Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

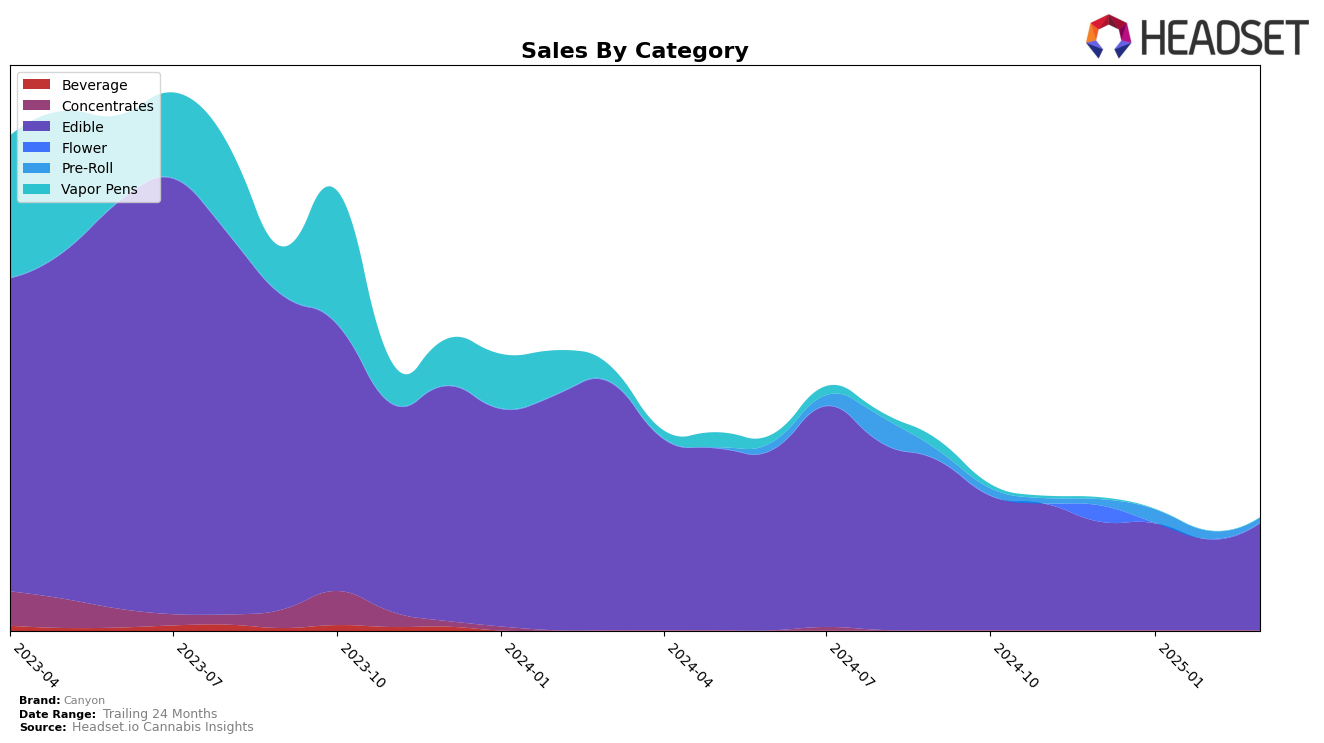

Canyon's performance in the Colorado market, specifically within the Edible category, demonstrates a relatively stable position in the rankings. From December 2024 to March 2025, Canyon maintained its presence within the top 30 brands, although it hovered towards the lower end of the spectrum. The brand ranked 28th in December, improved slightly to 27th in January, but then saw a slight decline to 29th by March. This consistency in rankings suggests that while Canyon is a recognized player in the Colorado edible market, it faces significant competition that prevents it from climbing higher in the rankings.

Despite the fluctuations in rank, Canyon's sales figures reveal some interesting trends. While the brand experienced a dip in sales from December to February, with a notable decrease from $50,422 to $42,119, there was a recovery in March, bringing sales back up to $49,659. This rebound might indicate successful strategic adjustments or seasonal factors influencing consumer purchasing behavior. However, the absence of Canyon from the top 30 in other states or categories suggests potential areas for growth and expansion. The brand's focus on maintaining its foothold in Colorado could be both a strength and a limitation, depending on its broader business objectives.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Canyon has maintained a consistent presence, albeit with a slight decline in rank from 27th in January 2025 to 29th by March 2025. Despite this, Canyon's sales have shown resilience, with a notable recovery in March 2025, reaching levels comparable to December 2024. In contrast, Dutch Girl has shown a significant improvement, climbing from 32nd to 27th place, driven by a substantial increase in sales. Meanwhile, Devour experienced a fluctuating rank, ultimately falling to 30th in March 2025, highlighting potential volatility in their market strategy. Nove Luxury Chocolate has maintained a stable position, closely mirroring Canyon's sales trajectory. Sweet Mary Jane has also shown a positive trend, improving from 34th to 31st, indicating a potential rise in consumer preference. These dynamics suggest that while Canyon remains a steady player, competitors like Dutch Girl are making strategic moves that could impact Canyon's market share if not addressed.

Notable Products

In March 2025, the top-performing product for Canyon was Chew It - CBD/THC 1:1 Sour Lemonade Gummies 40-Pack, which climbed to the number one spot with sales reaching 908 units. Following closely, Chew It - Sativa Sour Cherry Limeade Gummies 40-Pack ranked second, showing a steady rise from fourth place in December 2024. Suck It - Indica Blue Raspberry Hard Candy 40-Pack secured the third position, maintaining consistency after a brief absence in January. Suck It - Sativa Strawberry Lemonade Hard Candy 40-Pack improved its ranking to fourth, marking a notable increase in sales. Finally, Chew It - Indica Watermelon Lemonade Gummies 40-Pack rounded out the top five, despite experiencing a decline in sales over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.