Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

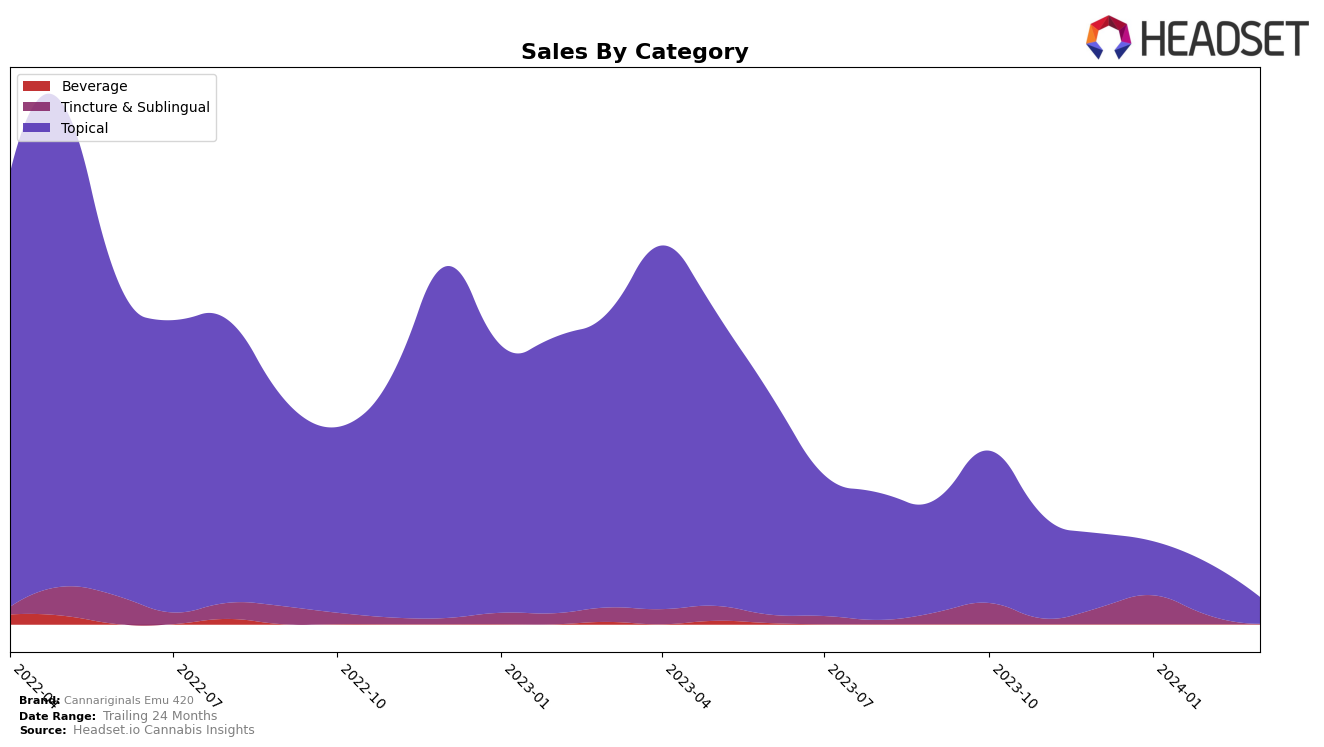

In the competitive cannabis market of California, Cannariginals Emu 420 has shown varied performance across different categories. Within the Tincture & Sublingual category, the brand experienced a fluctuation in rankings, starting from the 41st position in December 2023, improving to the 32nd in January 2024, but then dropping to the 39th in February 2024. Notably, the brand was absent from the top 30 rankings in March 2024, indicating a potential decline in its market presence in this category. However, the sales in January 2024 saw a significant increase, nearly doubling from December 2023's figures, suggesting a momentary peak in consumer interest or possibly a successful marketing push during that period.

Conversely, Cannariginals Emu 420 demonstrated remarkable stability in the Topical category, maintaining the 18th position consistently from December 2023 through March 2024. This consistency in ranking, despite a noticeable decline in sales over the same period, highlights the brand's strong foothold in this niche. The drop in sales, from 12,262 units in December 2023 to 4,345 units in March 2024, might reflect broader market trends or shifts in consumer preferences within the Topical category. Nonetheless, the ability to hold a steady ranking suggests a loyal customer base and a potentially effective strategy in maintaining its position amidst changing market dynamics in California.

Competitive Landscape

In the competitive landscape of the topical cannabis market in California, Cannariginals Emu 420 has faced a challenging start to 2024, maintaining a consistent rank of 18th from December 2023 through March 2024. This stability in rank comes despite a downward trend in sales, indicating a tough market environment or increased competition. Notably, High Gorgeous by Yummi Karma and Opi-Not have shown significant activity around Cannariginals Emu 420. High Gorgeous by Yummi Karma, despite a slight decline in rank from 13th to 16th, has maintained a higher sales volume, suggesting a strong brand presence. On the other hand, Opi-Not has seen a remarkable rise in rank from 23rd to 17th, coupled with a substantial increase in sales, indicating a growing consumer preference and a potential threat to Cannariginals Emu 420's market share. Other competitors like Quim and Mother Humboldt's have experienced fluctuations in both rank and sales, but their movements suggest a dynamic and competitive market. This analysis underscores the importance for Cannariginals Emu 420 to innovate and adapt to maintain and improve its market position amidst evolving consumer preferences and competitive pressures.

Notable Products

In Mar-2024, Cannariginals Emu 420 saw its CBD/THC 2:1 Black Transdermal Rub Emu Oil maintain the top spot among its products, with sales reaching 145 units. Following closely, the CBD/THC 2:1 Therapeutic Bath Crystals climbed to the second position, marking a notable increase in its rank from the third position in February to second, with sales figures witnessing a significant jump to 52 units. The CBD:THC 2:1 Black Methanol Rub dropped to the third rank, despite being a consistent performer in previous months. Notably, the Mystic Mango product line saw a disappearance from the top ranks in March, indicating a shift in consumer preference or possibly stock issues. These shifts highlight a dynamic market where topical products retain strong popularity, but with changing preferences for specific product types within the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.