Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

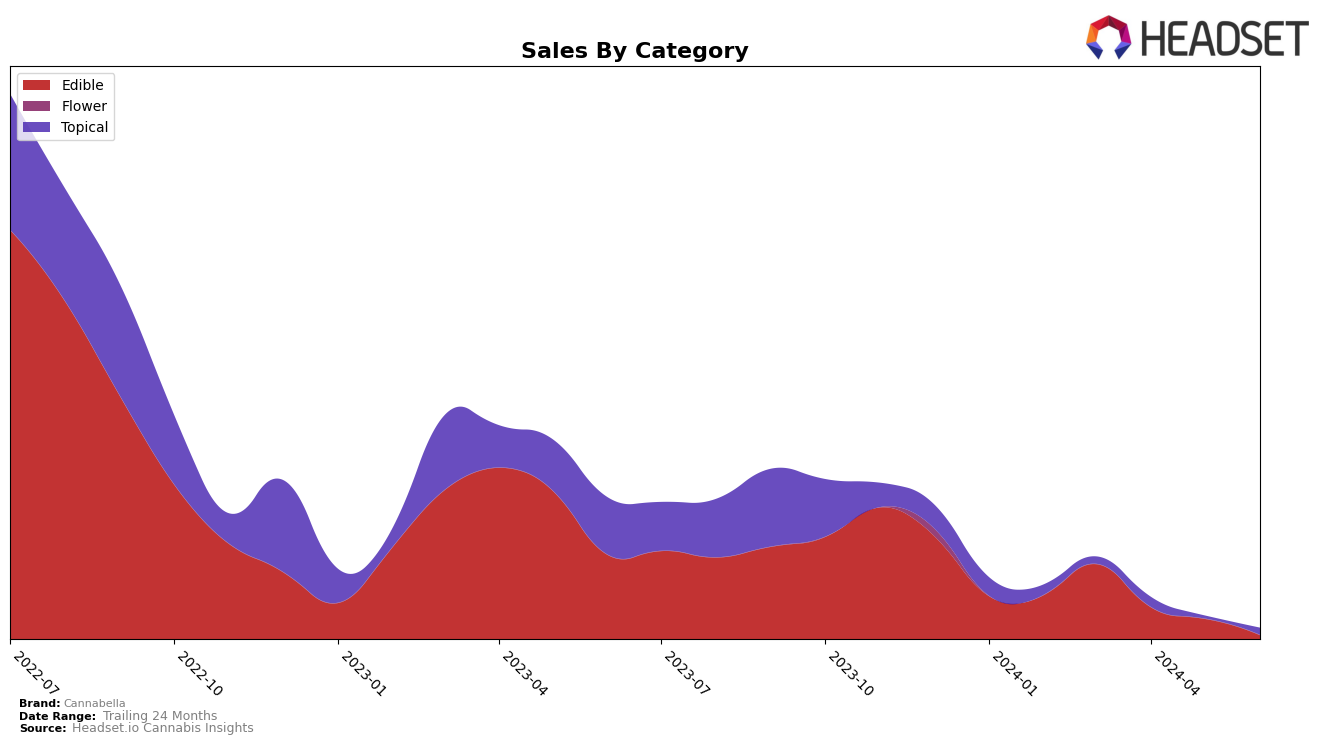

In the state of Nevada, Cannabella has shown some noteworthy movements in the Edible category. As of March 2024, the brand was ranked 31st, bringing in a total sales figure of $15,160. However, in the subsequent months of April, May, and June, Cannabella did not appear in the top 30 rankings, indicating a potential decline in market presence or increased competition. This drop-off could be seen as a negative trend, suggesting that Cannabella may need to reassess its strategy in Nevada to regain a foothold in this category.

Across other states and categories, Cannabella's performance has varied. While specific rankings and sales figures for other regions are not provided, the absence of Cannabella in the top 30 brands in any other state or category for the months of April, May, and June could imply challenges in maintaining consistent market share. This highlights the competitive nature of the cannabis industry and the importance for brands like Cannabella to continuously innovate and adapt to changing market dynamics. More detailed insights into their performance in other regions and categories would be necessary to fully understand their market positioning and growth potential.

Competitive Landscape

In the Nevada Edible category, Cannabella has experienced a notable decline in rank and sales over the past few months. Starting at rank 31 in March 2024, Cannabella failed to appear in the top 20 for the subsequent months, indicating a significant drop in market presence. In contrast, competitors such as Highly Edible and Deep Roots Harvest have maintained more stable positions, with Highly Edible improving from rank 30 to 26 and Deep Roots Harvest fluctuating slightly but remaining in the top 30. Mellow Vibes (formerly Head Trip) also saw a drop but managed to stay in the top 30 until May. These trends suggest that Cannabella may need to reassess its market strategy to regain its competitive edge in the Nevada Edible market.

Notable Products

In June 2024, the top-performing product for Cannabella was CBD/THC 1:1 Neuropathy Salve (200mg THC, 200mg CBD) in the Topical category, which climbed to the number one rank with notable sales of 33 units. Pineapple Cherry Bomb Buttercream Chews (100mg) maintained its second-place ranking from May 2024, despite a decrease in sales from 49 units to 15 units. Dried Pineapple (100mg) entered the rankings for the first time in June, securing the third position. Cannabella Honey (100mg) also appeared in the rankings for the first time, tying for fourth place with Dried Apricot 10-Pack (100mg), which re-entered the rankings after being absent in April and May. The rankings indicate a dynamic shift in consumer preferences, particularly with the rise of new products in the edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.