Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

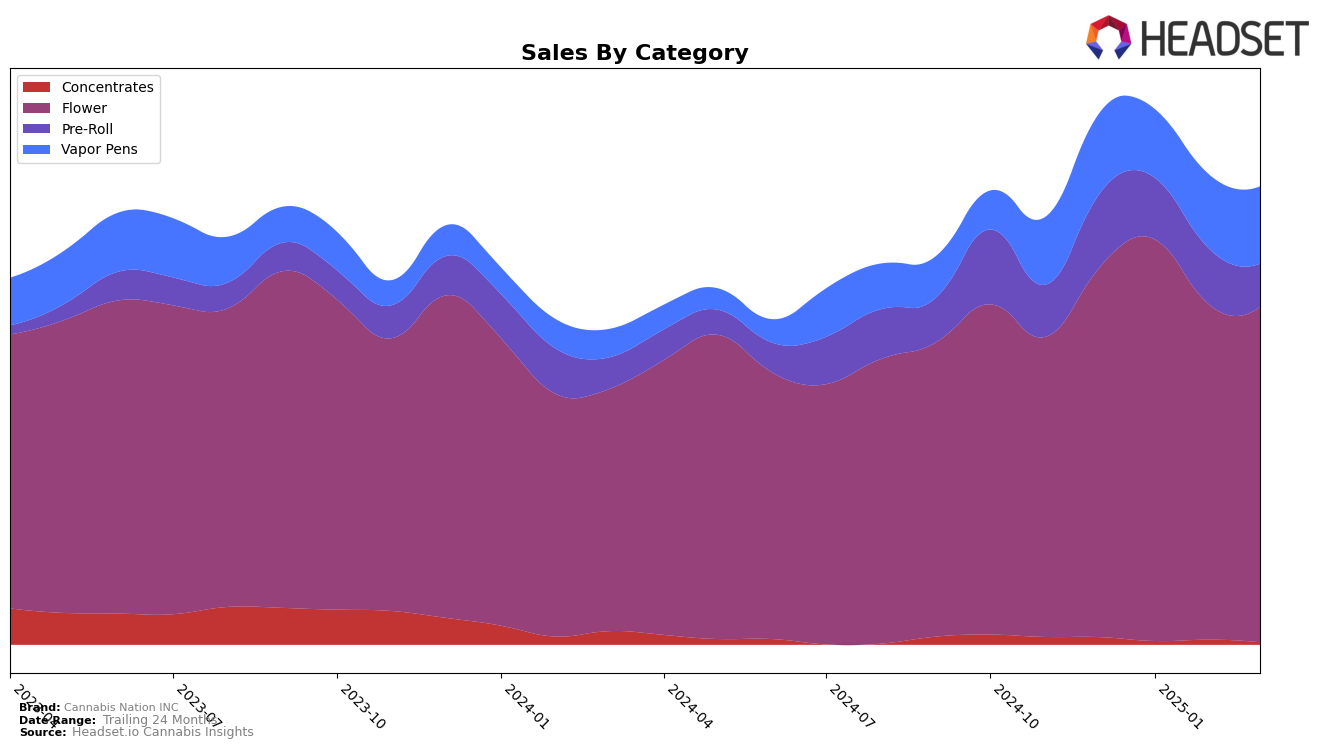

In the state of Oregon, Cannabis Nation INC has shown varied performance across different product categories. Notably, their Flower category has maintained a strong presence, consistently ranking within the top 11 brands from December 2024 to March 2025, despite a slight decline from 7th to 11th position over these months. This indicates a stable demand for their Flower products, even as their rank slips slightly. In contrast, the Concentrates category has not fared as well, with Cannabis Nation INC not breaking into the top 30, highlighting potential challenges in this segment. Their Vapor Pens have shown a steady ranking at 37th, reflecting a consistent, albeit modest, market position.

The Pre-Roll category presents a more dynamic picture, with Cannabis Nation INC's rank fluctuating from 29th in December 2024 to 37th in March 2025. This downward trend suggests increased competition or shifting consumer preferences that the brand may need to address. Despite these challenges, the Vapor Pens category has demonstrated a positive trend in sales, suggesting potential for growth if the brand can improve its ranking. Overall, while Cannabis Nation INC shows a strong foothold in the Flower category, other segments like Concentrates and Pre-Rolls signal areas for potential improvement or strategic realignment.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Cannabis Nation INC has experienced a slight decline in its ranking from December 2024 to March 2025, moving from 7th to 11th place. This shift is notable as it suggests increasing competition and potential challenges in maintaining market share. Brands such as High Tech and Kaprikorn have shown resilience, with High Tech rebounding from a dip in January 2025 to secure the 10th position by March 2025, and Kaprikorn climbing back to 9th place. Meanwhile, Deep Creek Gardens has fluctuated but ended March 2025 just ahead of Cannabis Nation INC at 12th place. The upward trajectory of PDX Organics, which started outside the top 20 in December 2024 and rose to 13th by March 2025, further highlights the dynamic and competitive nature of this market. These shifts indicate a need for Cannabis Nation INC to reassess its strategies to regain its competitive edge and bolster sales in the coming months.

Notable Products

In March 2025, the top-performing product for Cannabis Nation INC was Chocolate Thai Pre-Roll 2-Pack (1g) in the Pre-Roll category, securing the number one spot with sales reaching 1316 units. Banana Dulce and Candy Punch, both in the Flower category, tied for the second position, each achieving sales of 1202 units. Pineapple Mayhem Pre-Roll 2-Pack (1g) followed closely in third place with 976 units sold. Ghetto Bird (Bulk), also in the Flower category, ranked fourth with 968 units. Compared to previous months, Chocolate Thai Pre-Roll 2-Pack (1g) maintained its leading position, while Banana Dulce and Candy Punch showed a notable climb to the second position from no prior ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.