Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

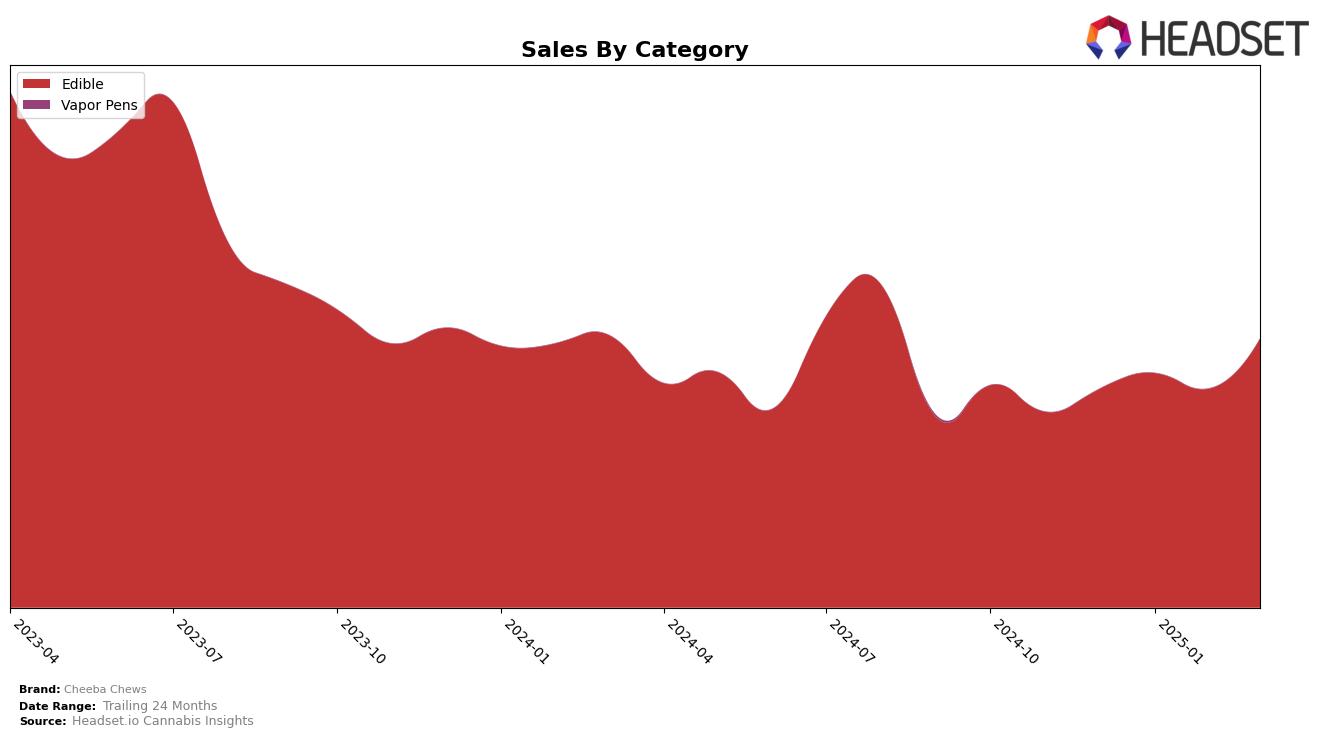

Cheeba Chews has shown varied performance across different states, with notable movements in rankings and sales. In Colorado, Cheeba Chews maintained a relatively stable position within the top 20 edible brands, with a slight improvement from 17th in December 2024 to 15th by March 2025. This stability is reflected in their sales figures, which, despite a dip in February, recovered to near January levels by March. Meanwhile, in Missouri, the brand struggled to maintain a strong presence, consistently ranking towards the bottom of the top 30 list. Their lowest point was in March 2025, where they barely held onto the 30th position, indicating challenges in gaining market share.

In contrast, Cheeba Chews has demonstrated growth potential in New Jersey, where the brand was absent from the top 30 in December 2024 but made significant strides to reach 24th place by March 2025. This upward trajectory is accompanied by a substantial increase in sales, suggesting a growing acceptance among consumers. Similarly, in Nevada, Cheeba Chews improved its standing from 28th in December 2024 to 19th by March 2025, with a consistent rise in sales each month. This positive trend in Nevada underscores the brand's potential to strengthen its foothold in competitive markets. These movements highlight the brand's ability to adapt and grow in certain regions, although challenges remain in others.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Cheeba Chews has demonstrated a steady presence, with its rank improving from 17th in December 2024 to 14th in February 2025, before slightly dropping back to 15th in March 2025. This performance indicates a resilient market position amidst fluctuating sales figures. Notably, Rebel Edibles consistently outperformed Cheeba Chews, maintaining a rank between 11th and 13th, suggesting a stronger brand preference or market strategy. Meanwhile, DOSD Edibles showed variable rankings, peaking at 13th in December 2024 and matching Cheeba Chews' rank in February 2025, indicating a competitive edge that could challenge Cheeba Chews' market share. Dablogic and Coda Signature also hovered around Cheeba Chews, with Dablogic showing a slight decline in March 2025, potentially providing an opportunity for Cheeba Chews to capitalize on. Overall, Cheeba Chews' ability to maintain and slightly improve its rank amidst these competitors highlights its potential for growth and the importance of strategic marketing to enhance its market position further.

Notable Products

In March 2025, the top-performing product for Cheeba Chews was the CBN/THC 1:2 Sleepy Time Chocolate Taffy Chew 20-Pack (50mg CBN, 100mg THC), maintaining its first-place position from previous months with a notable sales figure of 3164. The Hybrid Caramel Chews 10-Pack (100mg) climbed to the second position, improving from the fifth rank in January and second in February. The Sativa Chocolate Taffy 10-Pack (100mg) secured the third spot, showing a recovery from fourth place in February. The Indica Chocolate Taffy 10-Pack (100mg) came in fourth, consistent with its general performance over the past months. Finally, the CBD/THC/CBG 1:1:1 Trifecta Be Happy Caramel Taffy (100mg CBD, 100mg THC, 100mg CBG) rounded out the top five, experiencing a slight drop from its third-place ranking in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.