Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

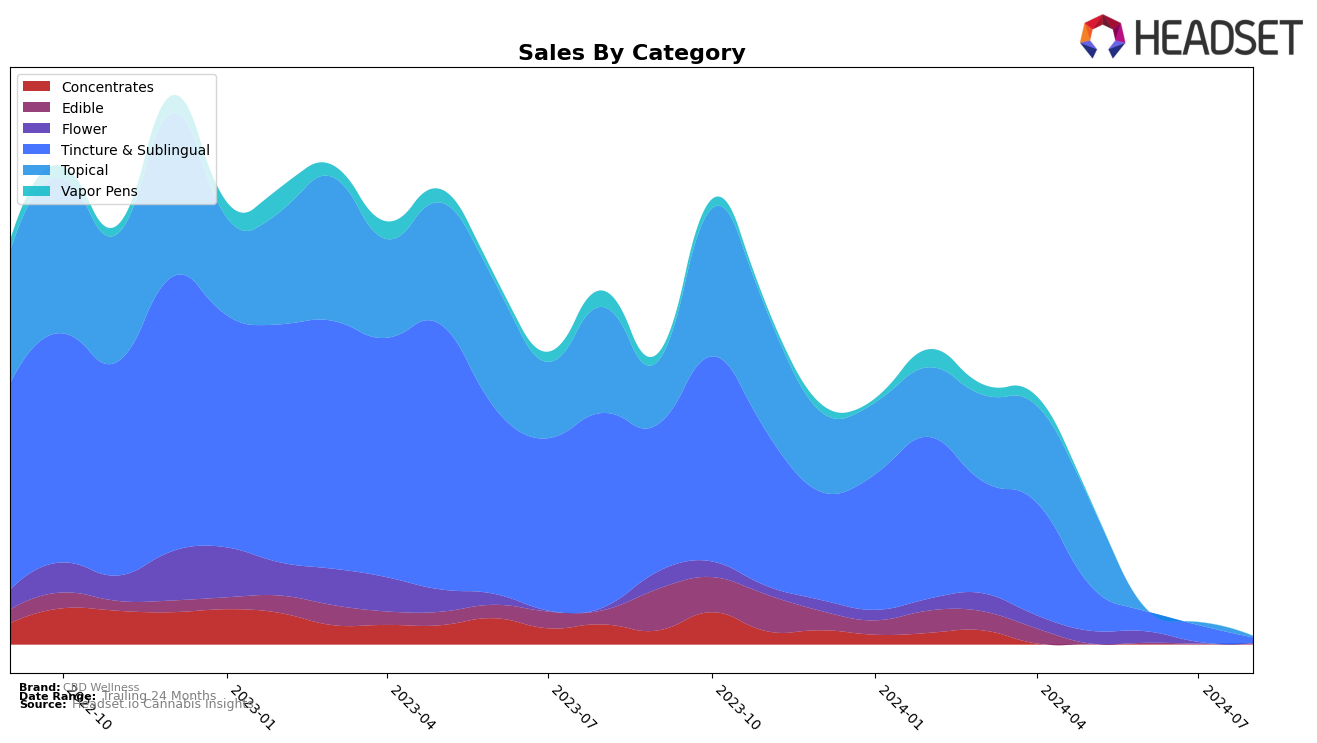

CBD Wellness has shown a notable presence in the Arizona market, particularly in the Tincture & Sublingual and Topical categories. In May 2024, the brand ranked 3rd in the Tincture & Sublingual category, indicating a strong foothold in this segment. However, the absence of rankings for subsequent months suggests a decline or potential challenges in maintaining their market position. Similarly, in the Topical category, CBD Wellness was ranked 7th in May 2024, but did not appear in the top 30 brands in the following months, which could be a cause for concern regarding their competitive edge or market dynamics.

While the rankings in Arizona highlight some fluctuations, it is essential to consider the broader market trends and competitive landscape. The significant drop in rankings post-May 2024 could imply increased competition or shifts in consumer preferences. These movements underscore the importance for CBD Wellness to analyze market conditions and potentially adjust their strategies to regain their standing in these categories. Observing these trends, stakeholders can gain insights into the brand's performance and areas that may require strategic focus.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Arizona, CBD Wellness has experienced notable fluctuations in its market rank and sales. As of May 2024, CBD Wellness held the 3rd position, but it did not appear in the top 20 rankings for the subsequent months, indicating a significant drop in its market presence. In contrast, Chronic Health consistently maintained the 2nd position from May to August 2024, showcasing stable performance with sales ranging from $21,145 to $34,324. Meanwhile, Drip Oils + Extracts dominated the market, holding the 1st rank throughout the same period with sales peaking at $61,825 in August 2024. This competitive pressure from consistently high-ranking brands suggests that CBD Wellness needs to strategize effectively to regain its market position and enhance its sales performance.

Notable Products

In August 2024, the top-performing product from CBD Wellness was the CBN Whole Plant FSE Tincture (1000mg CBN), which secured the number one rank. The CBG Assorted Fruit Gummies 30-pack (450mg CBG) climbed to second place, showing a steady rise from fifth in June and third in July. The CBD Eucalyptus Bath Soak (100mg CBD) ranked third, moving up from fourth in June. The CBC Rich Tincture (1000mg CBC) experienced a drop to fourth place after holding the top rank in July, with sales plummeting from 69 units in July to 8 units in August. The CBD Pain Relieving Original Salve (2000mg CBD, 2oz) maintained a consistent performance, holding the fifth rank for two consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.