Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

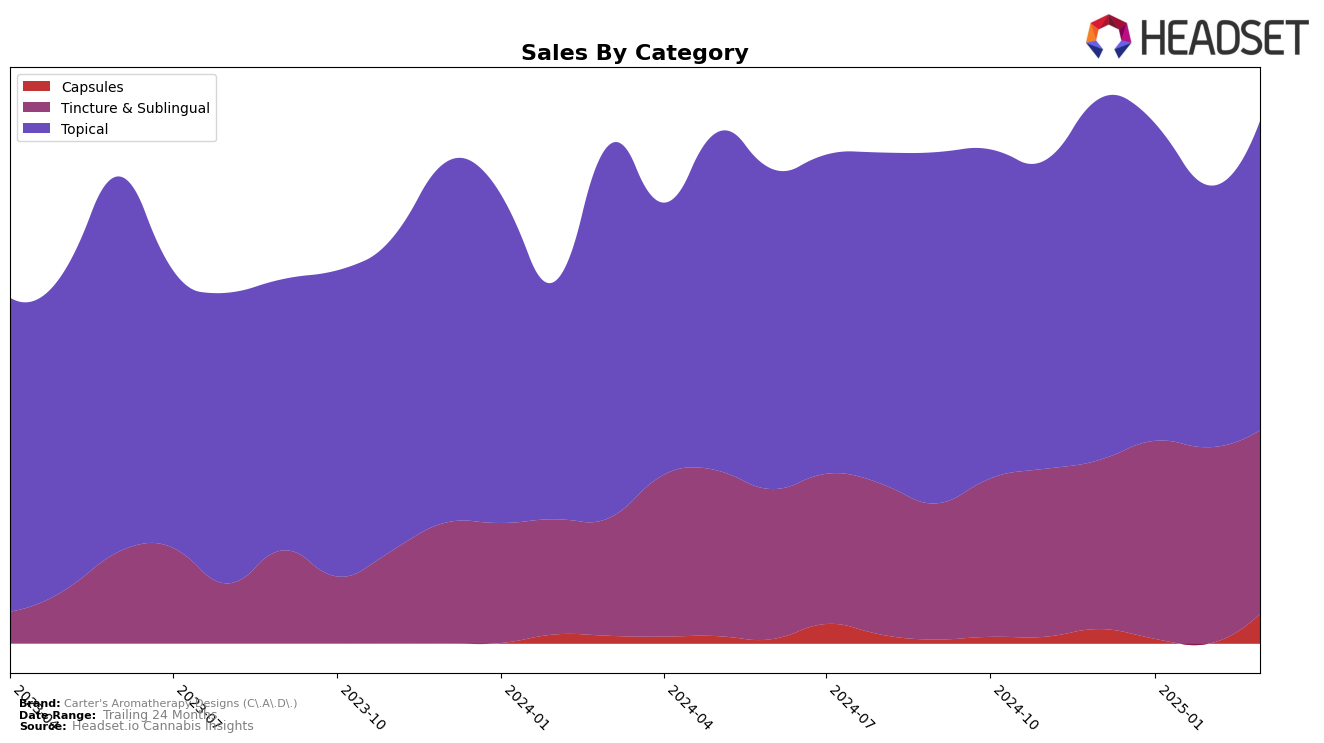

Carter's Aromatherapy Designs (C.A.D.) has maintained a steady presence in the California market, particularly in the Tincture & Sublingual category, where it has consistently held the 12th rank from December 2024 through March 2025. This stability suggests a strong brand loyalty or consistent product demand in this segment. In contrast, the Topical category shows a slightly different trend; despite holding a solid 4th place throughout the same period, there has been a noticeable fluctuation in sales figures. This could indicate a seasonal demand or a shift in consumer preferences. The consistency in rankings, however, underscores C.A.D.'s established reputation in these categories within California.

Interestingly, the data does not show C.A.D. ranking in the top 30 in any other state or province, which could either highlight a strategic focus on the California market or a potential area for growth and expansion. The absence from other state rankings might suggest limited distribution or brand recognition outside of California, which could be a missed opportunity in rapidly growing markets. For those tracking C.A.D.'s performance, these insights could inform potential market expansion strategies or product diversification to enhance their footprint beyond California.

Competitive Landscape

In the competitive landscape of the Topical category in California, Carter's Aromatherapy Designs (C.A.D.) consistently held the 4th rank from December 2024 through March 2025. Despite maintaining its position, C.A.D. faces stiff competition from brands like Mary's Medicinals, which consistently ranked 2nd, and Buddies, which held the 3rd position throughout the same period. Notably, Mary's Medicinals leads the market with significantly higher sales figures, while Buddies also outpaces C.A.D. in sales. Meanwhile, Sweet ReLeaf (CA) and Care By Design trail behind C.A.D., maintaining the 5th and 6th ranks respectively. This stable ranking suggests that while C.A.D. has a strong foothold in the market, there is potential for growth by differentiating its offerings or enhancing its market presence to climb higher in the ranks.

Notable Products

In March 2025, the top-performing product from Carter's Aromatherapy Designs (C.A.D.) was the Tranquility Tincture (1000mg THC, 29ml), maintaining its leading position with sales reaching 451 units. Following closely, the CBD/THC 2:1 Rasta Pain Cream (1000mg CBD, 500mg THC, 2oz) ranked second, showing a significant rise from its third position in February. The Original Green Cream (201mg CBD, 22mg THC) entered the rankings at third place, reflecting its growing popularity. The CBD:THC 2:1 Mimosa Cream (215mg CBD, 130mg THC, 1.9oz) slipped to fourth place from second in February, while the CBD/THC Elevation Tincture (1150mg CBD, 40mg THC) completed the top five after re-entering the rankings. This analysis highlights the consistent performance of tinctures and the dynamic shifts within the topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.