Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

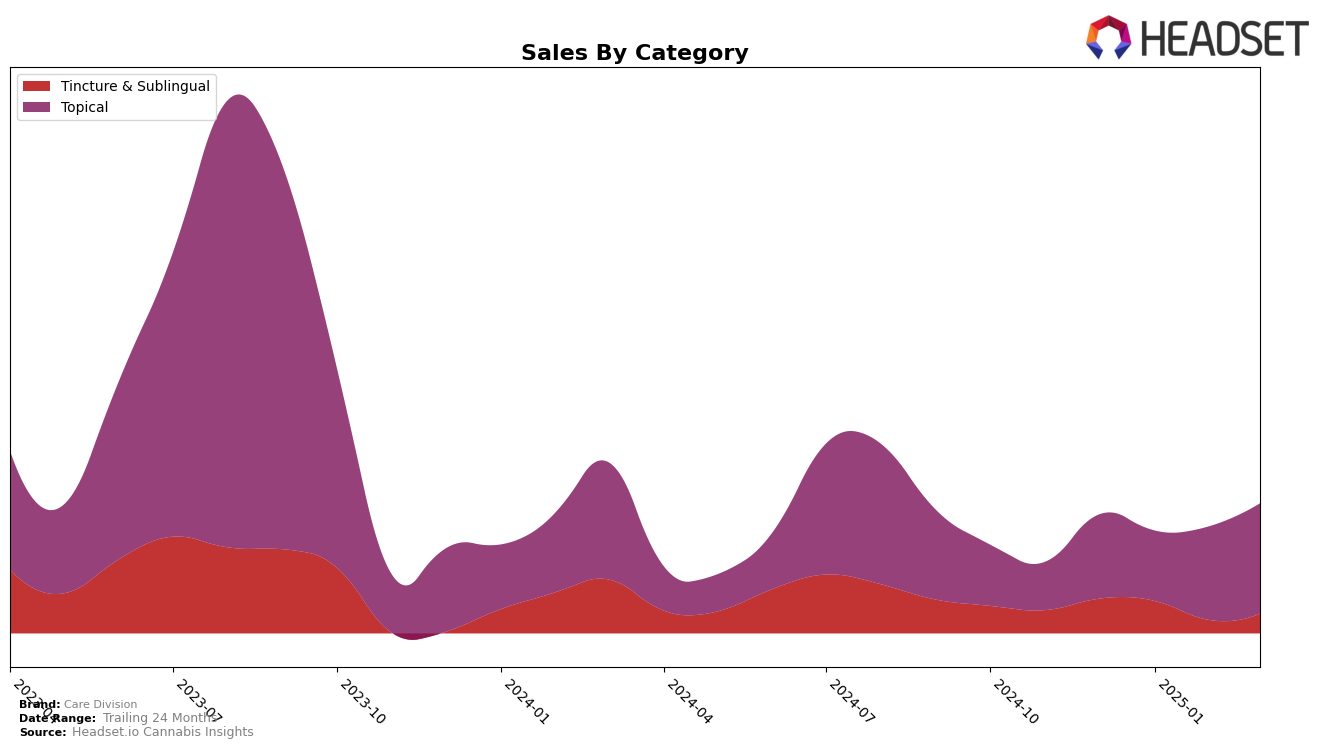

Care Division has shown a consistent performance in the Colorado market, particularly within the Tincture & Sublingual category. Over the observed months from December 2024 to March 2025, the brand maintained a steady position, ranking third from January through March, after initially holding the second spot in December. This suggests a slight dip in their competitive standing within this category, but they have managed to sustain a top-three position. Notably, there was a significant decrease in sales from December to February, followed by a recovery in March, indicating potential fluctuations in consumer demand or market conditions.

In the Topical category, Care Division has demonstrated an upward trend in Colorado. Starting at the fifth position in December 2024 and January 2025, the brand improved its ranking to fourth in February and March. This improvement is complemented by a notable increase in sales, particularly from February to March, where sales figures surged. The sustained presence in the top five and the upward movement in rankings highlight the brand's growing influence and acceptance in the topical segment. This trajectory could be indicative of strategic brand initiatives or a shift in consumer preference towards their topical products.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Colorado, Care Division has shown a promising upward trend in its market position. From December 2024 to March 2025, Care Division improved its rank from 5th to 4th, indicating a positive shift in consumer preference and brand strength. This advancement is particularly notable when compared to Nordic Goddess, which maintained its 4th position until February 2025 before dropping to 5th in March. Despite the consistent top ranks held by Mary's Medicinals and Mary Jane's Medicinals, Care Division's sales growth from $49,485 in January to $72,778 in March underscores its potential to challenge higher-ranked competitors. This growth trajectory suggests that Care Division is effectively capturing market share, likely through strategic marketing and product differentiation, positioning itself as a formidable player in the Colorado topical cannabis market.

Notable Products

In March 2025, Care Division's top-performing product was the CBD:THC 1:1 The Truth Pain Relief Cream (2000mg CBD, 2000mg THC) in the Topical category, maintaining its first-place rank for four consecutive months with a notable increase in sales to 1081 units. The CBD:THC 1:1 Stress Free Tincture (100mg CBD, 100mg THC) in the Tincture & Sublingual category climbed back to the second position, improving from its fifth-place rank in February. The CBD:THC 1:1 Soothe Pain Relief Salve (250mg CBD, 250mg THC), also in the Topical category, held steady in third place. Carefree - CBD/THC 1:1 Pain Relief Cream (500mg CBD, 500mg THC) dropped to fourth, despite being second in February. Lastly, the CBD/THC 20:1 Everyday Care Tincture (2000mg CBD, 100mg THC) consistently remained in fifth place over the past three months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.