Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

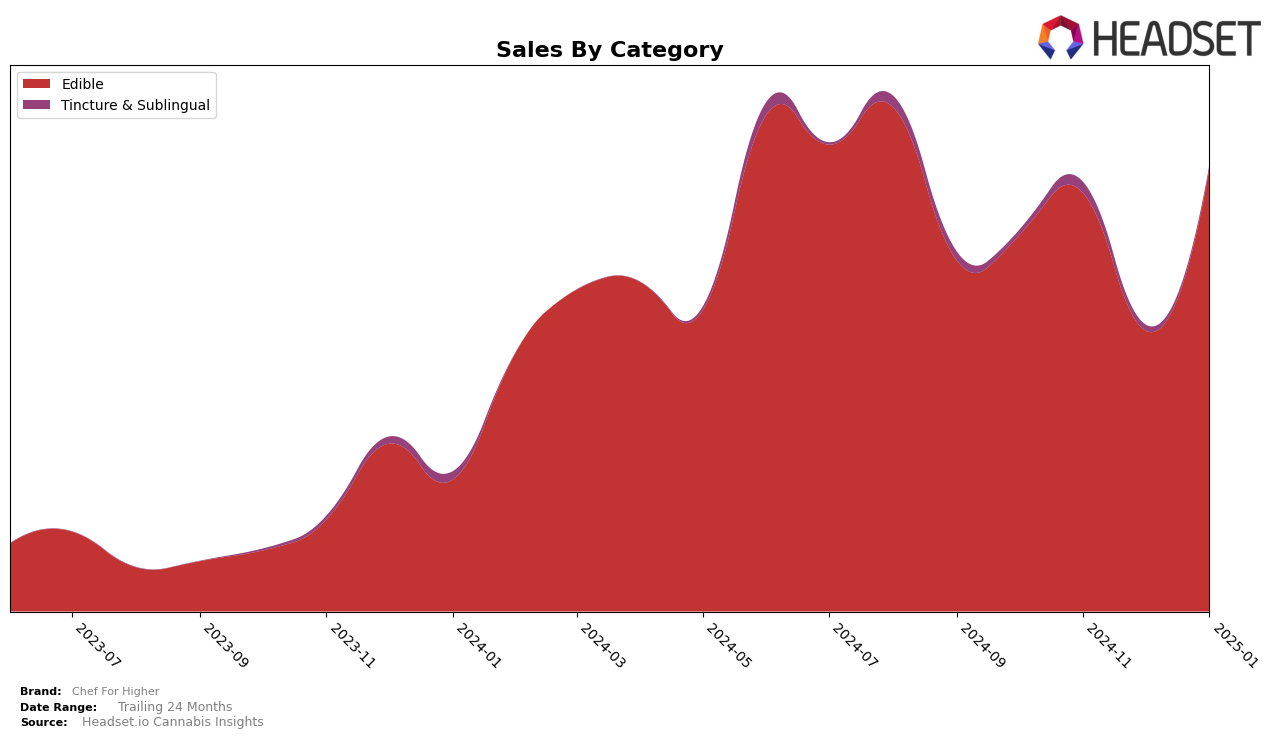

Chef For Higher has shown a fluctuating performance in the Edible category across the state of New York. Notably, they have not consistently secured a position within the top 30 brands, with rankings of 39 in October 2024, 38 in November 2024, and 41 in December 2024, before improving to 37 in January 2025. This indicates a dynamic market presence where Chef For Higher is striving to establish a stronger foothold. The brand's sales trajectory reflects a similar pattern, with a dip in December 2024 but a notable recovery in January 2025, suggesting potential seasonal influences or successful promotional strategies during the holiday season.

The absence of Chef For Higher from the top 30 rankings in any month highlights the competitive nature of the Edible category in New York. While they managed to improve their ranking slightly in January 2025, consistent presence in the top tier remains a challenge. This could be indicative of either an opportunity for growth or a need to reassess market strategies to better align with consumer preferences. The data suggests that while Chef For Higher is not yet a dominant player, there is potential for growth if they can leverage their sales momentum from January 2025.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, Chef For Higher has shown a dynamic performance, with its rank fluctuating from 39th in October 2024 to 37th by January 2025. This slight upward movement indicates a positive trend in brand recognition and consumer preference. In contrast, Tyson 2.0 experienced a decline, dropping from 24th to 33rd, suggesting potential challenges in maintaining consumer interest. Meanwhile, Love Oui'd and High Peaks have remained relatively stable, with minor fluctuations in their rankings. Notably, Hashtag Honey made a significant leap from being outside the top 20 to 35th in December, before settling at 39th in January. These shifts highlight the competitive pressures and opportunities within the market, where Chef For Higher's consistent performance could be leveraged to capture more market share against its competitors.

Notable Products

In January 2025, Chef For Higher's top-performing product was Linden Honey 240mg, maintaining its first-place ranking consistently from previous months, with sales reaching 263 units. Guava Jelly 10-Pack 100mg made a significant leap from fourth to second place, indicating a notable increase in popularity and sales reaching 141 units. Extra Virgin Olive Oil 240mg held steady in third place, showing consistent performance over the months. Coconut Oil 240mg slipped to fourth place from its previous second-place ranking, suggesting a decrease in demand. Passionfruit Jelly 10-Pack 100mg showed a positive trend, moving up to fourth place from fifth, with sales doubling from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.