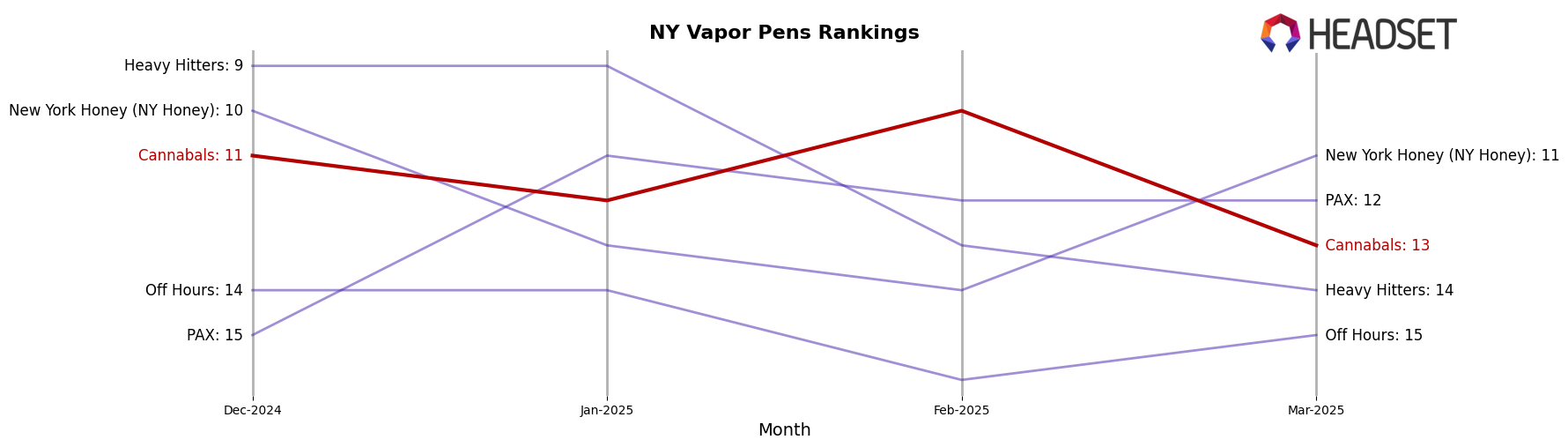

In the competitive landscape of vapor pens in New York, Cannabals has experienced some fluctuations in its market position over the past few months. As of December 2024, Cannabals was ranked 11th, but it saw a slight dip to 12th in January 2025. However, it regained momentum by climbing to 10th in February, only to drop again to 13th in March. This volatility is notable when compared to competitors like Heavy Hitters, which consistently maintained a higher rank, albeit with a downward trend from 9th to 14th over the same period. Meanwhile, PAX showed a positive trajectory, improving from 15th in December to 12th by March, indicating a robust growth in sales. New York Honey (NY Honey) also demonstrated resilience, ending March with a strong 11th position. Despite these challenges, Cannabals' sales figures indicate a potential for recovery, especially given its February peak, suggesting that strategic adjustments could help stabilize and enhance its competitive standing in the New York vapor pen market.

Notable Products

In March 2025, the top-performing product from Cannabals was the Brick - Strawberry Lemonade Live Resin Gummies 10-Pack (100mg) in the Edible category, reclaiming its rank 1 position from January after briefly dropping to rank 3 in February, with a notable sales figure of 2259 units. The Purple Haze Distillate Disposable (1g) from the Vapor Pens category followed closely, maintaining its strong presence by securing the second position after leading in February. Super Lemon Haze Distillate Disposable (1g) showed consistent performance, climbing to third place from its previous fourth position, indicating a steady increase in popularity. The THC/CBN 1:1 Blueberry Dream Gummies 10-Pack (100mg THC, 100mg CBN) experienced a slight drop to fourth place from its consistent second-place ranking in the preceding months. Lastly, the Dragonfruit Lemonade Live Resin Gummies 10-Pack (100mg) re-entered the top five, securing the fifth position, demonstrating a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.