Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

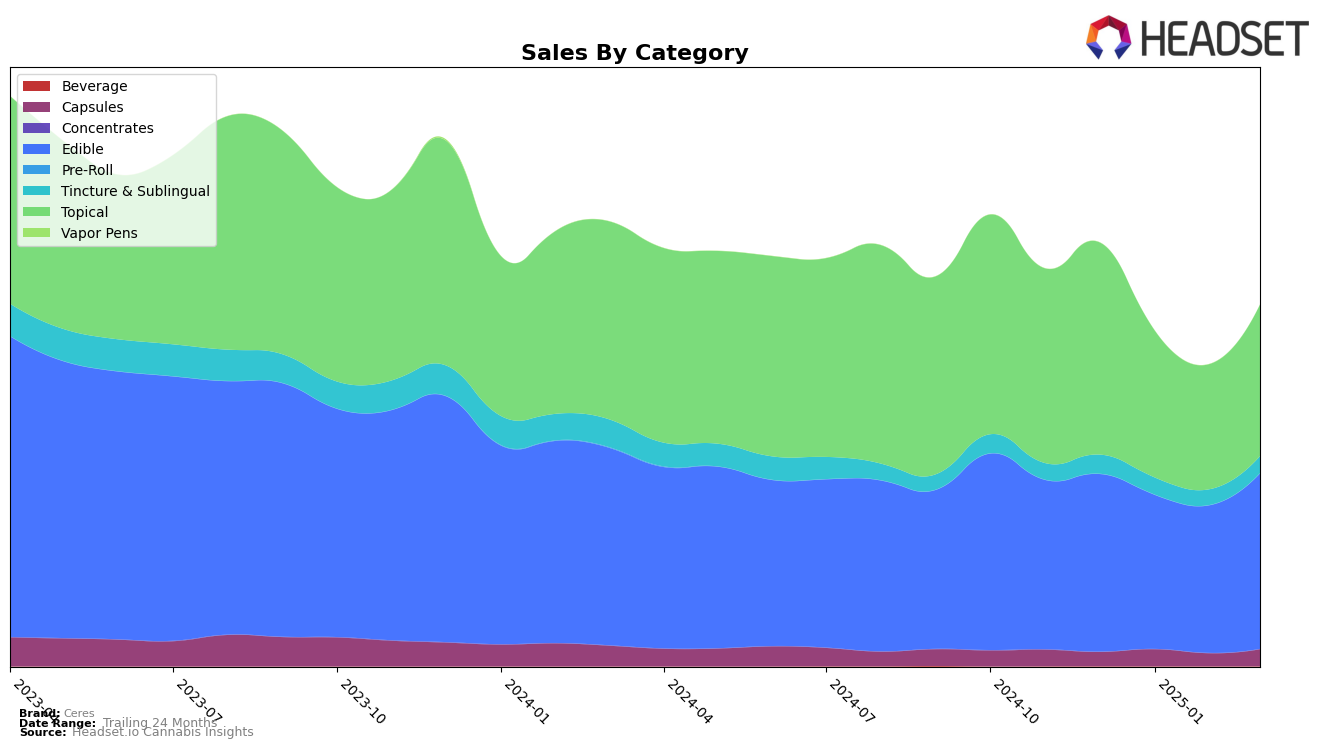

Ceres has demonstrated a consistent performance across various categories in Washington. Notably, in the Capsules category, Ceres maintained a steady rank of 3rd place from December 2024 through March 2025. This stability suggests a strong foothold in the market, despite fluctuations in monthly sales figures. Meanwhile, in the Tincture & Sublingual category, Ceres also held onto the 3rd position consistently, highlighting its resilient market presence. The Edible category saw Ceres maintaining a rank of 9th from January to March 2025, indicating a slight dip from December's 8th place, which could suggest either increased competition or a shift in consumer preferences.

In contrast, Ceres has excelled in the Topical category in Washington, where it has consistently held the top spot. This leadership position underscores the brand's dominance and strong consumer loyalty in this segment. However, the absence of Ceres from the top 30 rankings in other states and categories could be viewed as a missed opportunity for expansion and growth. The brand's ability to maintain high rankings in Washington suggests potential for leveraging its strengths to improve its presence in other markets, though the specific strategies and outcomes remain to be seen.

Competitive Landscape

In the Washington edible cannabis market, Ceres has maintained a consistent rank of 9th place from January to March 2025, despite facing stiff competition. Notably, Swifts and Good Tide have shown strong performances, with Swifts holding a higher rank at 6th and 8th place, and Good Tide fluctuating between 6th and 8th place during the same period. This competitive pressure is reflected in Ceres' sales, which saw a dip in January and February 2025 but rebounded in March, suggesting a potential recovery or strategic adjustment. Meanwhile, Marmas and Cormorant consistently ranked lower than Ceres, indicating that while Ceres faces challenges from higher-ranking brands, it remains ahead of some competitors. These dynamics highlight the importance for Ceres to innovate and strategize effectively to improve its standing and capture a larger market share in the coming months.

Notable Products

In March 2025, the CBD/THC 1:1 Xtra Strength Dragon Balm Roll on maintained its top position in the Topical category, as it has consistently done since December 2024, with sales reaching $10,412. The CBD/THC 1:1 Sativa Assorted Fruit Chews 10-Pack held steady at the second rank in the Edible category, mirroring its performance over the previous months. The CBD/THC 1:1 Indica Assorted Fruit Chews 10-Pack remained at the third rank, showing a slight decline in sales compared to February 2025. The Sativa Assorted Fruit Chews 10-Pack improved its ranking from fifth in January to fourth in March. A new entry, the CBD/THC/CBG 1:1:1 Sativa Assorted Tropical Fruit Chews 10-Pack, debuted at the fifth rank, indicating growing interest in multi-cannabinoid products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.