Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

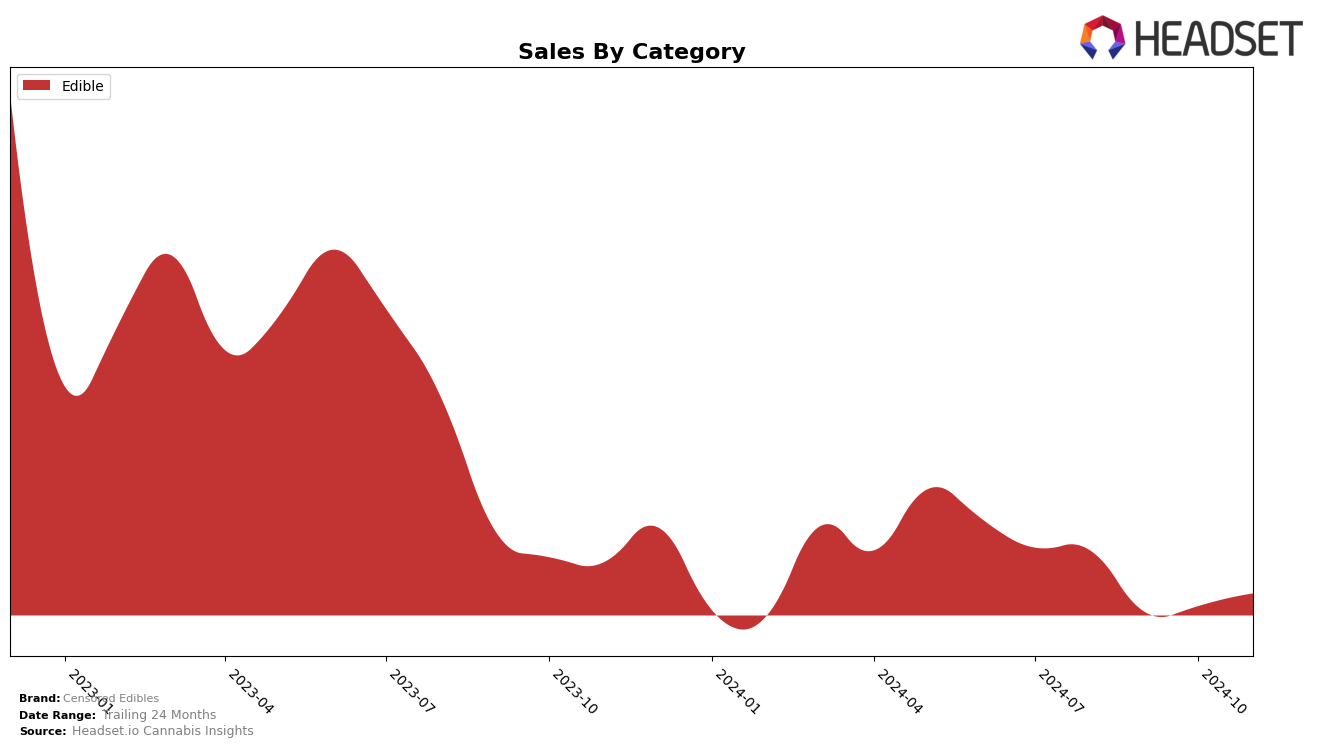

Censored Edibles has shown a fluctuating performance across different states and categories, demonstrating both potential and areas for improvement. In Alberta, the brand made it into the top 30 rankings in August 2024, securing the 26th position in the Edible category. This indicates a noteworthy presence in the market, though it appears they did not maintain this momentum in the subsequent months, as they were absent from the top 30 rankings from September to November 2024. This drop suggests either increased competition or a need for strategic adjustments to regain their standing.

Despite the challenges in Alberta, the initial ranking achievement in August highlights a potential area of strength that could be leveraged with targeted marketing or product innovation. The absence from the top 30 in the following months could be seen as a setback, but it also presents an opportunity for Censored Edibles to analyze market dynamics and consumer preferences to better align their offerings. Monitoring these trends closely could provide insights into how the brand might improve its ranking and sales performance in the future, not just in Alberta but potentially in other markets as well.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Alberta, Censored Edibles has faced significant challenges in maintaining its market presence. As of August 2024, Censored Edibles was ranked 26th, but it did not appear in the top 20 rankings for the subsequent months, indicating a struggle to sustain its position. In contrast, Vortex Cannabis Inc. held a strong 14th position in August 2024, suggesting a more robust market performance. Meanwhile, The Hazy Camper showed a consistent presence, albeit with a slight decline, moving from 24th to 26th place from August to October 2024. A-HA! re-entered the rankings in November 2024 at 23rd, indicating a potential upward trend. These dynamics highlight the competitive pressures Censored Edibles faces, emphasizing the need for strategic adjustments to regain and enhance its market position in Alberta's edible segment.

Notable Products

In November 2024, Censored Edibles' top-performing product was Blue Raspberry Penis Gummies 4-Pack (10mg), maintaining its consistent first-place ranking from August through November with a notable sales figure of 1856 units. Tutti Fruity Boobies & Booties Gummies 4-Pack (10mg) secured the second position, climbing back up after a dip to third in October. WAPs Gummies 4-Pack (10mg) held the third spot, showing a slight decline from its second-place rank in October. CBG Playtime Pack Gummies 4-Pack (10mg CBG) remained steady at fourth place from September onwards, while CBD Party Assorted Naughty Gummies 20-Pack (200mg CBD) re-entered the rankings in fifth place after not ranking in September. Overall, the product rankings for November show minor shifts, with Blue Raspberry Penis Gummies consistently leading the sales for Censored Edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.