Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

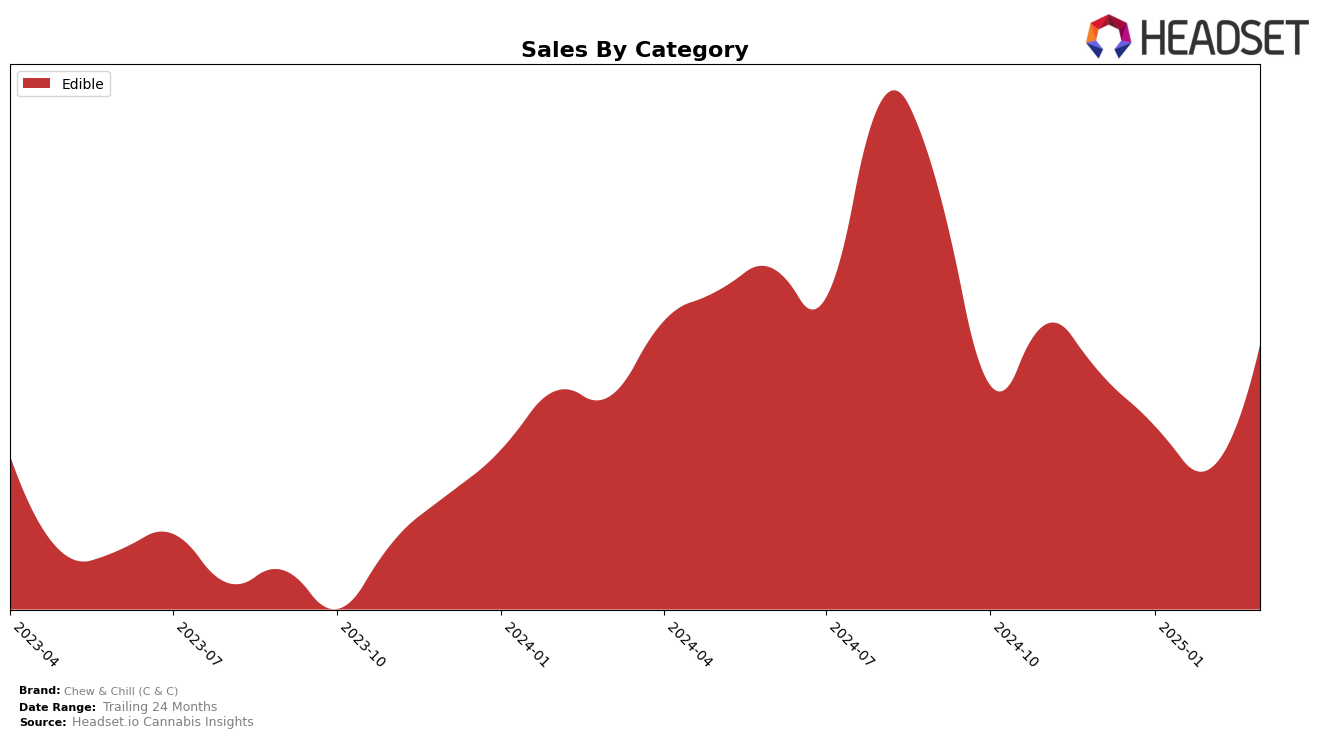

Chew & Chill (C & C) has shown varied performance across different states and categories over recent months. In Arizona, the brand has made significant strides in the Edible category, climbing from the 30th position in December 2024 to 25th by March 2025. This upward movement is coupled with a notable increase in sales, which more than doubled from December to March. Conversely, in Nevada, C & C's ranking has slipped slightly, moving from 29th in January to 33rd in March, indicating a need for strategic adjustments in the market.

In Illinois, Chew & Chill did not make it into the top 30 rankings in the Edible category for January and February 2025, highlighting a challenging market environment. The situation is similar in Massachusetts, where the brand was ranked 63rd in December 2024 and has not appeared in the top 30 since then. Meanwhile, in Ohio, C & C maintained a steady presence, consistently staying around the 30th position, although sales have shown a gradual decline over the months. These insights suggest that while C & C is gaining ground in some markets, it faces hurdles in others, which could provide opportunities for targeted growth strategies.

Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, Chew & Chill (C & C) has demonstrated a notable upward trajectory in its rankings from December 2024 to March 2025. Initially ranked at 30th in December 2024, C & C climbed to 25th by March 2025, marking a significant improvement in its market position. This rise coincides with a substantial increase in sales during the same period, suggesting effective market strategies or product offerings that resonated with consumers. In contrast, competitors such as Mellow Vibes (formerly Head Trip) and O'Geez (WA) experienced relatively stable rankings, with Mellow Vibes not breaking into the top 20 and O'Geez maintaining a position around the mid-20s. Meanwhile, Grow Sciences showed a strong performance, consistently ranking in the low 20s, and RR Brothers also maintained a steady presence in the rankings. The competitive dynamics indicate that while Chew & Chill (C & C) has made significant strides, the market remains competitive, with several brands vying for consumer attention in Arizona's edible category.

Notable Products

In March 2025, the top-performing product from Chew & Chill (C & C) was the Lavender Elderberry Live Resin Infused Gummies 10-Pack (100mg), which claimed the number one spot with notable sales of 1254 units. The Strawberry Watermelon Gummies 10-Pack (100mg) followed closely in second place, showing impressive performance despite not being ranked in previous months. Jasmine Peach Sugar Free Vegan Live Resin Gummies 10-Pack (100mg) maintained a steady position, holding third place for two consecutive months. Mango Tango Sugar Free Gummies 10-Pack (100mg) entered the rankings at fourth place, while THC/CBN 2:1 Black Cherry Sugar Free Gummies 15-Pack (100mg THC / 50mg CBN) returned to the top five after being unranked in February. These shifts indicate a dynamic change in consumer preferences, with new entries and comebacks reshaping the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.