Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

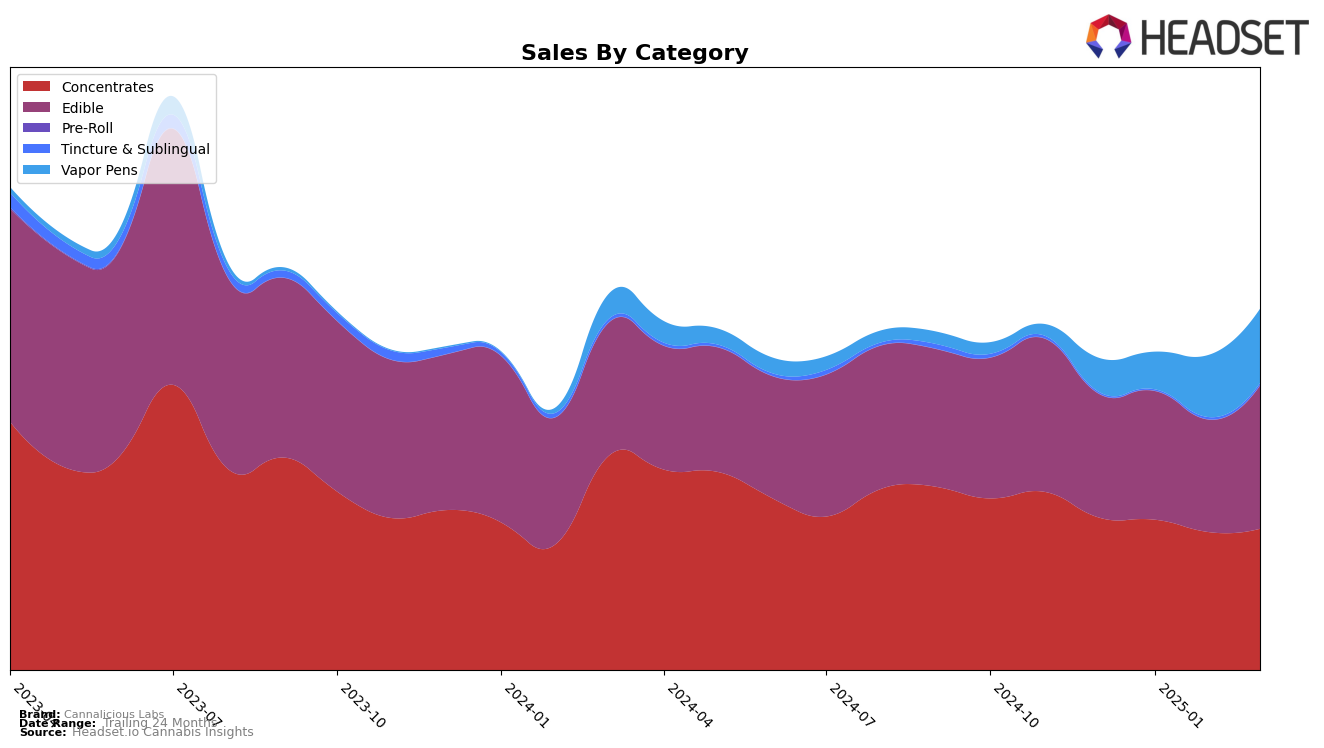

Cannalicious Labs has demonstrated a consistent performance in the Michigan market, particularly within the Concentrates category. Over the first quarter of 2025, their ranking remained stable at sixth place, indicating a strong foothold in this segment despite a slight decline in sales from December to February. In the Edible category, Cannalicious Labs showed a positive trajectory, climbing from 20th place in December to 16th place by March. This upward movement suggests a growing acceptance and demand for their edible products among consumers in Michigan. However, their absence from the top 30 brands in other states and categories implies potential areas for growth and expansion.

The most notable improvement for Cannalicious Labs was observed in the Vapor Pens category in Michigan. Starting at a rank of 66 in December, the brand made significant strides to reach 38th place by March. This upward trend is particularly noteworthy given the competitive nature of the vapor pen market. The increase in sales from January to March underscores the brand's successful penetration and growing popularity in this product segment. The absence of Cannalicious Labs from the top 30 in other categories and states highlights an opportunity for strategic growth and market diversification, which could be pivotal for enhancing their overall brand presence and performance.

Competitive Landscape

In the competitive landscape of Michigan's edible cannabis market, Cannalicious Labs has shown a steady improvement in its ranking over the first quarter of 2025, moving from 20th in December 2024 to 16th by March 2025. This upward trend is indicative of a positive reception to their products, despite facing stiff competition. Notably, Mojo (Edibles) maintained a slightly higher rank than Cannalicious Labs, consistently holding the 15th position in February and March 2025, which suggests a competitive edge in sales performance. Meanwhile, PC Pure remained close behind, with a rank of 17th in March 2025, indicating a tight race among these brands. Banned Cannabis Edible Co. and Lost Farm experienced fluctuations, with Banned Cannabis Edible Co. maintaining a stronger position in the top 14, while Lost Farm slipped to 18th by March. These dynamics highlight the competitive pressures Cannalicious Labs faces, yet their ability to climb the ranks suggests effective strategies in capturing market share.

Notable Products

In March 2025, the top-performing product for Cannalicious Labs was Watermelon Rest RSO High Dose Gummies 10-Pack, maintaining its number one rank consecutively from December 2024 through March 2025, with sales reaching 11,528 units. Recovery - Mango RSO Gummies 10-Pack held the second position for the second consecutive month, showing a notable increase in sales to 9,881 units. Mixed Berry RSO Rest Gummies 10-Pack ranked third, consistently maintaining its position from the previous month, although it had a higher rank in December and January. Blue Raspberry RSO Gummies 10-Pack made a significant move up to fourth place in March 2025, having been fifth in January. Recovery - Pear RSO Gummies 10-Pack entered the rankings at fifth place, indicating a strong performance for a new entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.