Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

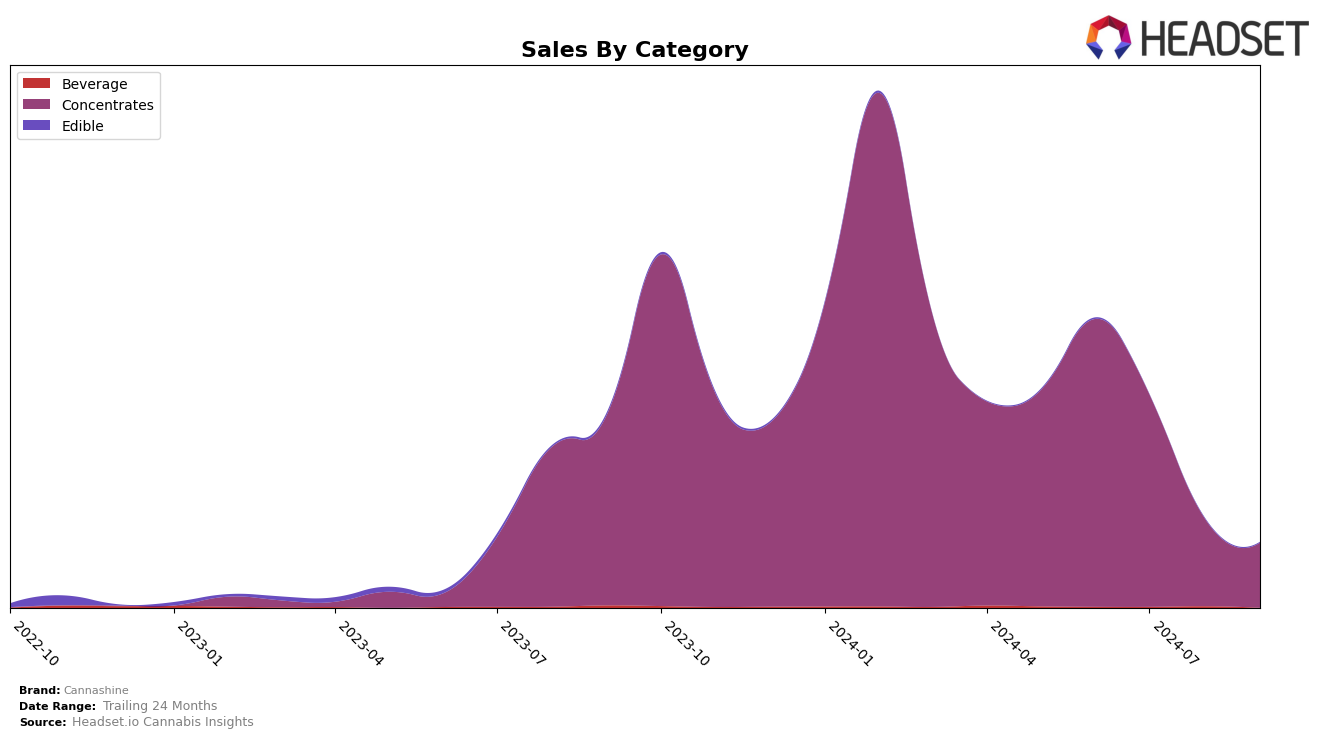

In the state of Michigan, Cannashine's performance in the Concentrates category has experienced a notable decline over the past few months. Starting in June 2024, Cannashine was ranked 24th, but by September 2024, it had dropped to 57th. This downward trajectory is further underscored by the significant decrease in sales, from approximately $198,955 in June to $44,681 in September. The brand's inability to maintain a position within the top 30 brands in August and September highlights a challenging period for Cannashine in this particular category within Michigan.

While Cannashine's performance in Michigan's Concentrates market shows a concerning trend, it's essential to consider how the brand fares across other states and categories to get a comprehensive view of its overall market presence. The absence of Cannashine in the top 30 rankings in August and September suggests that the brand may be facing competitive pressures or market shifts that are affecting its visibility and sales performance. Such insights are crucial for stakeholders to understand the brand's positioning and strategize accordingly.

Competitive Landscape

In the Michigan concentrates market, Cannashine has experienced notable fluctuations in its ranking and sales over the past few months. Starting in June 2024, Cannashine was ranked 24th, but by September, it had dropped to 57th. This decline in rank is mirrored by a significant decrease in sales, which fell from a high in June to less than a quarter of that figure by September. In contrast, competitors like True North Collective have shown more stability, maintaining a presence in the top 50 throughout the same period, even peaking at 39th in August. Meanwhile, Belushi's Farm demonstrated a recovery in September, climbing back to 62nd after not ranking in August. These dynamics suggest that Cannashine may need to reassess its strategies to regain its competitive edge in the Michigan concentrates market.

Notable Products

In September 2024, Blue Dream Sugar (1g) from Cannashine maintained its position as the top-performing product in the Concentrates category, continuing its streak from August and July. Animal Cookies Terp Sugar (1g) made a notable debut in September, securing the second rank with sales of 485 units. Blueberry Sugar (1g) slightly dropped to the third position after being second in August, indicating a decrease in sales momentum. Slurricane Terp Sugar (1g) held steady at fourth place, consistent with its July ranking, showing stability in its performance. Godfather OG Sugar (1g) entered the top five for the first time in September, moving up from the third rank in August, marking a new presence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.